Nearly half of North American electric utilities participating in the 2017-2019 Newton-Evans Research study plan to upgrade or retrofit their SCADA system by 2019. Twenty-two percent plan to upgrade or retrofit their energy management system (EMS), and twenty-five percent will upgrade or retrofit their outage management system (OMS). Twenty-six percent of North American utilities in the survey sample are adding a new or replacement distribution management system (DMS) or advanced DMS by 2019.

Continue reading Newton-Evans Study Finds Differences in Spending Plans for Electric Utility Control Systems Over the 2017-2019 Years

Category: Announcement

Research Findings Point to Upgrade of EMS, SCADA and DMS Capabilities during 2017-2019 among North American Electric Power Utilities to Accommodate Renewables Integration and Demand Response

Emphasis Placed on Extending Applications and Expanding Roles of Distribution Management Systems and Outage Management Systems

Continue reading Research Findings Point to Upgrade of EMS, SCADA and DMS Capabilities during 2017-2019 among North American Electric Power Utilities to Accommodate Renewables Integration and Demand Response

Newton-Evans Study Finds Market for Relay-Centric Devices and Controls Expanding with Emergence and Growth of Newer Industry Segments

Newton-Evans Research Company continues to assess the results of its six-month research study of protective relay usage patterns in the world community of electric power utilities. Findings from 114 large and mid-size utilities in 28 countries point to some newer trends in adoption and use of protection and control technology.

Continue reading Newton-Evans Study Finds Market for Relay-Centric Devices and Controls Expanding with Emergence and Growth of Newer Industry Segments

January 2017 Edition of Market Trends Digest

A new edition of the Newton-Evans Market Trends Digest is now available:

http://www.newton-evans.com/newsletter_archive/mtdJan2017.pdf

This issue includes:

- A look back at the Worldwide Protective Relay Marketplace study completed last month

- Progress report and interim findings from the 2017-2019 SCADA, EMS, DMS and OMS global market study

- Excerpts from a 2016 study on the need for third party consulting services in the areas of metering, OT and NERC CIP compliance

- Observations on the Metering, AMI and related Telecommunications Market

We look forward to sharing more energy industry market intelligence in 2017.

Early Survey Findings Point to Continuing Development of EMS, SCADA, DMS and OMS Capabilities during 2017-2019 among North American Electric Power Utilities

The Newton-Evans Research Company has released preliminary findings from its current study of EMS, SCADA, DMS and OMS usage patterns in North American electric power utilities, one of four component reports of the company’s global market assessment series on operational control systems.

Among the initial observations gleaned from interviews and surveys with over 60 officials from a broad range of U.S. electric utilities:

Continue reading Early Survey Findings Point to Continuing Development of EMS, SCADA, DMS and OMS Capabilities during 2017-2019 among North American Electric Power Utilities

Findings from Newton-Evans 2016 Study of Protective Relay Trends in the World’s Electric Power Utilities Depict a Receptive Market for Incorporating Advanced Technological Capabilities

Global Study Finds Continuing Moderate Growth in Protective Relay Market with Commitment to Improving Protection Coordination and Grid Security Practices

Role of Synchrophasors and Teleprotection Continues to Expand; Provides Better Situational Awareness and Visualization for Control System Operators

Continue reading Findings from Newton-Evans 2016 Study of Protective Relay Trends in the World’s Electric Power Utilities Depict a Receptive Market for Incorporating Advanced Technological Capabilities

Newton-Evans Surveys Underway

Outlook Study for HV and MV Equipment Purchasing Plans

Newton-Evans Research is conducting a study of U.S. electric utility plans for T&D equipment purchases over the coming 36 months. If you work in power transmission or distribution and specify or procure equipment, you can help the utility community by participating in the study. In turn, we will share back the findings and provide an honorarium as well. Aggregated equipment demand levels will have an influence on prices and options for capital equipment used in power transmission and distribution.

Continue reading Newton-Evans Surveys Underway

North American Protective Relay Marketplace: New Report Now Available

Volume One of this 2016 study of protection and control is based on a sample of North American investor-owned, public and cooperative electric power utilities.

The data provides information on a segmented basis by type of utility and by number of customers served. These tables help illustrate occasional important differences in the findings based on the type and size of utility.

The findings in this report are based on survey responses received from 79 electric utilities that include 16 investor-owned, 28 public power, 26 cooperatives, 4 electric power consulting groups, and 5 Canadian electric utilities. This survey was conducted between April and May of 2016. Initial phone calls were placed to utility officials and relay engineers to invite them to complete the survey either as a Microsoft Word attachment via email, or completing an online survey on www.surveymonkey.com. Reminders were sent via email every 2 weeks until the last call deadline was issued.

The 79 utilities participating in this year’s study represent 31 million electricity end users/customers, having 3,340 transmission substations and 7.841 distribution substations covering over 800,000 total T&D line miles. This sample is about 20% of the North American customer base and approximately 15.7% of utility-operated transmission and distribution substations. Newton-Evans has previously estimated that direct shipments to utilities account for about 40% of the overall North American market for protective relays.

Each question in this report contains:

- A pie chart or bar chart summarizing how all of the survey participants responded to the question

- A table (or series of tables) showing the data by:

- Summary: all survey respondents

- Investor Owned: investor owned utilities

- Public Power: publically owned utilities (municipals, public utility districts, state or federal government)

- Cooperative: member owned electric utility cooperatives

- Canada: electric companies in Canada

- Other/Consultant: respondents representing power technology companies, industrial facilities

- <100,000: electric utilities serving fewer than 100,000 customers

- 100,000 to 499,999: between 100,000 and 499,999 customers

- >=500,000: 500,000 or more customers (either directly via distribution, or indirectly via generation and transmission.)

- Some written analysis and observations based on the tables and charts

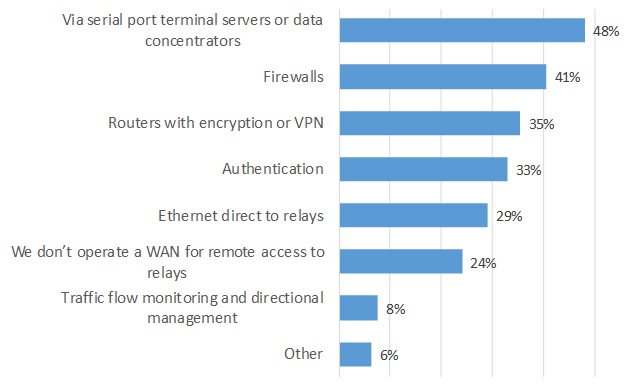

What approaches are you using to operate a WAN for remote access to relays?

While 24% of the respondents said they don’t operate a WAN for remote relay access, almost half said they connect via serial port terminal servers or data concentrators. Forty percent use firewalls in conjunction with the WAN, while just over one-third said they use routers with encryption or VPN capabilities to access relays over a WAN. Other mentions included “gateways”.

WAN Usage for Remote Access to Relays

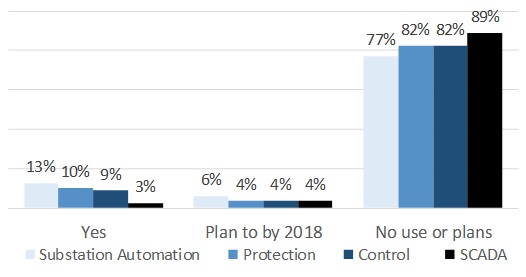

Does your utility’s control system use protocol IEC 61850 for Substation Automation, Protection, Control, or SCADA?

Seventeen respondents said they use IEC 61850 in at least one of the four areas. Thirteen percent said they use 61850 within the substation, and another 6% said they plan to use it in the substation by 2018. About 80% of the respondents have no use or plans for IEC 61850 in any area, and 89% said they don’t use or plan to use IEC 61850 for SCADA.

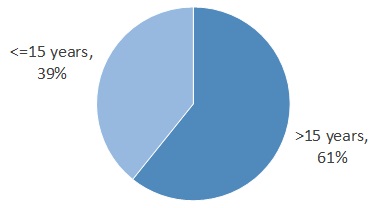

What % of your relays have been in service for more than 15 years?

Overall, 55% of survey respondents reported that more than one-half of their protective relays have been in service for more than 15 years. Out of all 76 respondents to this question, twelve said that less than 20% of their installed base is older than 15 years. However, in some cases the useful lifespan of a protective relay is stated as nearly 30 years. There are installations of electro-mechanical relays that have been in operation since the 1960’s according to some utility officials. According to the observations reported in Table 23, two-thirds of relays installed at surveyed IOUs (and nearly two-thirds among Canadian respondents) have been installed for more than 15 years.

Percent of Relays Among Newton-Evans Sample that are >15 years in service

To order Volume 1 of The Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018 visit our reports page or fax an order form to 1 410 750 7429: www.newton-evans.com/relaymarketplacestudy2016-2018

Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018

The Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018, a four volume report series by Newton-Evans Research Company, is scheduled for publication in August 2016. Volume 1 – North American Market is now available.

Overview

Newton-Evans’ Worldwide Study of the Protective Relay Marketplace: 2016-2018 is planned to be a multi-client study which encompasses the world market for protective relays in the electric utility industry. This four volume report series will be the seventh worldwide study of protective relays which Newton-Evans has undertaken. Participants in this market study will include utility engineers and managers from investor-owned utilities, municipal and provincial utilities, cooperative utilities within the United States and Canada, together with national power systems throughout the world. The study will measure current market sizes and contains projections on a world region basis for the next several years. The entire research program will define the product and market requirements which suppliers must meet in order to successfully participate in one or more of these diverse world market regions.

Newton-Evans Research Company estimates from our earlier 2012 relay market study indicate that the North American protective relay market stood at almost $600 million for both utility and industrial applications. It will be important for the P&C community to learn how changes in the world market conditions since 2014 will affect the outlook for 2016-2018.

To read more about this upcoming study and get ordering information, see the brochure page.

North American Study Finds Continuing Moderate Growth in Protective Relay Market with Commitment to Increasing Protection Coordination and Grid Security Practices

Role of Synchrophasors and Teleprotection Continues to Grow, Providing Better Situational Awareness and Visualization to Help Prevent Outages

Newton-Evans Research Company has prepared an interim news release based on preliminary findings from 59 large and mid-size North American electric utilities.

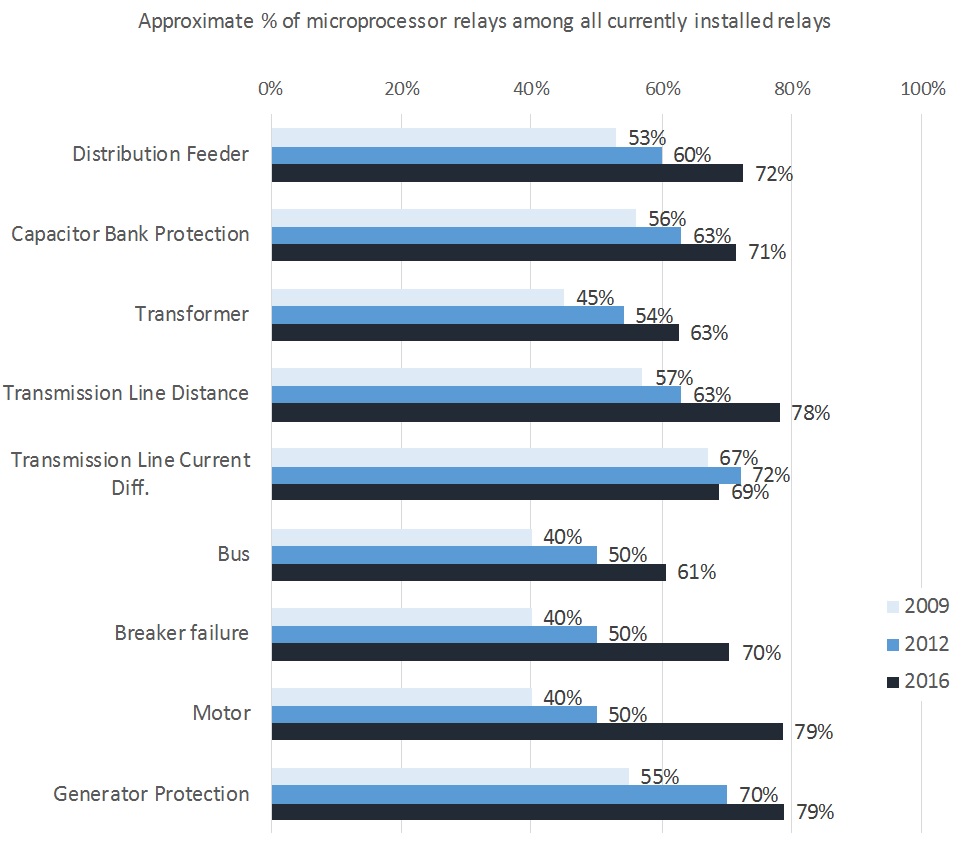

Among the early trends reported in this first of a four volume set of reports are these:

- The percentage of microprocessor relays in the mix of all protective relays used by utilities continues to increase with each passing year.

- The vast majority of new and retrofit units being planned for purchased are also digital relays, but in some of the protection applications studied, such as motor protection and large generator applications, and in installations where electrical interference is strong, electromechanical and older solid state relays continue to have a niche market position.

- Real-time analysis of synchrophasor data has become a key application for the emerging field of operational analytics for transmission operators.

Communications protocol usage patterns in North American utilities of all sizes continue to rely on DNP3, the dominant protocol in use in the North American region. IEC 61850 is found in some of the TOP 100 utilities, but is by no means prevalent as of mid-2016.

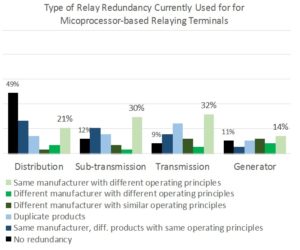

Relay redundancy being used for microprocessor-based relaying terminals varies by application as seen in the chart below.

The 2016 Newton-Evans survey of electric utilities includes more than 20 detailed product functionality topics, related technical questions, and market-related issues, together incorporating more than 250 items of information from each of the participating utilities.

This year’s study will result in a series of four reports published during June and July. These reports are geared to the planning needs of protective relay suppliers, power industry consultants, and utility protection and control departments. The four volumes include the North American Market Study, the International Market Study, Supplier Profiles, and Global Market Assessment and Outlook.

Further information on the research series The World Market for Protective Relays in Electric Utilities: 2016-2018 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com for additional information or to order the report series online.

Study of Commercial Lab Testing of Medium and High Voltage Equipment

Newton-Evans Research Company is currently conducting a study of the market for laboratory testing of medium and high voltage electric power T&D equipment. The purpose of this study is to find out how electricity producers, T&D companies, industrial facilities and transit and rail companies handle testing of equipment such as: power transformers, load tap changers, switchgear, load interruptors, outdoor circuit breakers, fused cutouts, relays, capacitors, load break switches, reclosers and instrument transformers.

Some of the tests for these pieces of equipment that are routinely performed in a laboratory situation include: arc flash, internal arcing fault, load and capacitive switching, short circuit interruption and withstand, overload, interrupting current tests, switching tests and cable/line charging. These laboratory-based tests are sometimes performed in-house by electric utility staff, but more often an outside consultant, equipment manufacturer, university or commercial test lab is hired to perform these tests.

In an effort to better serve electric power utilities, generating companies and industrial facilities, test labs want to know: “If you had the opportunity to troubleshoot a technical problem “off the grid” using an independent lab, what are some of the problems or issues you would test in that situation?”

If you or someone you know is involved in equipment testing or maintenance planning and would like to take our survey and receive a report of findings from this study, and a stipend, send inquiries to info@newton-evans.com or call 800-222-2856. A link to our survey, hosted by Surveymonkey.com, is available here:

https://www.surveymonkey.com/r/ElecPwrEquipTestingSurvey2016

2015 Newton-Evans Survey Respondent Donations to Charitable Organizations

Participants in various Newton-Evans research studies are often asked if they would like us to make a donation on their behalf (in amounts of $25 or $50 dollars a piece) to one of several pre-selected charitable organizations including UNICEF, the Wounded Warrior Project, the Canadian and the American Red Cross.

In 2015, Newton-Evans Research Company’s contributions – made on behalf of survey participants around the world – add up to $1,725: Over the past decade, our survey respondents have selected donations to charities with payments by Newton-Evans amounting to more than $35,000. We are grateful to our survey participants from around the world for donating their honorarium to these and other charitable organizations. During 2016, Newton-Evans will be conducting three major international studies, so the donations to UNICEF will likely be substantially higher than in 2015.

Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018

Newton-Evans is in the planning stages of updating one of its flagship report series on the Worldwide Protective Relay Marketplace, slated for completion in the second quarter of 2016.

If you are a supplier of protective relays, relay testing or integration services, or if you are interested in following technology trends, we invite you to contact us to let us know what questions, comments or concerns you have about this $2.5 billion world market.

Send us an email to relaymarket@newton-evans.com with any ideas you have, or if you are interested in pre-subscribing to this report series. Pre-subscribers are encouraged to help us design the survey/questionnaire which goes out to hundreds of electric utility decision makers and planners around the world by submitting from 2-5 questions for consideration.

Overview

Newton-Evans’ Worldwide Study of the Protective Relay Marketplace: 2016-2018 is planned to be a multi-client study which encompasses the world market for protective relays in the electric utility industry. This four volume report series will be the seventh worldwide study of protective relays which Newton-Evans has undertaken. Participants in this market study will include utility engineers and managers from investor-owned utilities, municipal and provincial utilities, cooperative utilities within the United States and Canada, together with national power systems throughout the world. The study will measure current market sizes and contains projections on a world region basis for the next several years. The entire research program will define the product and market requirements which suppliers must meet in order to successfully participate in one or more of these diverse world market regions.

Newton-Evans Research Company estimates from an earlier 2012 relay market study indicate that the North American protective relay market stood at almost $600 million for both utility and industrial applications. It will be interesting to see how changes in the world market since completion of the 2012-2014 study will affect the outlook for 2016-2018.

Methodology

Field survey work is conducted using a mix of primary research methods including personal interviews, mail surveys, faxes, e-mail and follow-up telephone interviews by Newton-Evans Research Company staff. In addition to discussions with utility managers and influencers, Newton-Evans conducts interviews with protective relay industry officials to gather management impressions about the size, scope, direction and trends in the relay business. Discussions and information exchanges with international suppliers provide additional market insight. Over the past 15 years Newton-Evans has received thousands of completed surveys from utility personnel.

Topics

The survey-based findings in Volumes 1 (North American Market) and 2 (International Market) will discuss the following:

- Number of relays to be purchased over the 2016-2018 period

- Percentage of digital/microprocessor relays in installed base and planned for new and retrofit applications purchases

- Estimates of annual budgets for protective relay hardware purchases

- Level of testing for new digital relays

- Communications approaches for wide area networks

- Relay communications protocol requirements

- Types of relay scheme redundancy used for microprocessor-based relaying terminals

- Third party services for relay testing

- Level of implementation of IEC 61850

- Uses of IEC 61850 within substation, for protection, control, and SCADA

- Use fiber optics to connect substations

- Outsourcing trends for testing, engineering, integration

- Use of condition based maintenance to reduce maintenance testing time of technicians

Volume 3 will provide a market forecast for the relay market through 2018. The survey sample from volumes 1 and 2 will be analyzed by world percentage of distribution line miles, transmission line miles, number of substations, nameplate capacity (as it applies to generator protection), and number of medium to large transformers included in the sample. This data is then used to estimate factory shipments according to type of relay (electromechanical vs. solid state), market segment (North American utilities, International utilities, and IPP/Industrial/OEMs), relay application (substation equipment, generators/motors, transmission lines, or distribution feeders), and market share by relay manufacturer.

Volume 4 profiles several of the major relay manufacturers and related equipment providers such as ABB, Alstom Grid, Basler, Beckwith, Cooper, Cutler Hammer, FKI, GE Multilin, Nari, RFL, Schneider, SEL, Siemens, and ZIV. Product descriptions and key contacts are provided, as well as reported 2014 and 2015 revenues where available.

EMMOS Conference Sep. 21-23

Just a reminder for those planning to attend the 22nd annual EMMOS (Energy Management and Market Operations Systems) user group conference on September 21-23 at the Marriott Renaissance Hotel in Carmel, Indiana can make hotel reservations at a discounted rate until August 27th.

This year’s conference agenda will feature topical speakers and roundtable sessions, technical training classes and a vendor exhibition.

Featured conference and training topics at the 2015 gathering of North American and international control and market systems operations management and staff include:

- Cyber Security Perspectives in Light of CIPS V5

- Overview of MISO Market and System Reliability Operations

- North American Developments in DMS and DA Usage

- Visualization

- Situational Awareness

- Communications Standards

- Renewables Integration and Management

- Network Security Applications

- Next Generation Systems

- The Future of Energy – Smart Grid and Beyond, and several additional control systems related topics.

The 2015 conference will include tours of the Midwest ISO (MISO) control center on Tuesday afternoon and Wednesday morning. The vendor exhibition will include a cocktail and hors d’oeuvres reception on Monday evening.

The annual EMMOS conference attendees include electric power operations officials involved with transmission, distribution and generation, as well as IT managers, planning engineers, consultants, ISO staffs, and related systems personnel involved with control systems and substation modernization, distribution automation, outage management and geographic information systems.

Further information on the upcoming 2015 EMMOS conference, including registration information and hotel booking arrangements can be found on the EMMOS website at www.emmos.org. Exhibitor opportunity information is available from Ms. Erika Ferguson at EFerguson@osisoft.com

July 2015 Market Trends Digest

The July 2015 Market Trends Digest is now available to read on our website. Find out what we’ve been researching for the first half of 2015!

Substation Automation 2015-2017 Market Overview Series Now Available

Newton-Evans Research has just finished updating a series of U.S. market overview briefs on fourteen different substation automation market topics, including: Remote Terminal Units, Programmable Logic controllers, Substation Automation Platforms, Multifunction Meters and Recorders, Inter-Utility Revenue Meters, Digital Relays, Digital Fault Recorders, Sequence of Events Recorders, Power Quality Recorders, Substation Reclosers, Substation Automation Integration Specialists, Substation Communications, Substation Voltage Regulators, and Substation Precision Timing Clocks.

Each report provides a list of major market participants and their year-end 2014 revenues and market shares, as well as estimates of product pricing and a U.S. market forecast through 2017. See the sample brochure for more detail.

This series of reports is available for purchase on our reports page

First Quarter 2015 Projects Underway at Newton-Evans Research:

Study for CIGRE WG D2.38 – Operational Readiness for Cyber Threats. The Newton-Evans staff is conducting an international survey of electric utility IT and OT organizations to learn about the current status of preparations and readiness to minimize the impact of cyber threats. Utilities that participate with us in this “pro bono” study for CIGRE will be entitled to share in the findings and recommendations from the survey and from the guidance to be set forth in a 2016 CIGRE technical brochure.

2015-2017 Substation Automation U.S. Market Overview Series: Newton-Evans is in the process of releasing a new series of market synopses concerning 14 components of electric power substation modernization in the United States. Fourteen report summaries are available individually or as a complete series. Taken together the fourteen components reported in the series accounted for an estimated $1.7 Billion in 2014 shipments to U.S. utility and industrial customers. Growing at an average rate of about six percent, Newton-Evans expects 2017 shipment values to reach nearly $2 Billion.

Included in the series are these individual topics: SA01 – Remote Terminal Units; SA02 – Programmable Logic controllers; SA03 – Substation Automation Platforms; SA04 – Multifunction Meters and Recorders; SA05 – Inter-Utility Revenue Meters; SA06 – Digital Relays; SA07 – Digital Fault Recorders; SA08 – Sequence of Events Recorders; SA09 – Power Quality Recorders; SA10 – Substation Reclosers; SA11 – Substation Automation Integration Specialists; SA12 – Substation Communications; SA13 – Substation Voltage Regulators; SA14- Substation Precision Timing Clocks. The report summaries are available individually at $150 per report, or the group of 14 report summaries is available for only $975.00.

2015-2017 Protective Relay U.S. Market Overview Series: Newton-Evans is now underway with work to update the 2012 series on protection and control. A total of ten market summaries will become available on April 10. The P&C series will include the following topical summaries:

PR01 – Feeder Relays; PR02 – Transmission (Distance, Overcurrent, Line Differential) Relays; PR03 – Generator Relays’ PR04 – Bus and Busbar Relays; PR05 Transformer Protection Relays; PR06 – Motor Control Relays; PR07 – Electro-Mechanical Relays; PR08 – Drop-In Control Houses; PR09 – Synchrophasors (PDUs/PDCs); PR10 – Teleprotection. The report summaries will be available individually at $150 per report, or the group of 10 report summaries will be available for $875.00.

Worldwide Study of the Protective Relay Marketplace In Electric Utilities (2015-2017). Newton-Evans staff is preparing to undertake a major update to the four volume flagship study of protective relay use in utilities around the world. We need to hear back from interested parties as to whether this study should be scheduled for a spring kick-off or whether we should defer work on this massive study until autumn 2015. Early commitments will mean lower subscription prices and earlier reports availability. Please provide your thoughts and information requirements on the study’s timing and desired content to us.

Commissioned Studies: Privately funded studies this first quarter include North American assessment of the recloser market; cyber security topics; ADMS market overview; software module pricing for AMI-OMS related systems; new compilation of North American EHV/HV and MV substations, transmission and distribution line mileage totals. (By state and by type and size of utility).

New Utility Insights on Adoption of Advanced Distribution Automation Applications

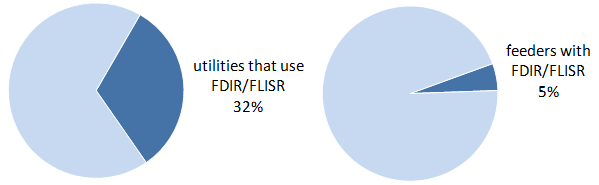

Findings from the Newton-Evans Research Company study completed in February 2015 indicate that a substantial number of electric utilities are using distribution automation technologies such as FDIR/FLISR and VVC/VVO/CVR, but the number of operating feeders currently configured with these features is still relatively low. These observations are based on a survey of 75 electric T&D utilities in the U.S. and Canada providing electric power service to 32 million customers (approximately 20% of North America’s electricity end users, according to Newton-Evans estimates.)

Percentage of all feeders that have Fault Detection Isolation Restoration (FDIR) or Fault Location Isolation Service Restoration (FLISR) Capabilities

On a summary basis, nearly one-third of the responding utilities (32%) cited their operation of one or more primary distribution feeders configured with FDIR/FLISR capabilities. However, the overall installed base of feeders with FDIR/FLISR capabilities was quite small, standing at about five percent of the total number of feeders operated by these utilities. According to the survey sample, six percent of 13-15kV feeders and seven percent of 22-26kV feeders are configured to provide FDIR/FLISR functionality.

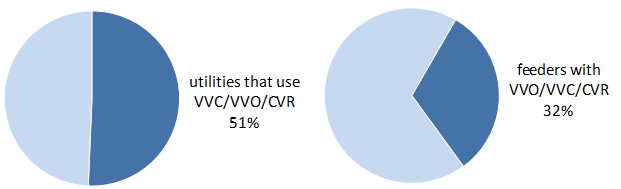

Percentage of feeders that support integrated Volt/VAR control (VVC), Volt Var Optimization (VVO), or Conservation Voltage Reduction (CVR)

Just over half of all respondents reported having at least some feeders supporting Integrated Volt/Var Control, Volt/Var Optimization (VVC/VVO) or Conservation Voltage Reduction (CVR). The 75 respondents indicated an installed base of 34,122 feeders across 4 voltage levels: 4kV (5,094 feeders), 13kV/15kV (22,831 feeders), 22kV/26kV (4,214 feeders), and 33kV/38kV (1,983 feeders). Overall, respondents indicated that 32% of all feeders currently support VVC, VVO or CVR, but out of 4,214 feeders at the 22/24kV level about 59% support these capabilities.

Percentage of utilities integrating VVC, VVO or CVR by year end 2017

Overall, 68% of the utilities replying to this question indicated that at least some feeders will support integrated IVV control/VVO and/or CVR by year-end 2017.

Decision factors for implementing VVC/VVO

Respondents indicated that “cost savings effected by reducing the need for infrastructure enhancements” was the single most-cited driver for volt-Var optimization (VVO) implementation, as reported by 38% of respondents. Additional cost savings brought about by “reducing the need for additional generation” was second in importance, at 33%. About 1 in 5 respondents also cited “regulatory compliance” as a significant driver for implementing VVO.

Other reasons mentioned for implementing include peak shaving to reduce demand costs, reducing losses, and maintaining power factor. A few utilities mentioned that VVO is either not a requirement for them or that they do not want to implement additional technology simply to raise revenue.

To see a table of contents and pricing information for the “North American Distribution Automation Market Assessment and Outlook: 2015-2017” visit our reports page

Utility Plans Call for Continuation of Substantial Investment in North American Distribution Grid Automation Programs

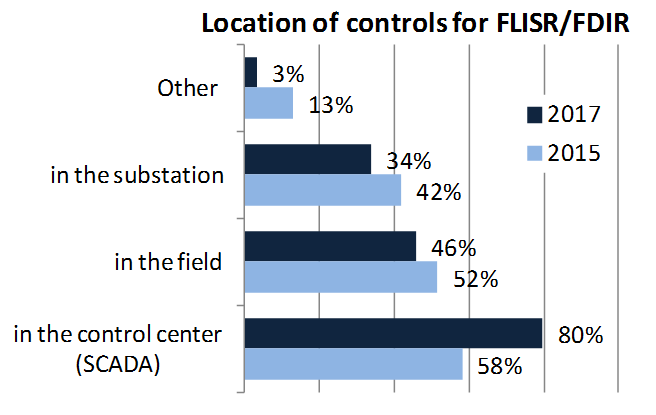

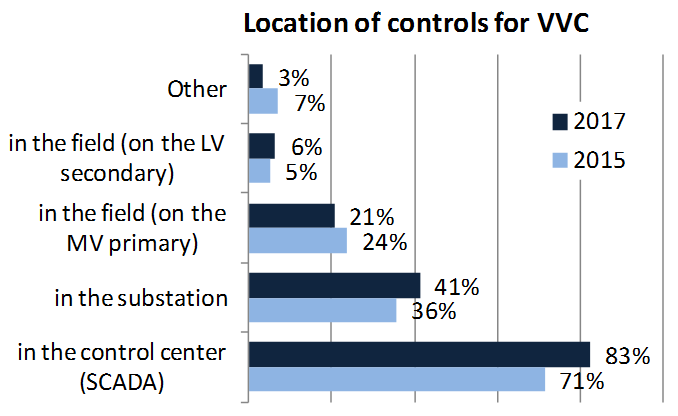

Findings Corroborate Earlier Newton-Evans Studies Regarding “Mixed” Placement of Controls of Field Devices

The Newton-Evans Research Company today released key findings from its newly published study of electric utility plans for distribution automation. Entitled “North American Distribution Automation Market Assessment and Outlook: 2015-2017” the 89-page report includes coverage of more than 35 DA-related issues.

Progress Being Made with Distribution Automation Programs:

North American utilities are making good progress in developing and implementing new DA applications and telecommunications network upgrades. The overall DA market among North American utilities is approaching one billion dollars and will continue to grow each year for the foreseeable future.

DA Controls Placement:

The placement of DA controls for field devices remains mixed. While some see controls being distributed to field locations, others are placing controls on substation automation platforms, while an even larger group is using control center systems-based approaches (centered on SCADA-DMS systems).

The outlook for controls placement in the future shows that utilities are bringing more controls for fault detection, isolation and service restoration (FDIR/FLISR) and for volt/var control (VVC) into the control center as shown in these charts.

Automatic Fault Sensing:

Devices providing information such as hot line status and fault indications are becoming a mainstay in many utility DA programs. IOUs and Canadian utilities were more likely to be using automatic fault sensing devices than were their counterparts at electric cooperatives or public power utilities. Usage patterns and plans for AFS devices were strongest among the respondent subgroup of very large utilities (those serving more than 500,000 customers). Of the subgroup using AFS devices, about one-third actively utilize the status of such devices in their DA schemes.

Integration of Communications and Controls for Distributed Generation into DA System Architecture:

By year-end 2014, only about 16% of utilities indicated some use of DA-related communications/controls while another 14% plan to integrate these for DG purposes by year-end 2017. In a related question, well over one third of the respondents indicated that they have a trial deployment to manage distributed energy resources within the DA system either underway or planned.

More than 30 additional topics are covered in the 2015-2017 Newton-Evans DA report. Seventy five major and mid-size utilities were surveyed and interviewed to gather the information for the report. This group provides a substantial sample, accounting for 20% of served customers and 19% of primary feeders across North America.

A supplemental North American DA market outlook synopsis for the years 2015 through 2020 will be released in March. The outlook supplement will provide DA market outlook information based on type, size and regional location of utilities.

Additional information on the North American Distribution Automation Market Assessment and Outlook: 2015-2017 report is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone 1-410-465-7316 or write to info@newton-evans.com

Save 25% Off Currently Available Reports

Through January 31, 2015, Newton-Evans Research is offering a 25% discount on all currently available 2014 and earlier reports. Click on the “Order Here” button and use the discount code “2014sale” at checkout to take advantage of this limited time offer, or give us a call at 410-465-7316 and mention this announcement when placing your order with us over the phone.

Get the “Overview of the 2014-2016 U.S. Transmission and Distribution Equipment Market – HV Equipment Series” for only $731.25 – a savings of over $240. Or purchase the entire four-volume report series, “The Worldwide Market for Substation Automation and Integration programs in Electric Utilities: 2014-2016” for only $5,212.50 – a savings of $1,737.50 for a comprehensive package of market intelligence.

See our Reports Page for a complete listing of report topics and prices.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies