In an electric power system, submersible switchgear is the special combination of electrical disconnect switches, fuses or circuit breakers used to control, protect and isolate electrical equipment all enclosed in a “vault-like” casing to prevent flooding damage. Submersible switchgear is used both to de-energize equipment to allow work to be done and to clear faults downstream. This type of equipment is important because it operates in the same way as other forms of switchgear and is directly linked to the reliability of the electricity supply.

A variety of interrupting devices can be used with vaulted submersible switches including fuses, air circuit breaker, oil circuit breaker, vacuum circuit breaker or gas (SF6) circuit breaker.

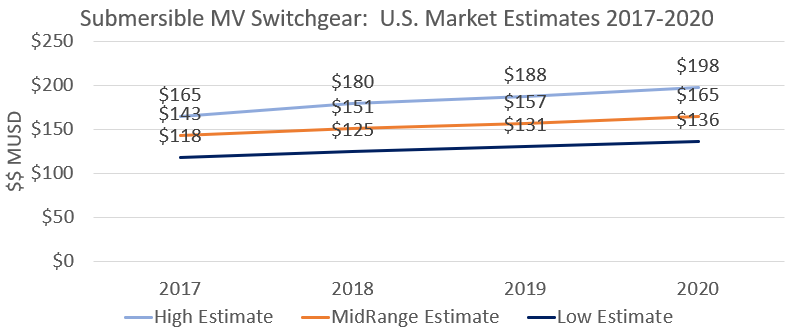

Newton-Evans has estimated the 2017 U.S. market for submersible switchgear to have been about $140-$155 Million – and growing at about 5% per year, a rate somewhat higher than other MV market segments for electric power infrastructure equipment.

G&W has been the historical share leader in the submersible segment of the medium voltage switchgear industry sector. Other key participants in this segment of the MV switchgear market include ABB, Eaton, S&C and Trayer. Several other major MV switchgear manufacturers manufacture underground switchgear, but do not appear to offer submersible, underground vaulted units.

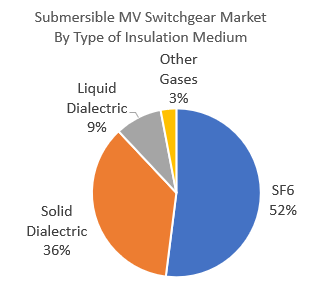

The average unit price range for submersible switchgear has ranged from about $17,500-$40,000 based on recent bid sheets (municipal level utilities) during the 2014-2018 period. Specific voltage requirements, choice of insulating medium and other optional equipment configuration considerations impact the final price range. While SF6 insulation has been widely used over the years, the trend in today’s market is undergoing a shift to solid dielectrics as the insulating medium of choice for more and more utilities.

Just as submersible switchgear equipment can have a variety of insulating mediums, the market sub-segmentation participants change based on insulating medium as well. G&W Electric is the leader in the SF6-based portion of the market with strong participation also coming from ABB, Eaton and S&C.

Newton-Evans estimates that ABB (including T&B) leads in sales of solid dielectric units with G&W also an important supplier of solid dielectric units. Key suppliers of submersible units using liquid dielectric insulating medium include Eaton and Trayer Engineering.

There are a number of economic, environmental and policy factors influencing the level of annual demand for MV submersible switchgear including new I&C construction projects, economic growth patterns in suburban areas, regulatory decisions mandating reliability improvements, climate change and the nation’s move to underground distribution facilities in many regions.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies