U.S. Electric Power Utility Capital Investment in Grid Modernization: Effects of COVID-19 Pandemic on Near-Term and Mid-Term Outlook

Interim Report By Charles Newton, Newton-Evans Research Company

This article has been developed based on findings from surveys completed by officials from 22 U.S. electric utilities comprising about 10% of served end-use customers. To date, the mix of participating utilities includes several IOUs, along with public power utilities and electric cooperatives.

The study is being undertaken to determine the effects of the COVID-19 pandemic on utility grid modernization plans involving capital expenditures. Newton-Evans has requested the participation of major and mid-size American electric utilities in an attempt to gauge whether or not CAPEX investments will continue to be made as planned earlier, and whether grid modernization projects will continue as scheduled or will likely be deferred for some time.

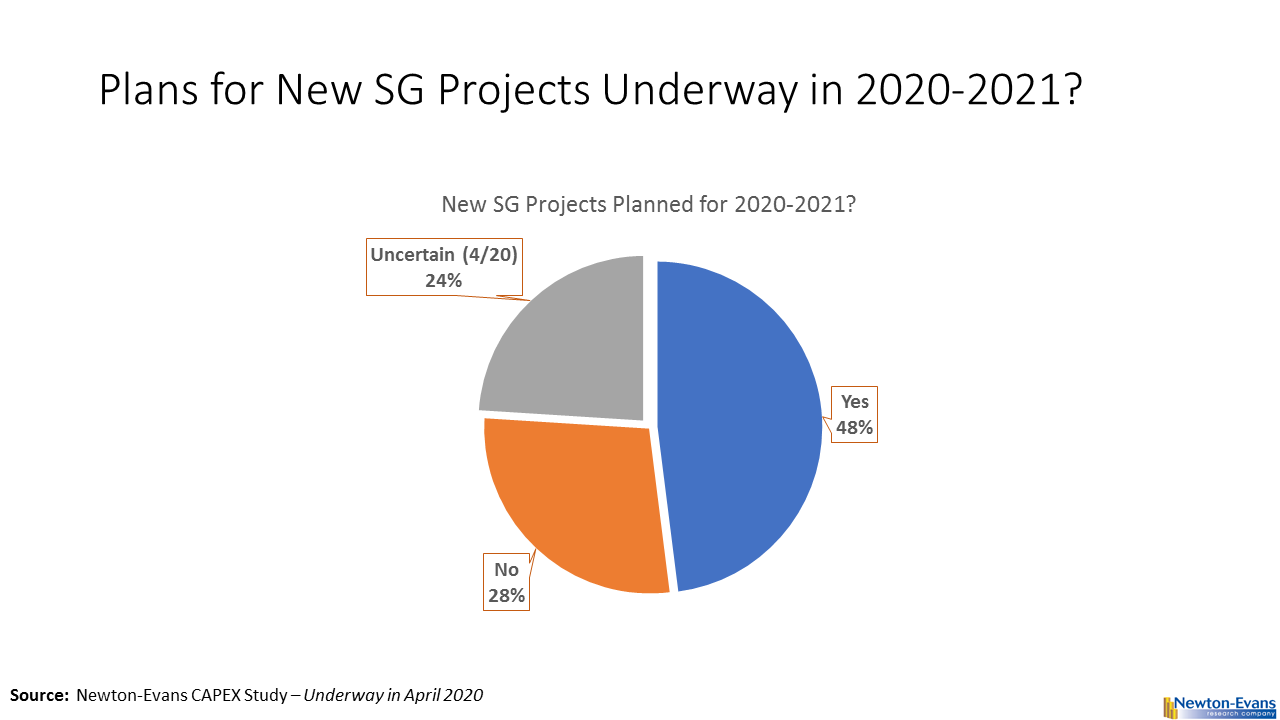

Figure 1 indicates that nearly one-half (48%) of the surveyed utilities continue to have plans to launch new smart grid projects either in 2020 or in 2021.

Figure 1.

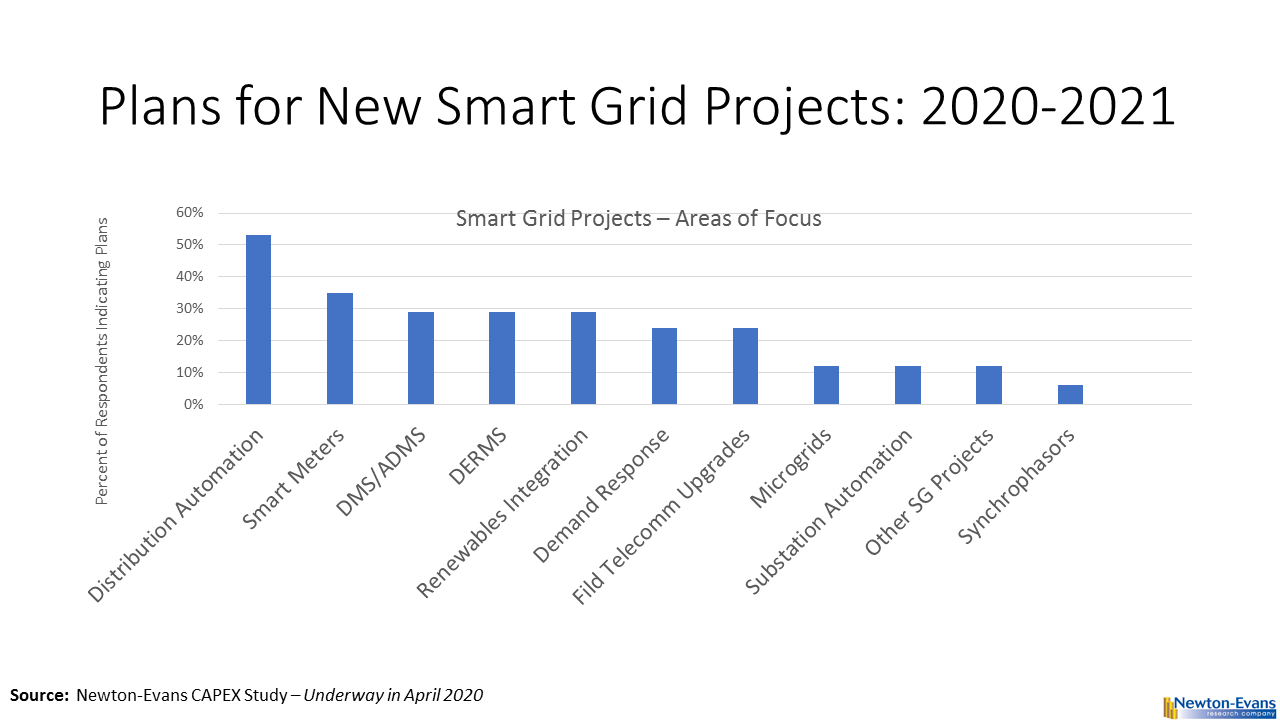

When respondents were asked to indicate which specific areas of grid modernization that their plans for new smart grid projects encompassed, distribution automation was the most frequently cited among 10 listed areas of focus for CAPEX investments. AMI/AMR smart metering projects were next, followed by ADMS and DERMS systems efforts and renewables integration projects. Following were these areas: demand response, field telecommunications upgrades, while about ten percent cited plans for microgrid development, substation automation and others. Only one utility respondent to date has indicated plans for a synchrophasor project start-up. See Figure 2.

Figure 2.

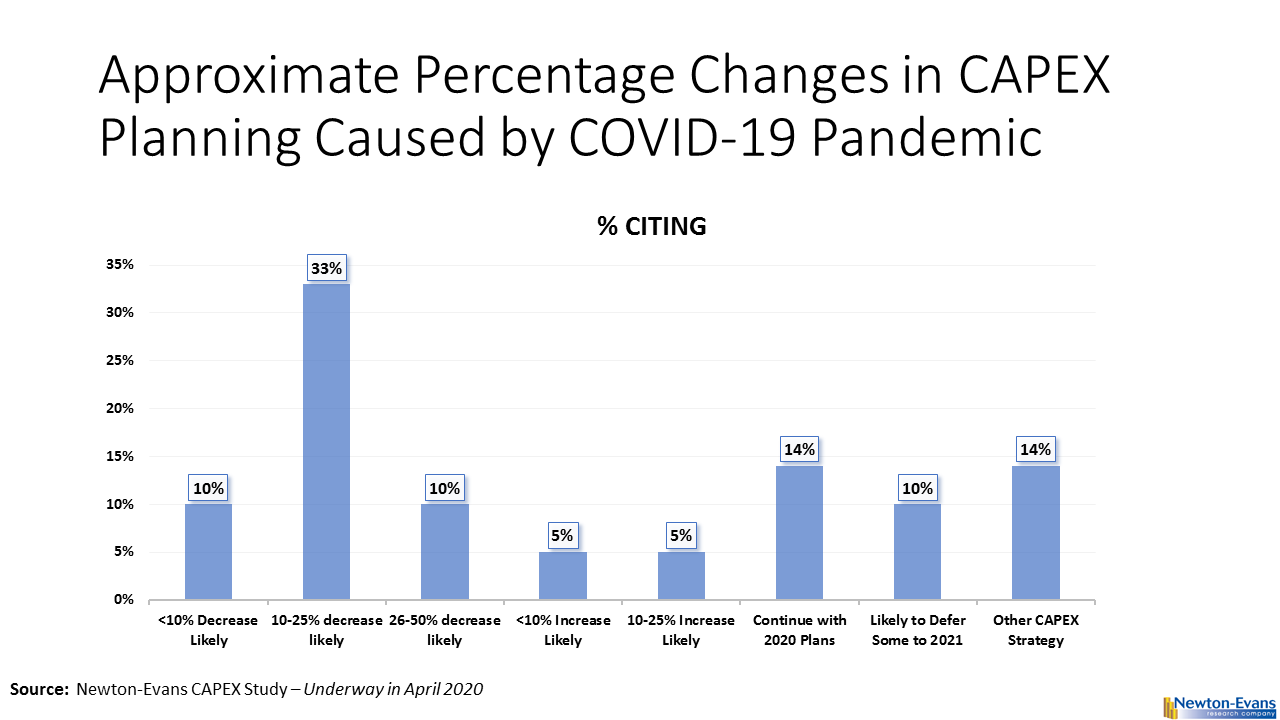

Respondents were requested to indicate the approximate percentage changes in CAPEX plans caused by the COVID-10 pandemic. More than one-half of the respondents to date suggested a deceased level of CAPEX investments were likely with the majority of these indicating a range of from 10% to 25% reduction in CAPEX for the near-term. Only ten percent of the respondents cited plans for some increase in CAPEX spending and 14% indicated that the CAPEX investments at their utilities would remain as planned earlier. See Figure 3.

Comments provided by respondents included the following for inputs received:

- “Expect short-term reduction with a medium-term rebound”

- “For waving of late fees and suspension of disconnects for non-payment it is too early to determine the amount of lost revenue at this time. CAPEX expenditures and planning will be directly related to the lost revenue. While we have enough cash on hand to cover the expected loss of revenue and expect our bottom line will still remain positive without cutting expenditures, we are projecting about a 10% loss in revenue this year due to the coronavirus and its resultants”

- “Only decrease is due to work conditions, trying to distance. Minimizing outage risk. CAPEX reduction hoped to be minimal, under 10%. “

- “No significant impact, at this time”

Figure 3.

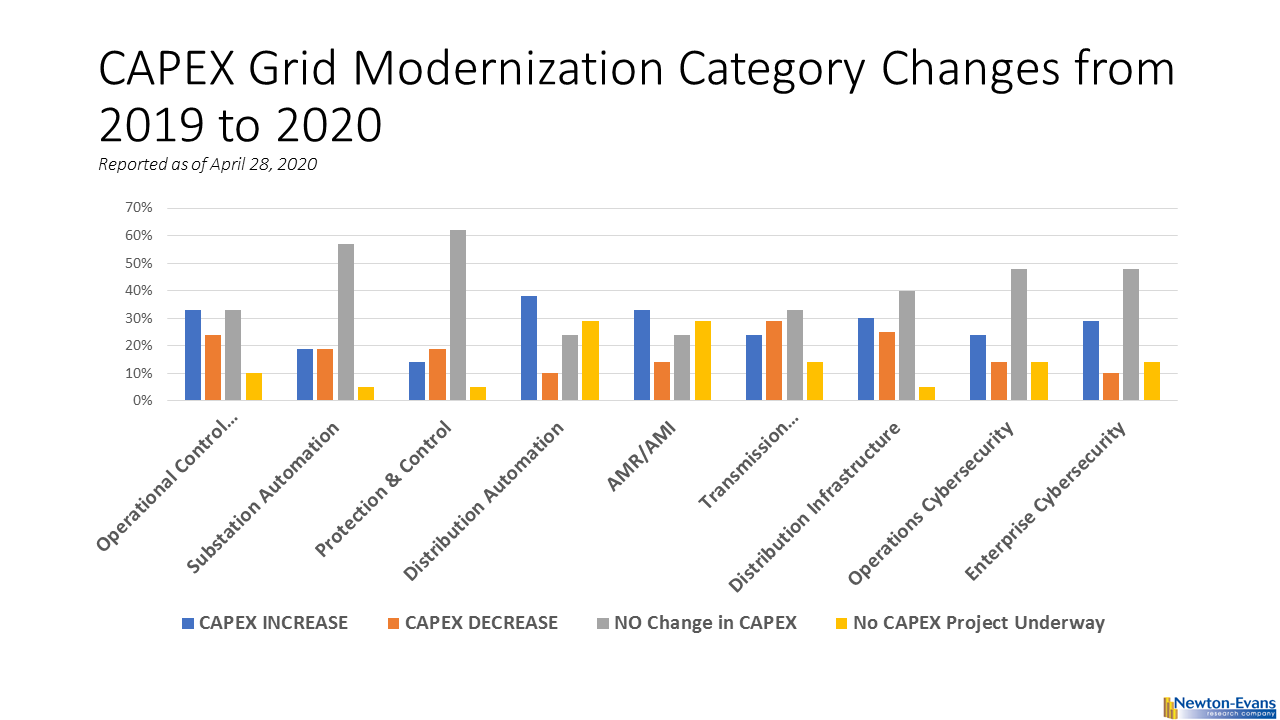

When asked to indicate the changes in CAPEX planning for a range of grid modernization projects from 2019 to 2020, note in Figure 4 that most observations reported increased levels of investment Most of these smart grid-related project topics indicated moderate to high increases in CAPEX investments. . The only exception was for protection and control for which there is a slight drop reported.

Figure 4

The Newton-Evans field work with U.S. utility officials will continue through May 15, 2020 and the final report will be available in early June, 2020.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies