The 2024-2026 “Overview of the U.S. Electric Utility Market for OT/IT Systems” from Newton-Evans Research highlights a significant growth trajectory in the market for operational technology (OT) and information technology (IT) applications within the U.S. electric power sector. Key points from the report include:

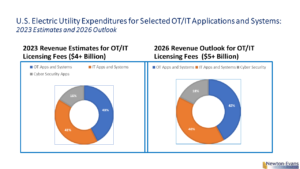

Market Size and Growth: In 2023, revenues from software license fees for OT and IT applications surpassed $4 billion, with expectations to reach $5 billion by 2026. This growth reflects the increasing importance and complexity of systems used by electric utilities and commercial and industrial (C&I) firms.

Application Coverage: The individual report summaries include a broad range of systems essential for utility operations and management, including:

Energy Management Systems (EMS)

Supervisory Control and Data Acquisition (SCADA)

Geographic Information Systems (GIS)

Customer Information Systems (CIS)

Outage Management Systems (OMS)

Meter Data Management Systems (MDMS)

Mobile Workforce Management (MWM)

Advanced Distribution Management Systems (ADMS)

Energy Market Management Systems (EMMS)

Generation Management Systems (GMS)

Distributed Energy Resources Management Systems (DERMS)

Control System Security offerings

Investment Beyond Licensing: In addition to the direct license fees, there are substantial soft dollar expenditures related to staffing and equipment necessary for developing, operating, and maintaining these systems. These additional costs can far exceed the hard dollar expenditures on licenses.

Historical Context and Trends: Historically, large utilities managed EMS and CIS through separate OT and IT departments. The evolution of the industry has led to increased integration and cooperation between these departments, resulting in greater IT/OT convergence by the 2020s.

Market Dynamics: While some applications have reached maturity and show slow growth, newer systems are experiencing rapid expansion. The competitive landscape includes over 50 major software providers, with an additional 35 companies focused on cybersecurity solutions for the energy sector, particularly for renewables asset owners and operators.

This comprehensive market overview underscores the critical role of both OT and IT systems in modernizing and optimizing electric utilities, highlighting ongoing trends and future growth areas in the sector. The OT-IT series of 12 reports can be ordered and downloaded here: https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-electric-utility-market-for-ot-it-systems/.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies