There are a number of equipment reliability, performance and safety tests conducted before T&D equipment is ready for commercial deployment. The list of potential tests that are conducted either by “outside services” firms or by the equipment manufacturer is extensive.

Some of the more common equipment specific tests include: internal arcing faults, short-circuit withstand, load switching, loop switching, capacitive switching, harmonics, temperature rise, impendence testing, partial discharge, dielectric, overload testing and others.

Only a relative handful of test labs are equipped to conduct high power testing for clients. The ability to conduct short circuit testing is largely dependent upon having high power test capabilities. In North America., there are only seven companies that presently operate high power laboratories. Two are commercial labs (DNV GL KEMA Powertest and PowerTech) and five are maintained by equipment manufacturers including Eaton, Littelfuse, Mersen, S&C and Schneider Electric. These manufacturer labs also provide lab testing services to outside manufacturers.

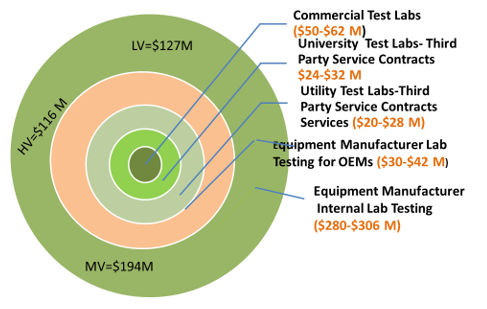

Commercial T&D equipment test labs compete for about $50-$62 Million in test revenues annually. Much more is spent on manufacturer and end-user testing conducted with “gray market” providers including universities, utilities and manufacturer labs that open their doors on a contract basis to other manufacturers (OEMs).

University labs can be found across the continent’s engineering schools and include Georgia Tech’s NEETRAC, Mississippi State University, PITT, University of Illinois and more than 20 others – several of which are located near T&D equipment manufacturing facilities. Newton-Evans estimates university labs earned about $28 Million in 2017 by conducting lab testing for manufacturers and equipment end-users.

Utility-operated labs will also undertake paid T&D equipment testing for manufacturers and even for service area end-use customers. Stalwart utility labs include those operated by AEP (Dolan Labs), PG&E (San Ramon facility), Southern California Edison (Westminster Lab) and at least fifteen other large utilities. The annual contract services revenues brought in by these labs amounted to about $24 Million in 2017.

Manufacturer-operated labs earned an estimated $36 Million performing lab tests for OEM equipment manufacturers and upon customer-reimbursed requests in 2017. Manufacturers and end-use customers also tested their own equipment in their own labs to the tune of nearly $300 million in test lab expenditures, according to Newton-Evans’ estimates.

The largest commercial T&D testing labs (KEMA, PowerTech, Kinectrics, UL) obtain the bulk of revenues from high power, surge withstand and short circuit testing of larger (MV/HV) capital equipment. Other test labs provide more limited capabilities such as high voltage testing of LV/MV equipment. Importantly, while commercial labs may have a 10-15% premium in pricing, they offer high quality, well-scheduled and executed test plans and a few can offer product type-test certifications.

There are at least five important organizations that many grid-scale LV/MV/HV electrical equipment test labs will be found to be actively engaged with in the North American market. These include the following:

NRTL: Nationally Recognized Test Lab – OSHA safety certification of these electric equipment test labs.

STLN – Short circuit testing liaison of the Nations of the Americas

A2LA – American Association for Laboratory Accreditation. ISO/IEC 17025 General Requirements for the Competence of Testing and Calibration labs.

IAS – International Accreditation Service – Key organization for labs providing High Power Testing

INMR – Trade organization for companies involved with manufacturing and testing of insulation-components of electrical equipment.

In 2017, there was a combined market for testing of T&D equipment that amounted to about $437 million, allocated according to the chart below.

2017 North AMerican Value Estimates of LV/MV/HV Equipment Testing Services for Selected T&D Equipment: (Range of $404-$470MUSD)

Newton-Evans will be publishing a more in-depth report on the T&D equipment testing market and outlook in the first quarter of 2019. Pre-publication pricing will be announced on our website (www.newton-evans.com) early next week.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies