On November 21, McKinsey & Company hosted an outstanding and timely webcast entitled Powering AI: Opportunities in Data Centers. If you have any involvement with data centers from a utility perspective or are involved with data center design, development, consulting or are simply interested in one of the booming sectors for power transformers and T&D equipment, you may want to spend an hour sitting in on this excellent webcast. The link is here: https://app.events.ringcentral.com/events/powering-ai-opportunities-in-data-centers-1966f3dd-0fb8-48ff-8093-1856433d6363/replay/UmVjb3JkaW5nVXBsb2FkOjI4MjI1

It seems to me that after a couple of months spent delving into the current situation regarding the impact of data centers on utilities and on transformer and other T&D equipment needs, both those in the U.S. and others around the world, there are a number of obstacles facing utilities that will also resonate with plans being made by data center owners and investors. The ongoing development of AI will lead to more numerous and more robust (hyper-scale) data centers being planned and constructed over the next five years.

However, the electricity markets in developed nations have built out and operate currently reliable supporting electric power infrastructure to meet recent demand levels. In many countries wherein only modest growth in power consumption is occurring, the available supply of electric power may not match up well with the growing power demands of data centers. In economic terms, the demand and supply curves are not in synch at this time, at least not at first glance, nor do they appear to line up any time soon. As a result, interesting work-arounds are being developed.

A range of options is available to meet the expected increases in power demand, and in the U.S., many utilities will need to increase the available supply of electricity through plant expansions, refurbishment or bring out of retirement some large fossil-fueled plants.

New power plants likely to be built in the near term to meet this rather sudden (in utility terms) huge increase in demand will be largely natural-gas fueled as these plants can be constructed and operating in a shorter time frame and at lower costs than can some larger renewables or other fossil-fueled projects. Recently, the Electric Power Research Institute (EPRI) stated that data centers may account for as much as 9% of power generation in the U.S. by 2030. Boston Consulting Group (BCG) has indicated power demand levels of well over 100 GW by 2030 may be reached.

Availability of electric power supply is only one part of the power equation needed to meet the upsurge in demand coming from AI developments and data centers. By looking at alternatives to today’s data center hubs, there are areas within the U.S. with more than sufficient power to meet current load requirements.

Permitting processes will have to be speeded up at the federal, regional, state and local levels while regulatory action must be taken to reduce obstacles to HV transmission development. During the 2020-2023 years, fewer than 400 new HV line miles have been annually added to the grid. Additional transmission assets must be developed. Transformer and other T&D equipment manufacturing capacity will need to be increased significantly. Training of a workforce that can support manufacturing is required, as is the need for developing capable data center operations personnel.

The data center-allied consortia recognize a near-term market need for their offerings and rightly want to seize on this opportunity. When searching for plausible sites, (as was voiced in the McKinsey webcast described above), companies are looking at secondary and tertiary regional locations – primarily heartland areas blessed with an abundance of power generation capacity to build new and very large data centers.

Today’s primary data center hubs around the world may be reaching capacity regarding electric power delivery capabilities and may have limited available infrastructure, so alternate site selection assessments are playing key roles for data center developers. Examples of secondary hubs in the U.S. include Chicago, Atlanta, Dallas and Phoenix, while Las Vegas, Reno and Columbus are considered examples of tertiary hubs at this time.

Today’s major U.S. data center owners/operators include subsidiaries of Amazon, Microsoft, Google and Meta along with Digital Realty and Equinox. Important locations (hubs) for very large data centers include Northern Virginia, home of the largest data center aggregation in the world, along with hubs in California and Texas and several other states.

As of November 2024, there are about 5,400 data centers operating in the United States alone. At least 380 new U.S.-sited data centers are being planned or being constructed at this time. Before these sites can become operational, large power transformers and high-voltage equipment must be purchased, manufactured, shipped, installed, tested and operational on the utility/energy provider side. A substation may have to be enlarged or a new substation built to serve the proposed data center.

The medium-voltage and low-voltage equipment used within the data center facility also has to be specified, purchased, installed and tested. Supply chain issues confront the utility-required equipment as well as the facility power equipment availability as manufacturer pipelines are somewhat clogged with the sheer volume of incoming orders, along with material sourcing issues, and in some cases, labor availability issues that can slow down production cycles and affect delivery times.

Effect of Tariffs

If the incoming Trump administration does follow through on its promise to impose 25% tariffs on imports from our friends and neighbors in Canadian and Mexican power equipment manufacturing locations, that action will add significantly to equipment costs and delivery delays, especially for power transformers and other T&D equipment, as a good percentage of both are currently manufactured in either Canada or Mexico.

The rapid increased in AI-fueled demand for very large and hyper-scale data centers will also significantly impact electronic devices with a requirement for increased cooling and heating systems needed for new generations of semiconductor developments.

It seems to me that a good option to meet the near-term reliable power needs of data center planners is to include on-site renewables with battery energy storage systems in addition to their grid-connected primary source of utility-delivered electricity. Sort of a hybrid micro-grid to supplement grid-supplied power.

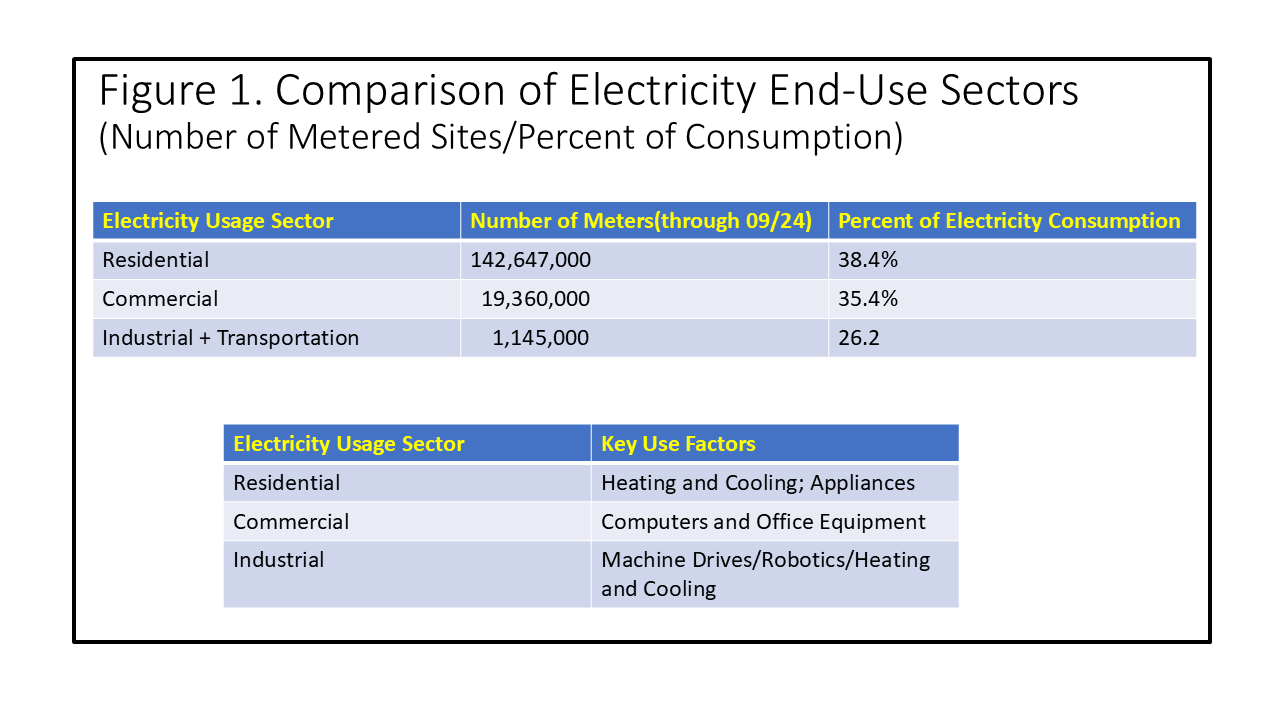

Looking across the American industrial base, we note that manufacturers and other industrial firms account for only 1,145,000 meters, serving about 450,000 industrial firms in the U.S. There are more than 19,360,000 commercial sites and the number of residential consumers will surpass 143 million meters in the next few months.

However, when it comes to consumption of electricity, residential use accounts for 38.4%U.S. of total usage, while commercial use stood at 35.4% and industrial use accounts for a significant 26% of the total. It is foreseeable that the percentage of power consumed by industrials will increase rapidly to account for perhaps one-third of the total electricity consumption by 2030. This will be due not only to the rapid growth of data centers, but likely to some degree of additional discrete and process manufacturing facilities being reshored as well as new factories coming online. SeeFigure1. In closing, it appears we will be in for a roller coaster of a ride, between the energy industry in transition, the need for more power capacity, and the explosive growth of not only data centers, now accompanied by a resurgence for high power requirements from a wave of new semiconductor fabrication plants, a likely strong expansion in mining industries, the reshoring of industrial firms, and a possible increase in several power hungry hydrogen production facilities now being designed for delivery during the next five years.

In closing, it appears we will be in for a roller coaster of a ride, between the energy industry in transition, the need for more power capacity, and the explosive growth of not only data centers, now accompanied by a resurgence for high power requirements from a wave of new semiconductor fabrication plants, a likely strong expansion in mining industries, the reshoring of industrial firms, and a possible increase in several power hungry hydrogen production facilities now being designed for delivery during the next five years.

– Chuck Newton

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies