The Newton-Evans Research Company has announced the publication of a new set of 13 U.S. transformer market segment summaries. The new series of market overview reports (executive market summaries) includes definitions, representative products, estimated market size for each transformer market segment, vendor market share estimates and market outlook through 2020. Electric utilities accounted for about 87% of purchases of small, medium and large power transformers and a variety of distribution transformers.

A majority of power transformers and almost all distribution transformers used in the U.S. are now being produced in North America. Distribution transformers (wet and dry types) accounted for about 40% of all transformer shipment values in the U.S. market in 2017, benefiting from some improvement in the pace of new residential and small commercial construction. Fewer very large, multi-million-dollar power transformers were imported from outside the NAFTA region in 2017 compared with earlier reporting, due to a number of newer large transformer production facilities built in the U.S., Canada and Mexico over the past decade by several of the world’s major manufacturers. Increased production capacity at several existing transformer plants has also been a key factor for increasing North America’s self-reliance on this critical component of the electric grid infrastructure.

The Power Transformer series ($975.00) includes U.S. market size, market share estimates and market outlook for these 13 transformer-related product and service categories:

TX01 – Mobile Trans6formers

TX02 – Medium Power Transformers

TX03 – Medium-Large Power Transformers

TX04 – Large Power Transformers

TX05 – Very Large Power Transformers

TX06 – Shunt Reactors

TX07 – Specialty Transformers (Arc, Furnace)

TX08 – Distribution Transformers (OH, Oil, 5kva+)

TX09 – Distribution Transformers (Dry Type)

TX10 – Transformer Life Management Services

TX11 – Transformer Monitoring & Diagnostics

TX12 – Phase Shifting Transformers

TX13 – Small-Medium Power Transformers

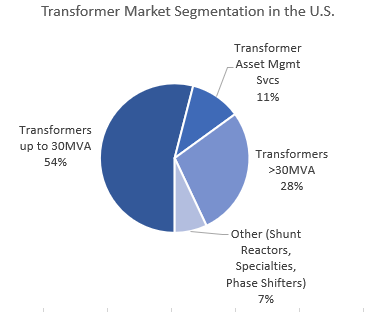

Note in the chart below the important role played by distribution and low power transformers in the overall market for utility-operated transformers.

Based on the U.S. Department of Commerce most recent data on annualized residential housing starts, there is strong growth in year-over-year multi-family residential construction (+13.2%), meaning about one-half million multi-family units and a need for thousands of larger voltage transformers. There is also good growth (6.5%) in single family housing permits issues. On an annualized basis, more than 800,000 single family residential units are likely to be constructed/under construction this year. Again, this level of construction will require the procurement and installation of many thousands of new three-phase pad-mount transformers. In turn, this will also provide the impetus for increased demand for larger power transformers “up the line” to include MV distribution substation requirements.

Four related T&D market series published in the past several weeks by Newton-Evans include: Substation Automation (13 summaries), Protection and Control (8 summaries), Distribution Automation (9 summaries); and T&D Control Systems (11 summaries). Two remaining series – High Voltage Equipment (15 summaries) and Medium Voltage Equipment (20 summaries) will be available later in April.

Further information on each of the seven T&D market overview series comprising more than 85 individual U.S. electric power industry market summaries is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316. Visit the report page for a brochure or to order any of the related report series online. For those interested in subscriptions to multiple report series, please call or email us at info@newton-evans.com for special introductory pricing offers.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies