As of early April, much of the 2013 T&D research work already completed or now underway for clients has once again centered on fundamentals required for a more resilient power grid— that is, on “infrastructure building blocks” rather than on pure automation or IT.

While many observers continue to overlook the critical role of “widgets” — basic T&D grid components – – – that have themselves benefited from technical advances over the past decade, our research programs have included a number of studies of these components. During the first quarter of 2013, we have come to understand that more reliable and greener components available in the newest generation of core grid products are indeed making headway in the North American Grid and throughout the world.

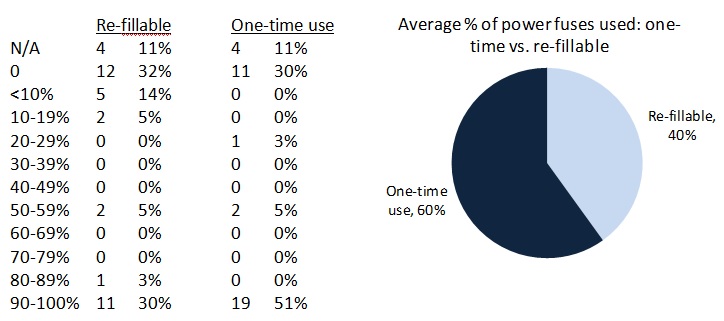

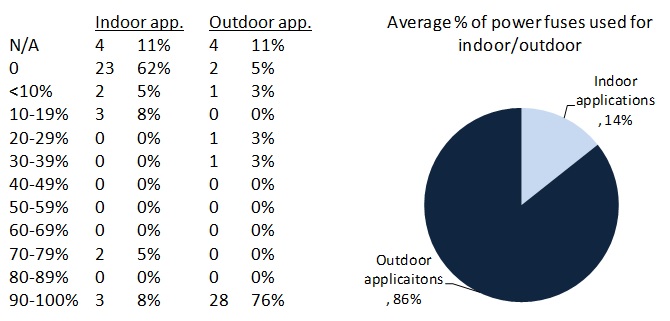

Currently, Newton-Evans staff is fully engaged in client studies researching the emerging roles being played by such basic grid components as power fuses, capacitor bank switches, and even the various improvements in transformer oils being used in the millions of power and distribution transformer installations in North America. We are about to begin a private study of high voltage circuit breaker trends.

We have not overlooked “smart grid” developments, of course, being the earliest industry marketing research firm to study T&D control systems . . . beginning in 1981. We have recently released the four volume 2013-2015 edition of the World Market Outlook for EMS, SCADA, DMS and OMS Systems. For another private client we have already completed a detailed year-by-year history and eight year outlook for distribution automation in North America.

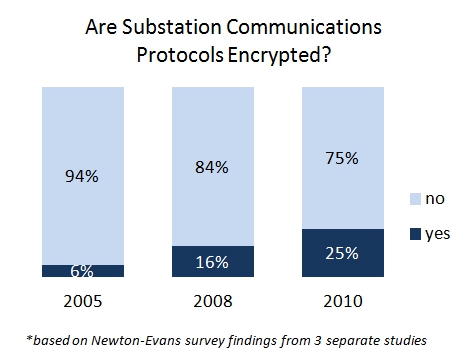

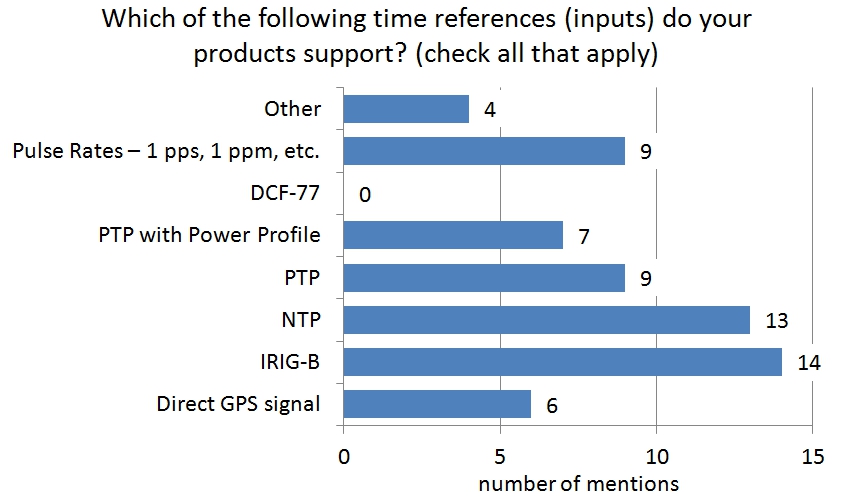

Another first quarter client study provided a major power utility client with the ability to measure the opinions, attitudes and experiences of other electric utility operations officials regarding the pros and cons of alternative data communications infrastructure choices for operational data acquisition. These report findings enabled our client to make an educated decision about how to proceed with its own communications infrastructure upgrades.

The findings presented in the project report were based on a survey sent out to large electric utilities around the world. Utility officials involved in communications network planning or oversight from more than 15 countries responded to the survey. While not all participating utilities operated control systems that are configured with multiple control centers, survey participation and informative feedback was welcomed from everyone.

Illustrative diagrams were included throughout the survey to guide respondents into thinking about four specific network communications scenarios being considered by the client utility. After being presented with the diagrams and descriptions, survey respondents were asked a series of questions including, “What scenario do you think will offer the best opportunity to accomplish the following:”

- transition easily to an IP data infrastructure with better cost control and reduced latency

- transition easily to a better data acquisition infrastructure using synchrophasors (PMUs)

- easily update data points over the network & synchronize the updates with other systems

In early June, one of our clients will be hosting an exclusive afternoon reception and discussions of advanced cyber security and related compliance topics, with speakers from NIST and ENERNEX among others. Newton-Evans will soon be sending out invitations to selected utility officials from the mid-Atlantic area. Qualified senior utility officials, who may be interested in learning more about defense-in-depth file transfer techniques between various operational systems and multiple enterprise systems, can contact us for an invitation to attend this small group event which will be held in suburban D.C. The seating for this event is limited; there is no cost for attendees (other than transportation).

This event promises to be another great way to learn more about the implications of the new 2013 cyber security executive order for critical infrastructure, as well as receiving updates to NERC compliance topics, and how advanced cyber technology developments will transfer from one usage sector to the electric power industry to secure file transfers between operational control systems and IT systems.

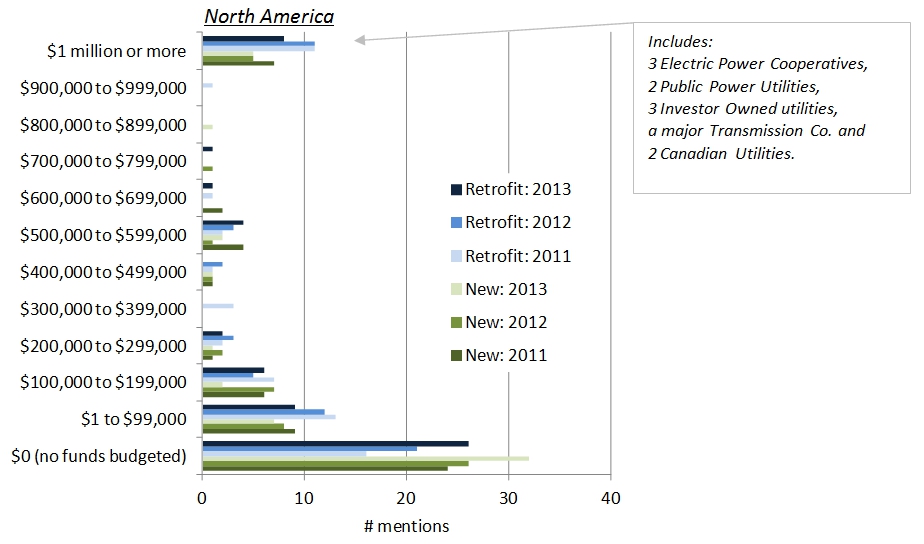

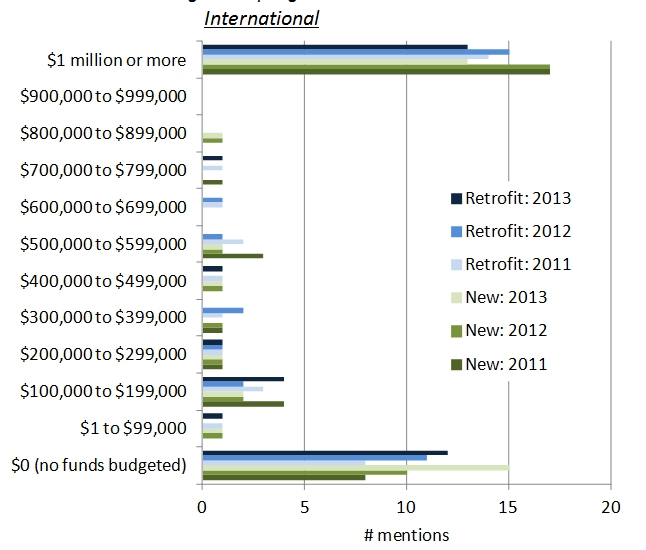

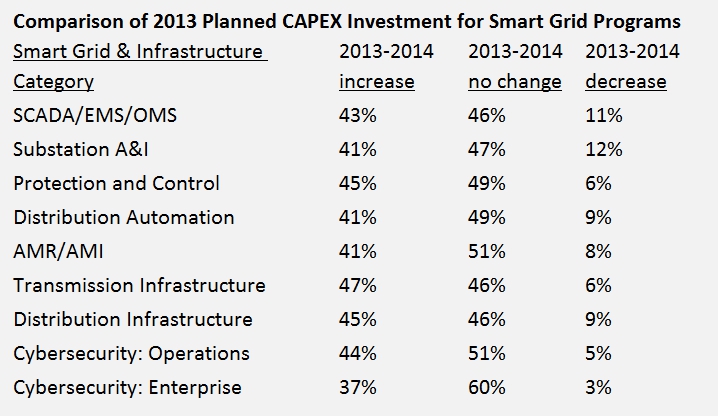

During the summer months, Newton-Evans will be “going global” once again with its fifth edition of the CAPEX/OPEX outlook among the world’s electric power utility community. Concurrently, we expect to be underway with a major update to our historical compilations of distribution automation developments and trends.

Newton-Evans’ CEO, Chuck Newton, has been selected by Energy Central to serve as the Operations Track Chair for this autumn’s KNOWLEDGE 2013 Conference, scheduled for November 4-6, 2013 at the exclusive Broadmoor Hotel and Resort in Colorado. We are looking for a few additional senior level Operations/Smart Grid people to serve as program committee members. The KNOWLEDGE Conference is known for its attractiveness to C-Level executives and other senior managers who are afforded the opportunity to have open discussions and dialogue with peers on IT and CIS topics in a relaxed setting. We hope to make the Operations track a vital new component of this exclusive conference.

Finally, during the first quarter, Newton-Evans contributed articles to the following publications:

Intelligent Utility (March 13, 2013 edition) “Current, Planned Global Deployment of Analytics Capabilities”

Utility Horizons Quarterly (April, 2013 edition) “Usage Patterns and Trends in Electric Utility Automation”

Transmission & Distributions WORLD (May 2013 edition) “Special Supplement Communications: “Assessment and Outlook for Telecommunications Networks and Protocols in the World’s Electric Power Utilities”

In addition, our latest global control systems studies received coverage on a number of financial news sites around the world as well as in the following industry publications:

Transmission and Distribution World – Online – Feb 20, 2013

“Global Spending for Power Delivery Control Systems for 2012-2015 Likely to Exceed $5.5 Billion” http://tdworld.com/smart_utility/newton-evans-delivery-study-0213/#ixzz2LT9GejmD

Renew Grid – February 19, 2013

“North American Utilities Lagging On Standards And Best Practices”

http://www.renew-grid.com/e107_plugins/content/content.php?content.9586#.USUiB1f_qsk

Smart Grid News – February 15, 2013

“Study reveals U.S. utilities falling behind in adoption of essential best practices”

http://www.smartgridnews.com/artman/publish/Technologies_Standards/Study-reveals-U-S-utilities-falling-behind-in-adoption-of-essential-best-practices-5517.html/?fpt#.USUhWlf_qsk

PowerGrid International, January, 2013

“Newton-Evans: EMS, SCADA, DMS, OMS Likely to See Much Growth Through 2015″

Print Magazine article (page 20)

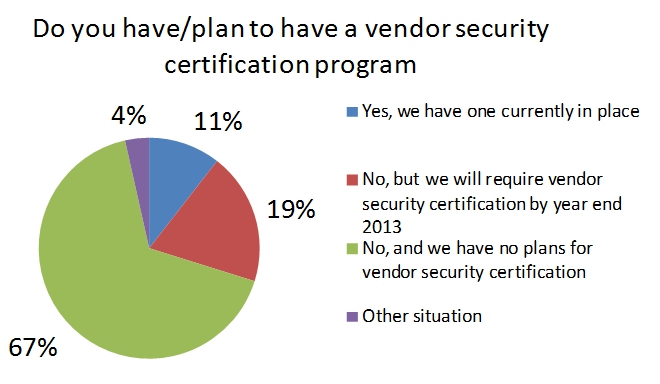

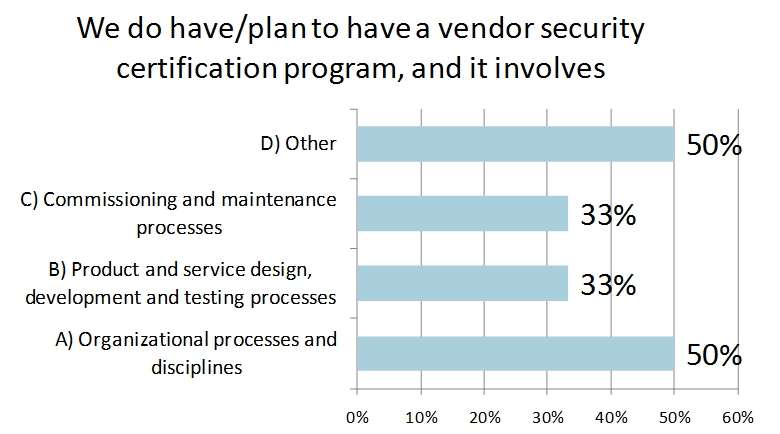

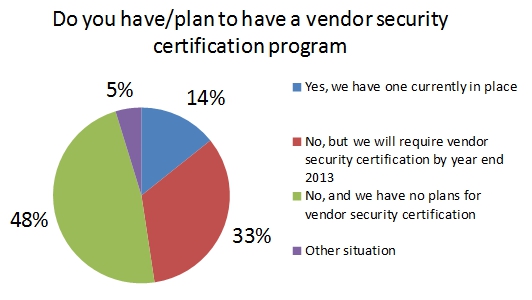

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies