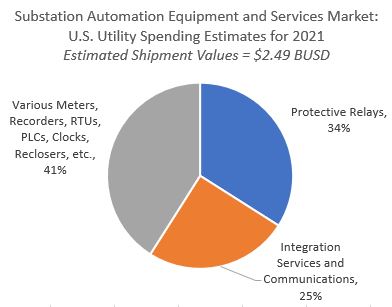

When the estimated sales of 14 product/service topics covered in the newly released 2022-2024 edition of U.S. Substation Automation Market Overview Series are totaled, the estimated value of these product/services purchased by American utilities and industrial substation sites reached $2.493 Billion in 2021. Equipment types reported in the series include RTUs, PLCs, protective relays, multifunction meters and recorders (digital fault recorders, sequence of events recorders, power quality recorders) reclosers, inter-utility revenue meters, automation platforms, time synchronization clocks, voltage regulators, communications equipment and integration services.

The total of spending on substation automation-related equipment and smart devices, along with substation integration services is on the rebound from COVID-era induced spending cutbacks. Newton-Evans Research expects investments in substation modernization to continue to grow over the next 24-36 months at a moderate rate of growth. As new substations come onto the grid to support renewable energy sites, these will be highly automated.

While automation budgets will remain a substantial portion of all substation-related budgets, additional investment is necessary to shore up grid resiliency and cyber and physical security defenses at the substation level and so these expenditures will share in the overall investment plans. The need for substation physical expansions and upratings will also continue to cause substations investments to rise.

Newton-Evans Research also finds that there are three distinct tiers of substation integration service providers. These include substation automation specialist firms, SCADA industry participants having substation devices and which also provide integration services and T&D engineering service firms having substation integration expertise.

Individual substation market overview reports are priced at $195.00 and the entire 14-report series is available for $1,150.00. Each market overview report includes a segment description, estimated market size, market shares for key participants and the U.S. market outlook through 2024.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies