April 24, 2020. The 27th annual three-day conference of the Energy Management and Market Operations Systems (EMMOS) Users Group will be held in San Diego, California during September 13-16, 2020, starting with a welcoming reception at the beautiful Kempton Hotel Palomar, San Diego on the evening of Sunday, September 13.

This year’s conference agenda will feature topical speakers and roundtable sessions, technical training class, a tour of the SDGE control center and vendors’ exhibition. The conference will be held in conjunction with the OSISoft PI Generation and T&D conference, which is being held during the same week in San Diego.

Featured conference sessions at the 2020 gathering of North American and international control systems and market operations management and staff will include topics such as: Design Matters, Protection and Control, Block Chain, 5G Networking Applications, Big Data, Grid Analytics, Situational Awareness, and others. Presentations will be delivered by representatives from IOUs, ISOs, RTOs and the T&D Consulting community. Please contact Mr. Reza Alaghehband at Reza@emmos.org for proposals and suggestions.

Panel discussion topics: “Contingency Plans for Control Centers Operating Under Emergency Conditions” and “Current and Future Utility Industry Technology Solutions and Challenges”

Technical Tour: The 2020 conference will include a control center tour and will also feature a micro grid tour.

Vendor Exhibition: An Energy Management and Market Systems focused vendor exhibition will be held on Monday evening and will include a cocktail and hors d’oeuvres reception.

Training workshop/tutorial: A 4-hour training workshop on “Power Network Applications and Tuning” will be held as part of the conference. Participants will receive a certificate of completion.

The annual EMMOS conference attendees include electric power operations officials involved with transmission, distribution, generation, Market Systems, as well as IT managers, planning engineers, consultants, ISO staffs, visualization and situational awareness engineers, and related systems personnel involved with control and/or market systems and substation modernization, distribution automation, outage management and geographic information systems.

The EMMOS website is now open and available for registrations for this September’s conference.

Further information on the upcoming 2020 EMMOS conference, including registration information and hotel booking arrangements can be found on the EMMOS website at www.emmos.org. Exhibitor opportunity information is available from Mr. Dave McGinnis at davemcginnisalt@yahoo.com . Recommendations for additional topical presentations are welcomed and should be submitted to Mr. Reza Alaghehband at Reza@emmos.org.

In the event that the conference has to be cancelled, refunds will be made to registrants or optionally can be applied to the 2021 EMMOS conference. In the event that it becomes necessary to cancel the physical conference, we will plan to conduct a live streamed video conference with speakers and roundtable discussions. The virtual conference would be available to remote attendees at a substantially reduced price.

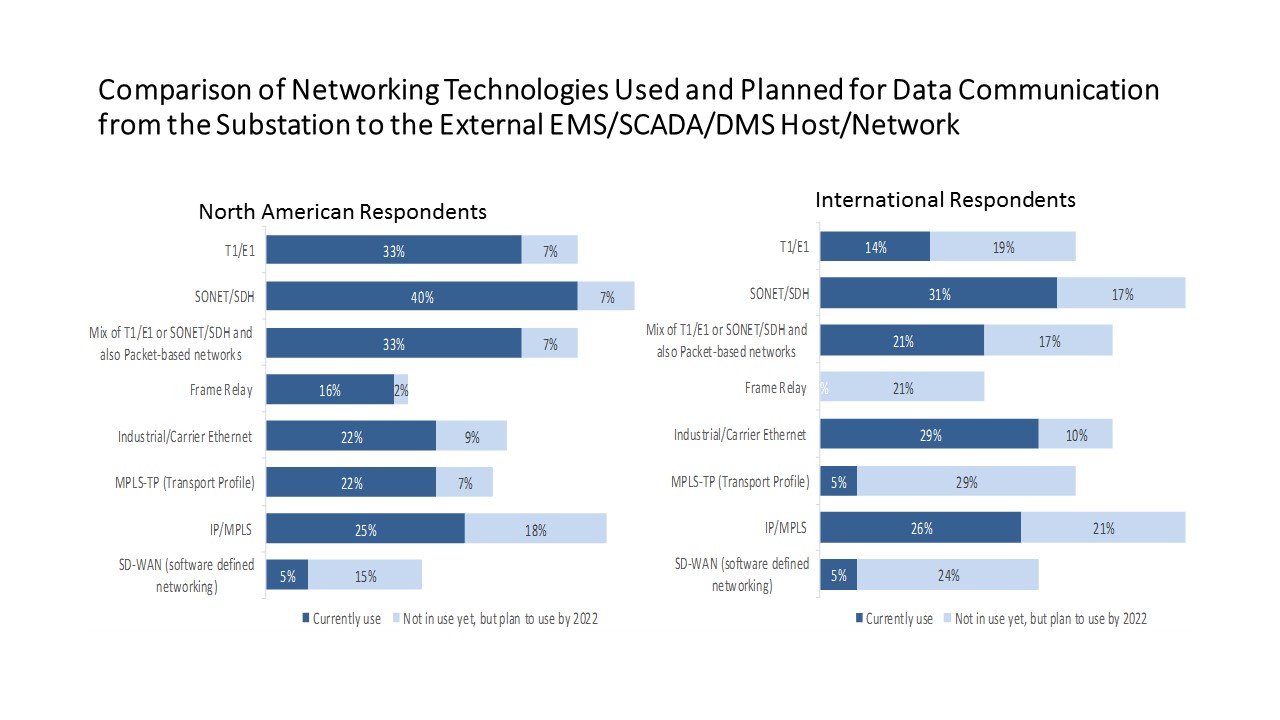

The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

The most prevalent networking technologies used in 2019 among the 42 international utility survey participants included SONET/SDH (31%), Industrial Carrier Ethernet (29%) and IP/MPLS (26%). Based on the survey sample, the leading technologies planned for development by 2020 include MPLS-TP (29%) and SD-WAN (24%).

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies