The Newton-Evans Research Company has released findings from the North American volume of its newly published four volume research series entitled: The World Market for Substation Automation and Integration Programs in Electric Utilities: 2011-2013. The new study compares the current round of research findings with earlier tracking studies conducted by the firm.

Newton-Evans Research estimates the current North American spending for substation automation and integration programs at more than $500 million, with an overall potential market size of nearly $10 billion. Global potential is estimated at about $38-$40 billion. This amount includes spending for a wide range of intelligent substation-resident equipment and devices and the manpower to undertake the systems integration efforts required.

The years 2008-2009 were slow growth – or at best moderate growth – years in most categories of intelligent electronic equipment sales related to the modern, increasingly digital, electric power substation. Fewer retrofit programs were undertaken except for the most critical of substations. The pool of funding for substation automation projects increased somewhat by virtue of a portion of the stimulus funds made available by the U.S. Department of Energy, with most of this amount likely to be spent in 2011-2012.

Additional topics being covered in the four volume series of substation automation studies include strong coverage of multiple communications topics, vendor security certification requirements, external systems linkages to the substation, preferred equipment suppliers, and an assessment of where North America’s electric power substations are positioned along a three-phase path to complete automation.

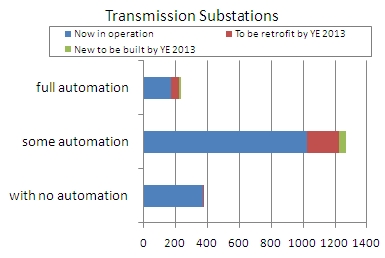

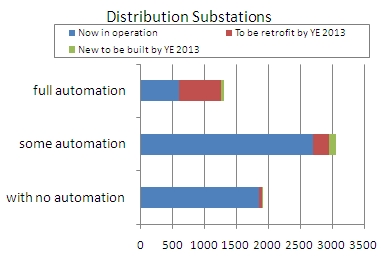

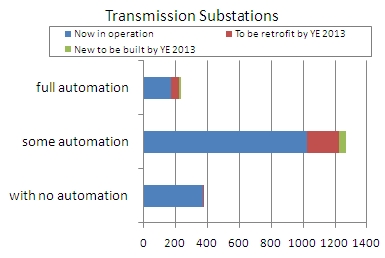

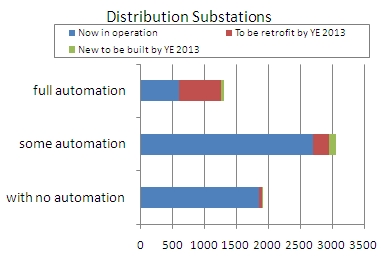

Level of automation of substations reported in North American survey sample

Respondents indicated a total of 1,567 transmission substations and 5,154 distribution substations in operation as of the 4th quarter of 2010. These represent a 9% sample of U.S. and Canadian combined totals of transmission voltage substations and nearly 10% of all distribution voltage substations.

It seems surprising that as of 2010, there were significant numbers of transmission substations reported to have no IEDs and no automation, although retrofit programs over the 2011-2013 period will likely improve the status of more than one-half of those currently non-automated substations.

Of 5,154 distribution substations in operation at participating utilities, nearly 36% were reported to be without any automation. Just over one-half (52%) of these distribution substations were classified as Stage 1 sites (having some IEDs, RTUs, and two-way communications). About 12% were reported to be “fully automated.”

The finding that 60 new transmission substations and 170 new distribution substations are on the drawing board for construction by 2013 provides some cautious optimism for EPC firms, as this level of planning is a sign of re-investment in grid-essential infrastructure.

The World Market for Substation Automation and Integration Programs in Electric Utilities: 2011-2013 Volume 1, North American Market is available for $2,500. To order volumes of these reports as they become available, and to view pricing details for all our reports, visit our Market Research Reports page. For samples or to view the table of contents, send a request to info@newton-evans.com with the subject line “Substation Automation Market 2011.”

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies