The findings presented and excerpted from this three-volume study are based on a global research survey sent out by Newton-Evans over the course of the second, third and fourth quarters of 2011. One hundred and two utility officials involved in Operations and Telecommunications Planning and Design responded to the survey. These utilities combined serve over 153 million end use customers globally; 30 million in the U.S. alone. Volume Two includes many case studies of smart grid communications projects and Volume Three provides a fresh outlook for telecommunications expenditures and trends over the 2012-2014 period.

What are some of the key datacomm issues facing your utility?

In summary, when reviewing the comments received from most of the participating utilities, there is almost a different issue or sets of issues facing each utility when it comes to key data communications challenges. Newton-Evans’ analysts have grouped the large number of responses into several categories. The most frequently mentioned issue across all 81 comments was Cost (mentioned in 22 comments) followed by Reliability (mentioned in 16 comments) and Security (15 comments.) Other issues mentioned included zoning approval for new radio towers, communications carriers facing the same economic pressures as utilities, choosing a DA communications technology, the impact of data management on computing and human resources, lack of ability to manage disparate systems with utility resources, and others.

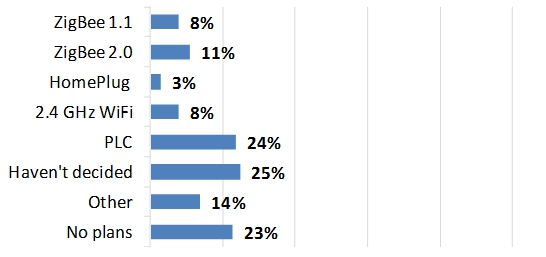

For your customer-site residential/commercial application needs, what technology do/will you employ?

Twenty-five percent of utilities said they haven’t decided on a technology for customer-site residential/commercial applications. Twenty-four percent either currently use or plan to use Power Line Carrier (PLC); this was the most frequently cited among the listed options provided on the survey. Twenty-three percent have no plans for Automated Metering Infrastructure (AMI) which screened them out of this portion of the survey.

Cooperatives were more likely to be using or planning on using PLC than others. Public utilities were more likely to be undecided. International uncertainty was prominent among respondents from the Asia-Pacific region.

For your customer-site residential/commercial application needs, what technology do/will you employ?

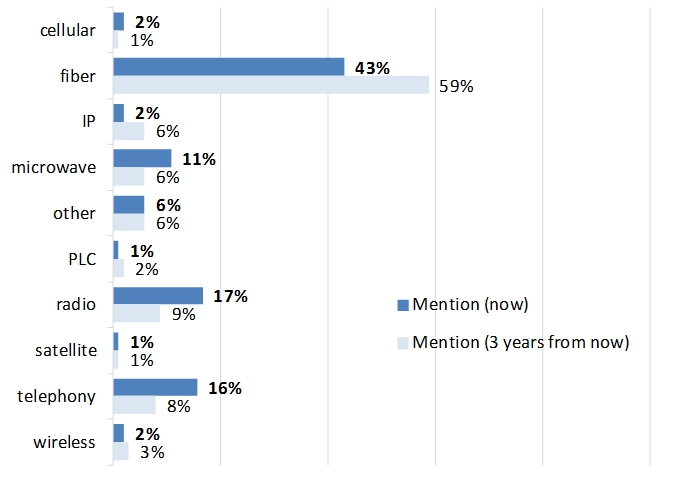

Which SCADA communications technology has the dominant use NOW at your utility and which do you expect to be dominant 3 years from now?

Fiber was most frequently cited as the dominant SCADA communications technology in 4th quarter 2011 and three years out. Radio and telephony came in a distant second and third in terms of the number of mentions.

Survey respondents provided a great deal of information as to the current use and planned use of key technologies. The response groupings are based on the selections made by utility officials.

Which SCADA communications technology has the dominant use NOW at your utility and which do you expect to be dominant 3 years from now?

This three volume study also includes vendor profiles, utility case studies, and a global market outlook. Volumes 1 and 2 are complete; the full report series will be available in January, 2012. Check our reports page to order!

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies