Introduction:

Newton-Evans believes that there is significant opportunity for providers of SCADA-related systems and application software to help manage the operations of commercial and utility-scale wind and solar power resources.

The U.S. Department of the Interior’s USGS agency reports that there are about 67,000 large (utility-scale) wind turbines in operation in the United States. These thousands of wind turbines are installed at about 1,500 sites or farms. The country is adding about 3,000 utility-scale wind turbines each year. (!)

According to the U.S. Department of Energy’s EIA (Energy Information Administration), there are more than 2,500 utility scale solar plants/farms now operating in the United States. Most of these facilities represent from 1 to 5 megawatts of generation capacity. (2) There have been a number of larger solar plants coming onstream in the last five years.

Each of these 4,000-plus utility-scale renewables sites now operational in the U.S. requires a SCADA-like system to acquire operating information and to coordinate grid planning activities. For enterprises operating multiple facilities, capabilities exist to coordinate multiple SCADA installations (or site automation/control systems) under the control of a larger company-wide or utility-wide SCADA system.

Wind Power SCADA

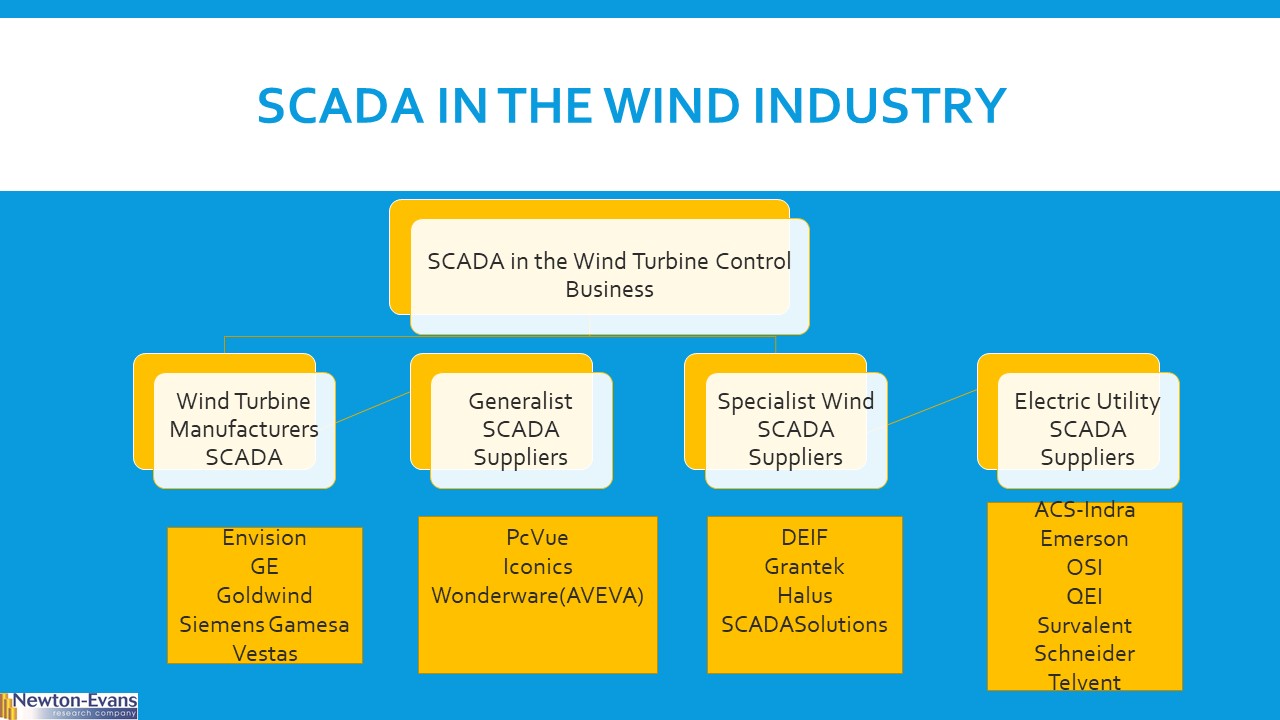

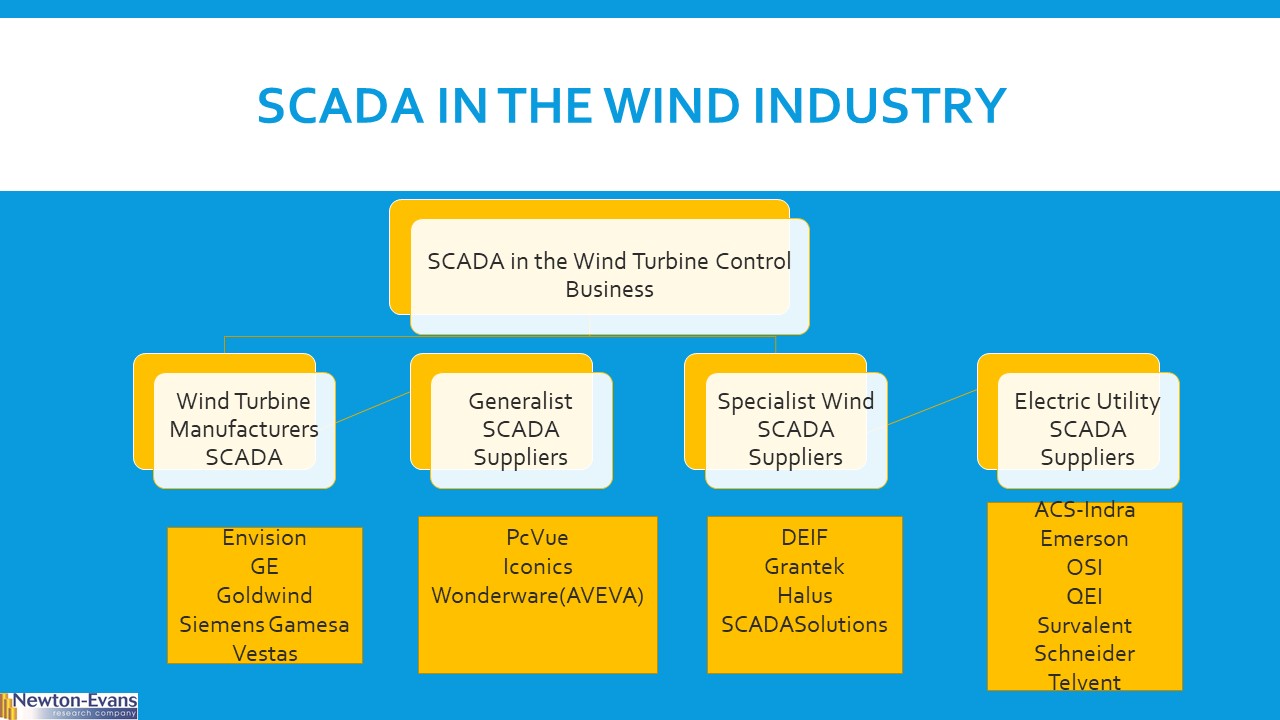

There are four types of SCADA providers serving the wind power industry as shown here:

The first group of wind SCADA offerings is comprised of the leading wind turbine manufacturers for the U.S market, including GE, Siemens and Vestas, (collectively representing about three-quarters of US wind turbine sales) and supplemented with some Chinese manufacturer installations and supporting control systems software from either Goldwind or Envision, both of which have a U.S. presence and have current installations around the country.

The SCADA applications developed by each turbine manufacturer center around wind turbine controls, but the offerings also extend to include a bevy of related monitoring and control applications for commercial wind farms. The SCADA offerings from these firms appear to be designed with current generation software platforms and incorporate some useful apps development tools – an optimal solution for those sites that make use of wind turbines from a single manufacturer.

The second group of wind SCADA offerings is provided by a number of wind technology specialist firms, including DEIF, Grantek, Halus and SCADASolutions. Offerings from these firms enable wind farm operators having wind turbines acquired from multiple suppliers to work in an integrated manner, analogous to a substation automation system that has to coordinate among multiple protective relay suppliers. Status reporting, turbine condition assessment, activity controls can be accomplished by the SCADA offerings from these suppliers, regardless of the turbine type, size or manufacturer.

The third group of wind SCADA offerings comes from “generalist” SCADA suppliers, those companies that provide packages or configurable SCADA to multiple industries, from energy utilities to process industries, to discrete product manufacturers and commercial building control systems. Products from leading suppliers including PcVue, Iconics, Wonderware (Aveva) and others have all been successfully applied to numerous wind farms in the U.S. and elsewhere.

The fourth group of offerings that have made some inroads with utility-operated wind farms is provided by the “traditional” suppliers of electric utility SCADA, DMS and energy management systems. Most of these firms have now developed requisite software or have partnered for development of wind energy applications, and have likely implemented wind applications for one or more utility customers at this point in time. Included here are large companies such as ABB and Schneider, as well as key suppliers to the mid-size utility market and include firms as ACS-Indra, OSI, QEI, Survalent and others.

Solar Energy SCADA

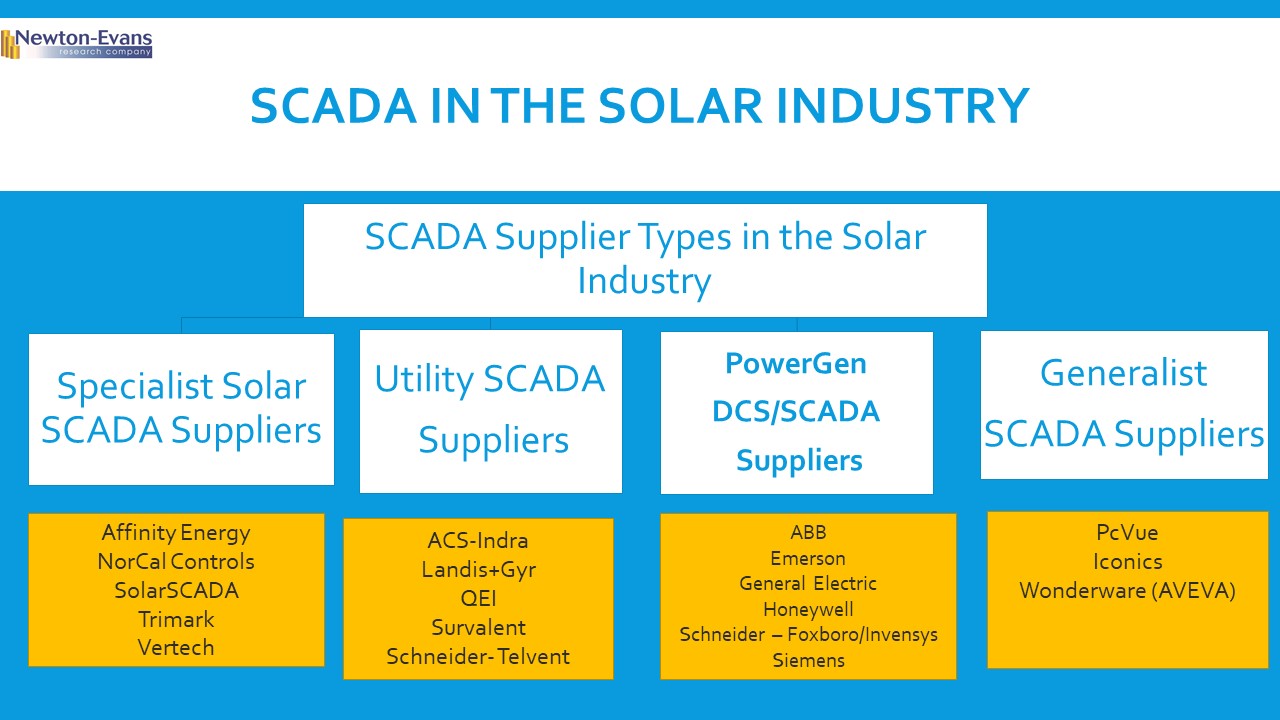

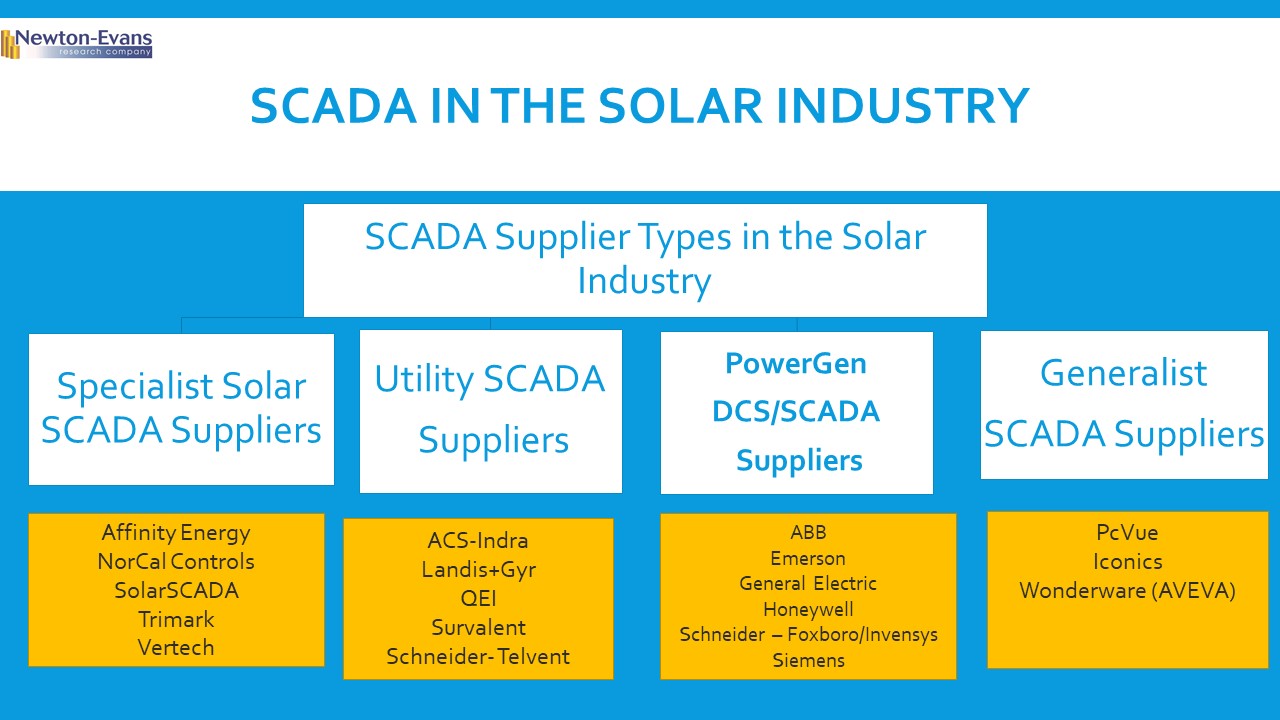

The more than 2,500 utility-scale solar farms operating in the U.S. also have a requirement for SCADA systems. Similar to the groupings of SCADA providers in the wind sector, there are four major types of solar SCADA offerings for the U.S. market.

There are at least five solar SCADA specialist firms operating in the U.S. market in 2021 having currently installed solar SCADA systems, and there are likely additional firms operating on a regional basis around the country. These firms primarily serve commercial solar energy facility operators.

Distribution utility SCADA providers have also developed several solar and DERMS applications of interest to their utility customers operating solar facilities. If not solar applications specialists themselves, the utility SCADA/DMS systems can partner with or link with offerings from solar IT/OT specialists

The third group of solar SCADA providers is comprised of: a) large firms that have traditionally provided distributed control systems for electricity generation plants; and b) the multinational firm providing large-scale EMS/SCADA/ADMS systems.

Generalist SCADA suppliers that were listed earlier for the wind farm sector of renewables are also actively participating in the solar market as well.

The Utility Role in Aggregating Non-Utility Renewables (Utility-Scale Distributed Energy Resources)

Recently, the NREL reported that “Although 23 utility-led efforts exploring DER aggregation were launched in the United States by late 2018, DERMS remains in the nascent stages of implementation, with many utilities still in the process of exploring or piloting the range of available commercial solutions.” .(3)

Newton-Evans Research had earlier estimated that the U.S. utility DERMS market in 2020 had reached about $75 million and is likely to double to $150 million by 2024. (4)

Control is the Key

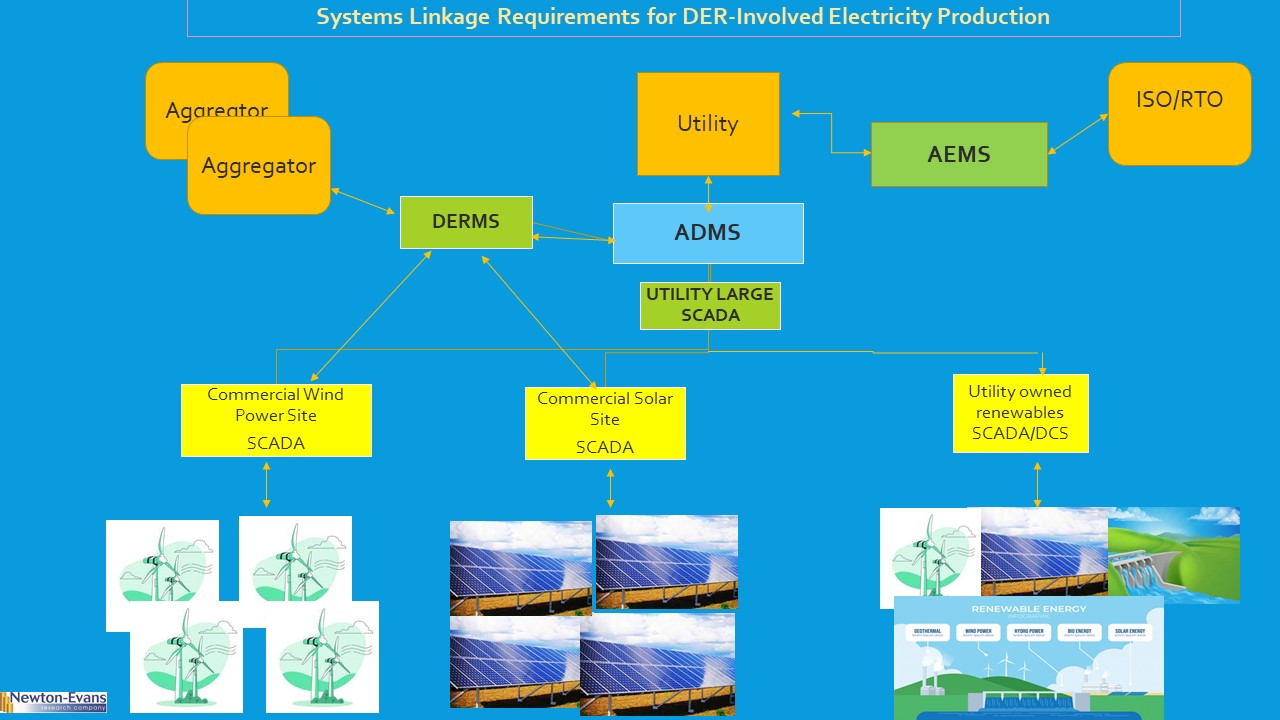

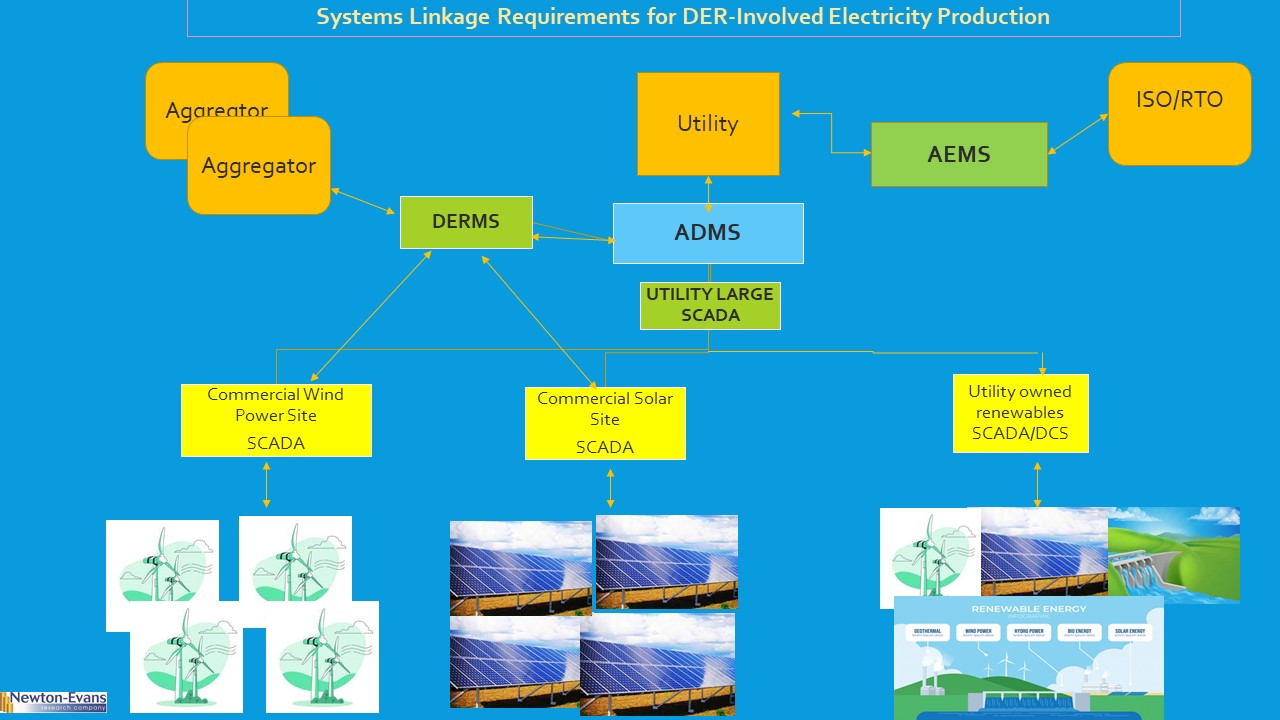

Importantly, the less control over renewable energy resources that the utility industry has (at both the transmission and distribution levels) the more tightly coupled and securely linked must be the control systems with which the utility can best manage operations to ensure grid stability. This is why there is a separation between SCADA at the distributed energy resource site level which must be in place for operational data acquisition and is the rationale for the utility to have an up-to-date GIS providing DER locational data, supplemented by weather information as part of (or available to) it own DERMS and/or available to (or co-resident with) the DER site(s).

The prosumer-aggregator category of DER supplier adds yet another dimension lending additional urgency to the need for a comprehensive and scalable DERMS designed specifically for utility use. While the author has read about the need for DERMS at the renewable facility level, the real need at these thousands of sites is for a SCADA-type system that can summarize information for the asset owner/operator and transmit requisite information securely to the utility entity (transmission or distribution-level) to enable the utility to optimize grid operations. Multi-site renewables facilities will need their own large system to manage all assets regardless of location. A fine example of a multi-site (on a nationwide scale) renewables SCADA system and national control center) is that of Iberdrola. (5)

What seems clear at this time is that the inclusion of renewables owned by aggregators (commercial and community levels) as electric power generation resources adds significant complexity to the already sophisticated nature of utility-operated transmission and distribution grids. A quarter century ago, most power generation assets were under the direct control of utilities. That is no longer the situation with an ever-increasing portion of power generation coming from renewables, and with a high percentage of renewables sites not owned or operated directly by regulated utilities.

In turn, a smooth-running grid will require ever-closer systems and telecommunications collaboration among T&D utilities, ISOs/RTOs, aggregators and regulators. Disparate systems will have to be linked to some degree, with secure and reliable communications becoming absolutely vital to the safe, secure and reliable operation of the country’s power grids. It will be incumbent on utilities to manage these complex relationships with all the technical resources available, because after all is said and done, it is the nation’s electric utilities that are charged with the operation of the grid on local and regional levels.

The increasing complexity of today’s grid architecture and the challenges posed to IT/OT staffs to develop comprehensive systems that can meet current and likely regulatory requirements to safely and securely accommodate commercially-owned power generation assets is among the greatest challenges found in any sector of the nation’s industrial, commercial, government sectors. The need is paramount for a new generation of ADMS, AEMS, DERMS, SCADA/DCS. GIS and DRMS that are each based on open standards, configurable, scalable and capable of providing two-way telecommunications pathing.

Here is one view of how renewables SCADA systems are playing and will continue to play an important role in enabling utility-level coordination among aggregators at the commercial and community levels, and aligned with regional requirements of ISO/RTO organizations.

- Source: https://www.usgs.gov/faqs/how-often-us-wind-turbine-database-updated?qt-news_science_products=0#qt-news_science_products

- Source : https://www.eia.gov/todayinenergy/detail.php?id=38272

- National Renewable Energy Laboratory (Washington, D.C.) Expanding PV Value: Lessons learned from Utility-led Distributed Energy Resource Aggregation in the United States, https://www.nrel.gov/docs/fy19osti/71984.pdf.

- Note that the Newton-Evans’ growth estimate, though moderately strong, is in fact lower than that of other energy research and consulting firms having a focus on DERs and DERMS.

- Iberdrola. National Control Center: the most advanced renewable energy control center in the United States. https://www.iberdrola.com/innovation/core-renewable-energy-operation-center-usa

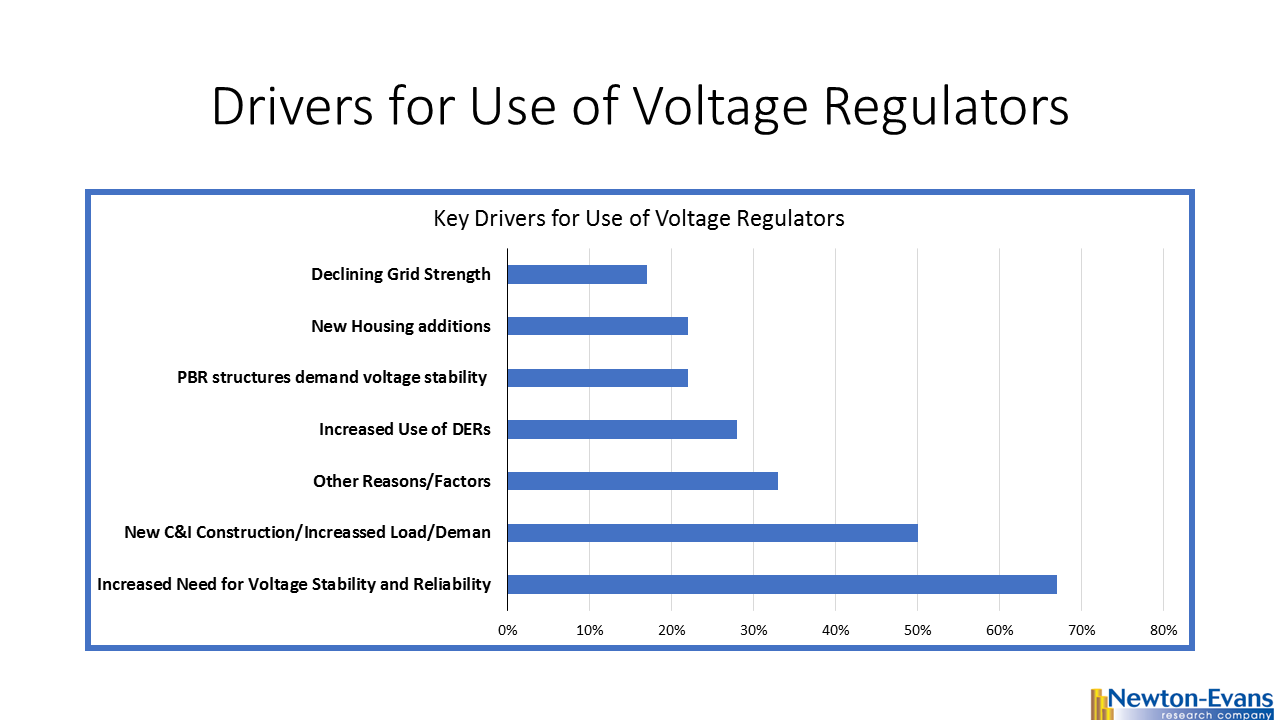

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

Additional topics being studied include phase-to-ground voltages used in conjunction with VR; the use of VRs with other voltage improvement devices such as distribution feeder capacitors and substations capacitors; purchasing methods and preferences; installation methods, requirements for unit compliance with the latest IEEE requirements, wish lists for new VR product capabilities and a number of other pertinent topics.

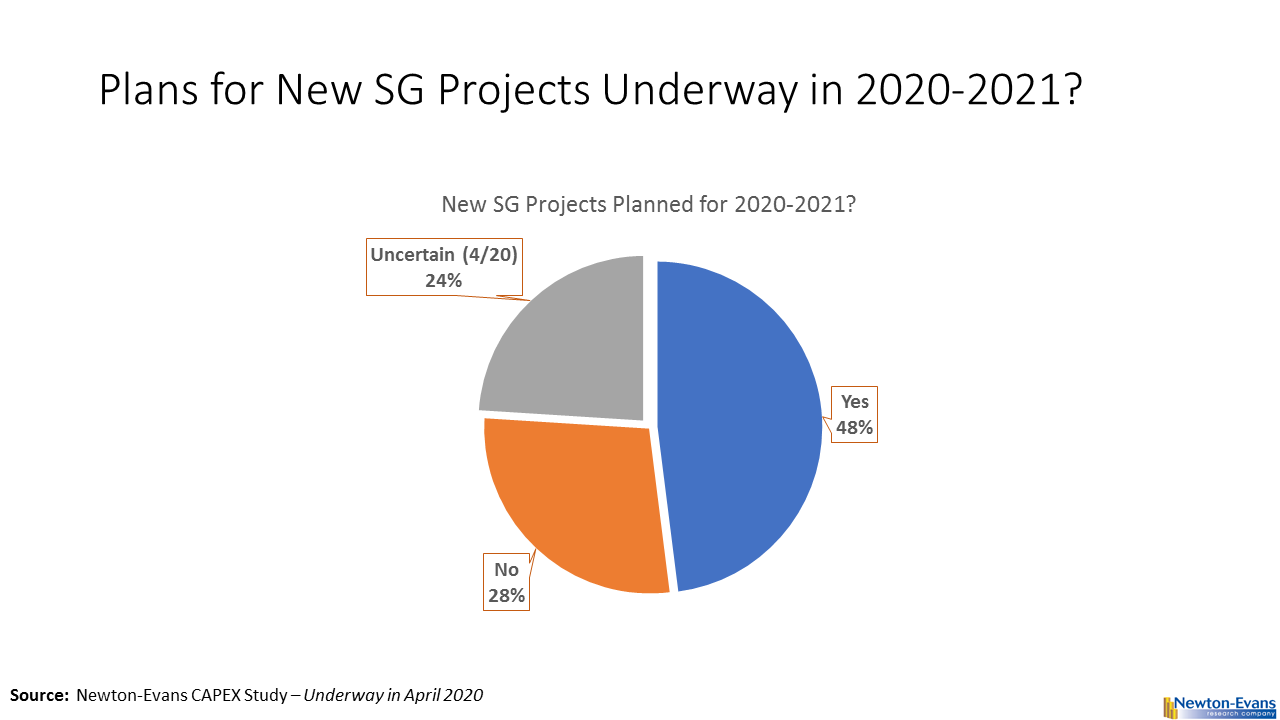

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020.

A special “thank you” gift is is also available for participants at the end of the 12-question (largely multiple choice) survey. To date, we have well-thought-out responses in hand from major IOUs, public utilities and electric co-ops. Looking forward to your survey participation, we thank you kindly for sharing your insights. We are closing off survey data collection work on Friday, May 15, 2020. summary reviews and highlights from completed studies

summary reviews and highlights from completed studies