From 2008 onward, Newton-Evans Research Company has completed one or two client-based, proprietary studies each year to provide mid-term and longer-term outlooks for one or more components of the burgeoning Distribution Automation market comprised of U.S.-based electric power utilities. The primary focus of these studies has centered on various DA field equipment types and associated controllers as well as DA software and platforms, located in the field, at the substation level or at the MV operations control center.

Research Methodology

These studies have included several weeks of primary research based on direct communications with major and mid-size utilities, requesting their insights regarding DA plans through 2020. These studies also included secondary research methods to learn about documented plans for DA among other North American utilities and to better understand the likely impact of economic growth projections and electric utility revenue outlook and CAPEX spending. Overall economic information used in the preparation of our range estimates was also based on NGO and a variety of government outlook documents.

The following observations are based on survey completions provided by scores of electric power utility officials during 2012-2014.

DA expenditure allocation among three purchasing categories

The overall indications from the surveys completed prior to 2014 pointed to somewhat more than one-half of the 2013-2015 DA budgets going to the procurement of field equipment, with an equal percentage of the remaining budget allocated for platforms and software, and for DA controller devices.

Over the longer term horizon (2016-2020) the DA expenditure outlook indicated a slight shift in spending patterns, suggesting increases in the percentage of program funding allocated to DA field equipment, and slightly lower percentages going toward platforms, software, and DA controller devices.

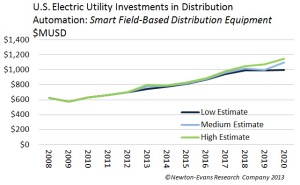

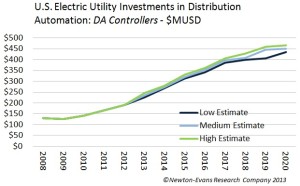

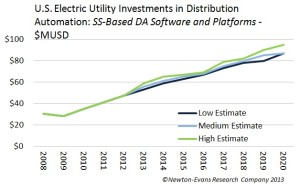

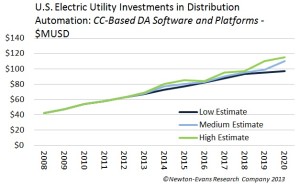

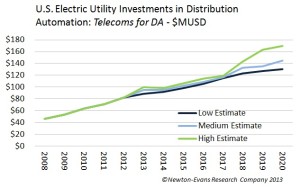

The following series of charts represent the Newton-Evans consensus view of low, mid-range and high estimates of likely DA spending for five components:

- DA smart field-based distribution equipment

- DA controllers

- substation-based DA platforms and software

- control center-based DA platforms and software

- Telecoms for DA

Specific DA communications network developments are excluded from this outlook. The mid-range outlook is based in large part on the utility survey responses and a cautiously optimistic assessment of the near-term and mid-term.

The low range outlook takes into account the possible continuation of unclear energy policies at the federal and state levels, federal and local government budget woes, minimal growth in electric utility industry revenues and a continuation of relatively flat electricity consumption patterns.

The high range outlook factors in a stronger economic outlook for the periods from late 2013 thorough 2016, based on the economic analysis information reported by several external organizations.

References were made to recent publications provided by several organizations including The Conference Board, Moody’s Analytics, The World Bank, The Federal Reserve and the Bureau of Economic Analysis.

The historic DA spending baseline years in this study have been derived from the larger and more comprehensive mid-2010 study of North American utilities conducted by Newton-Evans Research Company.

The forthcoming update to the report series, “Overview of the 2014-2016 U.S. Transmission and Distribution Equipment Market: Distribution Automation Series” goes into more detail with respect to the market for specific DA equipment and spending categories such as Automatic Circuit Recloser Controls; DA/DMS System Components; Voltage Regulators; Capacitor Bank Controllers; Fault Indicators; Pole Top (and Pad Mount) RTUs; Line Mounted Monitoring Devices; Communications Components for DA; and Engineering Services for DA.

See our reports page for topic listings and pricing details, and be sure to send us an email at info@newton-evans.com or call 1 800 222 2856 to place your order.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies