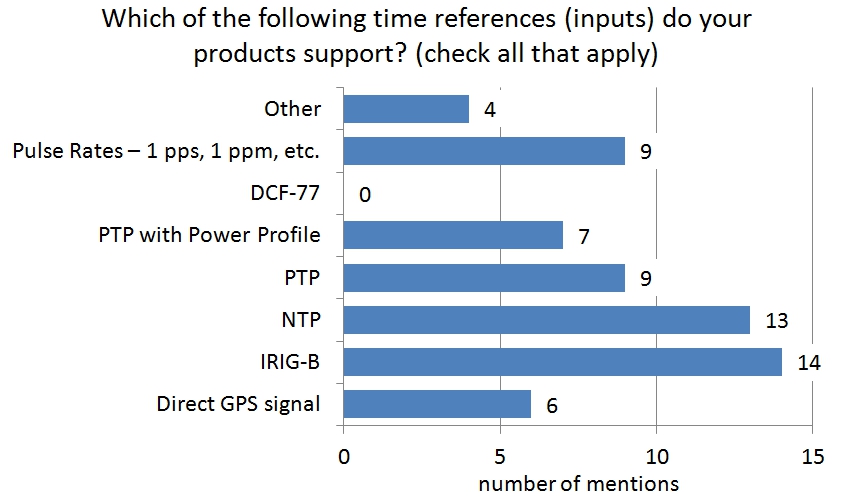

Precision timing and time synchronization are topics vital to the future of smart grid operations, especially in electric power substations. In the recently published Newton-Evans, “Assessment and Overview of the World Market for Time Synchronization in Electric Power Substations,” we asked 17 vendors what time references their substation IEDs support. Fourteen out of 17 said that their products support IRIG-B, and 13 indicated NTP (Network Timing Protocol). Precision Timing Protocol (PTP) and Pulse Rates are offered and supported by 9 of these manufacturers while PTP with Power Profile is supported by 7. Just over one-third (35%) reported using direct GPS signals, while nearly one-quarter (23.5%) of the group reported “other” time references were used or offered with their substation equipment.

The participating manufacturers represent the majority of substation-based intelligent electronic devices (other than protective relays) used in conjunction with substation modernization programs. A number of these respondents also manufacture synchrophasor products including phasor measurement units and phasor data concentrators. Among the other product classes represented are: metering products; communications switches; fault and event recorders; protective relays; automation processing platforms; equipment monitors, and a range of IEC 61850 and DNP 3 supported equipment and devices.

Utility and Consultant Survey Observations

There was strong support for this time synchronization study received from 57 utilities in 24 countries. In addition to the utilities, six leading international engineering consulting firms provided key members of their substation consulting teams to participate in the study. The survey included 14 questions related to substation timing issues and current approaches to synchronize and distribute timing information.

Current Market for Precision Time Clocks

The multi-industry use of precision clocks (masters and slaves) is estimated to be in the range of $200-250 Million as of 2012, with moderate to good growth anticipated by clock manufacturers as well as by utility users. The mid-to-long term market outlook indicates growing interest in adoption of precision timing protocol (PTP) IEEE 1588.

Global sales of time synchronization devices for use in electric power substation (and all other electric power) applications are estimated to be in the range of $35-50 Million for 2012.

This 64 page report, “Assessment and Overview of the World Market for Time Synchronization in Electric Power Substations: A Utility and Industry Survey-Based Report on Precision Timing Requirements” is now available for $975.00 on our reports page. Samples from the report are available.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies