Newton-Evans Research has been assessing the increase in demand for power transformers of all size ranges since the COVID pandemic. Many observers have focused on the growth of the data center and artificial intelligence market as being the principal driver for this increase in demand. Additionally, there are equally important – but somewhat less impactful – market drivers that are also increasing the demand for power transformers.

The Trump administration’s dual focus on expanding mining operations and reshoring of manufacturing, the Biden administration’s prior push on increasing U.S.-based semiconductor fabrication operations and its earlier focus on clean hydrogen production, are each adding to the increase in demand for power transformers. Add to this the typical utility-driven demand to replace hundreds of aged-out large power transformers annually and one can see the demand for medium and large power transformers being likely to continue over the short-term and medium-term economic cycles – likely through 2030.

The recent administration decision to apply tariffs to imported finished goods of all types and the duties planned to be applied to commodities and key components of electrical equipment could certainly put a damper on at least part of the planned increase in demand for large power transformers.

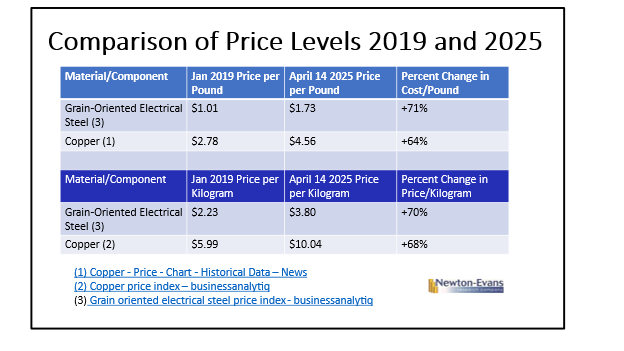

Commodity price increases, especially for electrical steel and for copper, coupled with the surge in demand from utilities and the C&I community, have necessitated that such costs be passed along to the buyer. See Table 1 for a look at the significant price increases for these two key components from January, 2019 to April, 2025.

FIGURE 1.

So, the question before us is this: How do we shorten the lead time between order placement and scheduled delivery of a medium to large power transformer? Certainly, development of additional manufacturing facilities and expansion of existing factories is going to help. Figure 2 lists the known plans among transformer manufacturers to expand existing manufacturing facilities or to construct new facilities in the United States over the next 12-36 months. This new capacity will help shorten the currently extensive lead times between order placement and delivery of power transformers. There are 20 transformer manufacturers on our list of known sites planned for expansion or new facility construction spread over 11 states across the U.S. Seven of the listed suppliers are expanding power transformer production capacity. Nearly 3,000 manufacturing and support positions are being added among this group (which is likely not all-encompassing).

FIGURE 2.

If the IEEE PES, NEMA and others could form a task force to standardize on design and performance characteristics to a reasonable extent for large power transformers, that would also help shorten unit production times. A recent article from Wood-Mackenzie focused on the efforts of U.S. mining companies now seeking to mine extensively for copper, given the high level of demand for power and distribution transformers. (3)

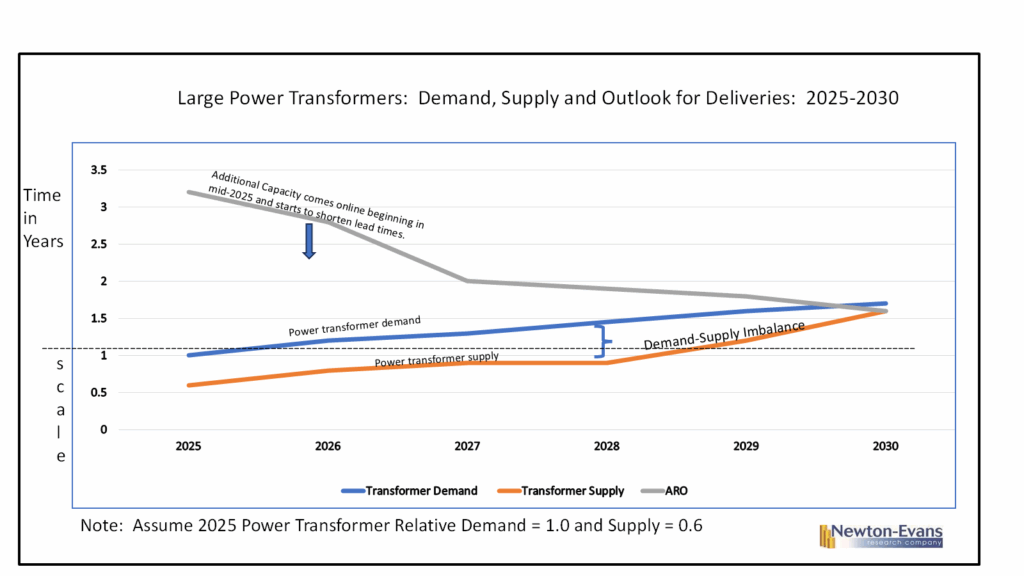

In Figure 3 below, I have attempted to scale perceived unit demand and supply capacity through 2030. Note that relative current imbalance between power transformer supply (orange line) and demand (blue line). The third line (grey line) indicates the view that the increased unit production capacity will have a positive effect on closing the multi-year gap between power transformer order placement and shipment of completed units.

FIGURE 3.

Next month, we will address the distribution transformer industry segment and look at what will likely shape up as a somewhat similar supply-demand imbalance curve, and the time lags affecting deliveries. We will separate pole-mount and pad-mount data as best as we can.

In the meantime, our Market Overview series on Power and Distribution Transformers provides up-to-date coverage on 14 transformer-related topics. Purchasers of this series will be provided with a complimentary update in the third quarter 2025. More information can be found at https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-transformer-series/ ,

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies