The Newton-Evans Research Company has released findings from its International market study, the second of four reports collectively titled: “The World Market for Substation Automation and Integration Programs in Electric Utilities: 2017-2020.” The international study compares the current round of research findings with several earlier substation modernization tracking studies conducted by the firm. A total of 90 large and mid-size electric power utilities from 22 countries actively participated in the world market study.

Continue reading International Utilities Planning to Expand Investments in Substation Modernization

Author: Editor

A Closer Look at the Changing Russian Electric Power Industry

Russia is the world’s third largest consumer of energy, and as such the country has announced plans and programs to modernize its energy infrastructure, especially for the nation’s power sector. Currently, the Russian national power grid includes more than 230 GW of production capacity. The country’s utilities are known as energos. These energos operate more than 31,000 T&D substations located throughout multiple regions and time zones. There are almost 800 large scale power plants in the country, including 15 nuclear sites operating some 35 reactors. Seven new nuclear units are now under construction as of mid-2017.

Continue reading A Closer Look at the Changing Russian Electric Power Industry

Midpoint Of 2017 North American Study Finds Increase In Substation Construction And Retrofit Plans Over 2014 Findings

The Newton-Evans Research Company has reached the midpoint of its triennial tracking study of change and automation occurring in the world’s electric power substations.

Continue reading Midpoint Of 2017 North American Study Finds Increase In Substation Construction And Retrofit Plans Over 2014 Findings

Upcoming Early Autumn Conference Participation

After a brief summer hiatus, away from energy industry events, with the successful IEEE Power and Energy Society event recently completed, and this not being a CIGRE year, the summer lull in conferences has taken hold until early September.

Continue reading Upcoming Early Autumn Conference Participation

Early Survey Findings Indicate Continuing Growth in Substation Modernization Investment

Substation Data Communications Protocol Usage Continues to Find Heavy Reliance on DNP3 in North America

Continue reading Early Survey Findings Indicate Continuing Growth in Substation Modernization Investment

Multi-Part Newton-Evans Research Study Reveals Significant Growth Likely for Advanced DMS Systems and Applications

The Newton-Evans Research Company continues to assess its findings from the firm’s comprehensive 2017 study of EMS, SCADA, DMS and OMS usage patterns among utilities from more than 30 countries.

Continue reading Multi-Part Newton-Evans Research Study Reveals Significant Growth Likely for Advanced DMS Systems and Applications

Newton-Evans Study Finds Heavy Use of IP/MPLS and Continued Reliance on Utility-Operated Telecommunications Networks for EMS/SCADA and DMS Systems

The latest findings from the Newton-Evans Research Company study of control systems used in the electric power industry point to heavy reliance on IP/MPLS networks for wide area communications from substations and other field locations to central site control systems.

Continue reading Newton-Evans Study Finds Heavy Use of IP/MPLS and Continued Reliance on Utility-Operated Telecommunications Networks for EMS/SCADA and DMS Systems

Newton-Evans Study Indicates Similarities in Plans for Full Digital Substations and Differences for Condition-Based Maintenance Programs Among Electric Utilities

Newton-Evans Research Company continues to assess findings from its six-month research study and survey of protective relay usage patterns in the world community of electric power utilities. Insights received from 114 large and mid-sized utilities in 28 countries point to some interesting differences in plans for implementation of the “full digital substation” concept and to increased use of condition-based maintenance (CBM) strategies for protective relays.

Continue reading Newton-Evans Study Indicates Similarities in Plans for Full Digital Substations and Differences for Condition-Based Maintenance Programs Among Electric Utilities

Newton-Evans Study Finds Differences in Spending Plans for Electric Utility Control Systems Over the 2017-2019 Years

Nearly half of North American electric utilities participating in the 2017-2019 Newton-Evans Research study plan to upgrade or retrofit their SCADA system by 2019. Twenty-two percent plan to upgrade or retrofit their energy management system (EMS), and twenty-five percent will upgrade or retrofit their outage management system (OMS). Twenty-six percent of North American utilities in the survey sample are adding a new or replacement distribution management system (DMS) or advanced DMS by 2019.

Continue reading Newton-Evans Study Finds Differences in Spending Plans for Electric Utility Control Systems Over the 2017-2019 Years

Findings from International Study of EMS, SCADA, DMS, and OMS Indicate Differences in Usage Patterns and Development Priorities When Compared to North American Companies

The Newton-Evans Research Company has published report findings from the company’s recently completed study of EMS, SCADA, DMS and OMS usage patterns in international electric power utilities. This is the second of four volumes of its 14th global market assessment of operational control systems – a survey-based study conducted by Newton-Evans since 1984.

Here are some observations gleaned from interviews and surveys with 31 utility participants from 25 countries:

Systems in Use

All utilities that participated in the survey are operating SCADA systems, and 74% also have an energy management (EMS) installation. Fifty-two percent use a distribution management systems (DMS) and 61% use an outage management system (OMS).

Research Findings Point to Upgrade of EMS, SCADA and DMS Capabilities during 2017-2019 among North American Electric Power Utilities to Accommodate Renewables Integration and Demand Response

Emphasis Placed on Extending Applications and Expanding Roles of Distribution Management Systems and Outage Management Systems

Continue reading Research Findings Point to Upgrade of EMS, SCADA and DMS Capabilities during 2017-2019 among North American Electric Power Utilities to Accommodate Renewables Integration and Demand Response

Newton-Evans Study Finds Market for Relay-Centric Devices and Controls Expanding with Emergence and Growth of Newer Industry Segments

Newton-Evans Research Company continues to assess the results of its six-month research study of protective relay usage patterns in the world community of electric power utilities. Findings from 114 large and mid-size utilities in 28 countries point to some newer trends in adoption and use of protection and control technology.

Continue reading Newton-Evans Study Finds Market for Relay-Centric Devices and Controls Expanding with Emergence and Growth of Newer Industry Segments

Coming Soon: The World Market Study of SCADA, EMS, DMS & OMS in Electric Utilities: 2017-2019

Here is a brochure and order form:

http://www.newton-evans.com/2017EMSSCADABrochure.pdf

Newton-Evans’ World Market Study of SCADA, Energy Management Systems, Distribution Management Systems and Outage Management Systems in Electric Utilities: 2017-2019 is a four volume, multi-client market report. Participants in this market study include utility engineers and managers from investor-owned utilities, municipal and provincial utilities, cooperative utilities within the United States and Canada, together with national power systems throughout the world.

Continue reading Coming Soon: The World Market Study of SCADA, EMS, DMS & OMS in Electric Utilities: 2017-2019

January 2017 Edition of Market Trends Digest

A new edition of the Newton-Evans Market Trends Digest is now available:

http://www.newton-evans.com/newsletter_archive/mtdJan2017.pdf

This issue includes:

- A look back at the Worldwide Protective Relay Marketplace study completed last month

- Progress report and interim findings from the 2017-2019 SCADA, EMS, DMS and OMS global market study

- Excerpts from a 2016 study on the need for third party consulting services in the areas of metering, OT and NERC CIP compliance

- Observations on the Metering, AMI and related Telecommunications Market

We look forward to sharing more energy industry market intelligence in 2017.

Early Survey Findings Point to Continuing Development of EMS, SCADA, DMS and OMS Capabilities during 2017-2019 among North American Electric Power Utilities

The Newton-Evans Research Company has released preliminary findings from its current study of EMS, SCADA, DMS and OMS usage patterns in North American electric power utilities, one of four component reports of the company’s global market assessment series on operational control systems.

Among the initial observations gleaned from interviews and surveys with over 60 officials from a broad range of U.S. electric utilities:

Continue reading Early Survey Findings Point to Continuing Development of EMS, SCADA, DMS and OMS Capabilities during 2017-2019 among North American Electric Power Utilities

Findings from Newton-Evans 2016 Study of Protective Relay Trends in the World’s Electric Power Utilities Depict a Receptive Market for Incorporating Advanced Technological Capabilities

Global Study Finds Continuing Moderate Growth in Protective Relay Market with Commitment to Improving Protection Coordination and Grid Security Practices

Role of Synchrophasors and Teleprotection Continues to Expand; Provides Better Situational Awareness and Visualization for Control System Operators

Continue reading Findings from Newton-Evans 2016 Study of Protective Relay Trends in the World’s Electric Power Utilities Depict a Receptive Market for Incorporating Advanced Technological Capabilities

Bringing Grid Modernization to the Distribution Transformer

Guest Article by Vince Martinelli

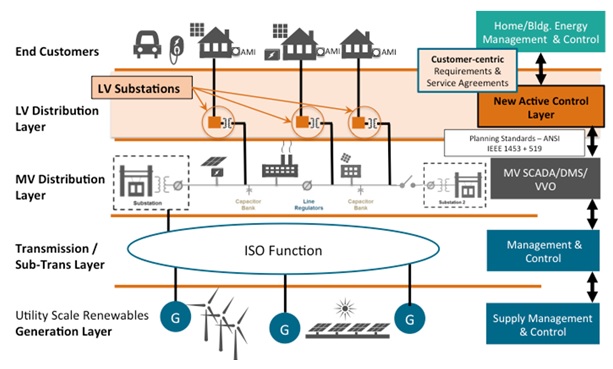

The reliable operation of the North American power grid is testament to the quality of design, planning and execution over multiple generations of utility engineers. As part of this progression, previous grid modernization efforts added high-performance sensing and communications technologies, first to generation and transmission, and eventually to the distribution system. These technologies helped utilities squeeze more capacity and resiliency out of existing assets cost-effectively, reacting to changes driven by load growth and diversification, as well as industry restructuring.

These trends led to broadly deployed “automation” in the medium-voltage (MV) portion of the distribution system. Medium-voltage substations, where high-voltage power is stepped down to MV on its path toward end customers, have seen the greatest degree of automation. Combined with automation at some of the MV devices downstream from the substation, such as reclosers, capacitor banks and line regulators, this provides the ability to measure and control the system with higher fidelity as compared to managing from the transmission layer. Utilities have evaluated technologies, tested specific solutions in trials, validated use cases and financial models, and made prudent investment choices in rolling out MV automation.

History Repeating Itself

A similar “automation” transition is now happening at the low-voltage (LV) level. Driven by higher reliability expectations, growth of rooftop solar PV generation, energy efficiency programs, the emergence of electric vehicles in the transportation mix, and the promise of battery storage for a range of grid-connected applications, new pressure is being placed towards the edge of the grid. It is more acute in some service areas than others, and can be clustered within one utility’s territory – or even within specific feeder circuits. Driven by these trends, the next frontier in grid modernization is at the interface between the MV distribution layer and the LV distribution layer, centered on the humble distribution transformer, as represented in Figure 1.

Figure 1. LV Substations provide critical new capabilities for grid modernization.

Similar to the MV automation rollout, LV substation modernization will happen first at acute “pain points,” becoming more widespread as the technology matures and the detailed use cases are developed.

Active LV Substations Solve Multiple Problems

Among the variety of potential applications, local voltage regulation is a clear “pain point” that cannot be addressed at the MV layer alone. Whether for increasing PV hosting capacity at the neighborhood level by countering voltage rise during reverse power flow, or for supporting energy efficiency programs where the goal is to deliver voltage to customers at the lower end of the acceptable ANSI A range, the benefits of adding automation to the distribution transformer – what we refer to as an LV substation – are becoming clear.

Figure 2 shows two examples of LV Substations deployed by U.S. electric utilities. In each case, a standard distribution transformer is paired with a grid automation device providing control with power electronics-based multi-function regulating capabilities, visibility with onboard current and voltage sensors, and automation with processing and memory components and communications capabilities. These regulating functions include voltage regulation in forward and reverse power flow, power factor correction, and harmonics mitigation. The system also reduces voltage sags, swells, and flicker for the customer connected downstream.

These compact, maintenance-free systems take advantage of existing “real estate” on poles and pads, simplifying the easement process and providing an alternative to costly upgrades on the MV system. The flexible communications platform can integrate with SCADA on the MV system and interact with downstream LV devices, such as AMI (“smart meters”) or behind-the-meter resources, such as next-generation smart inverters, EV chargers or energy storage resources.

Figure 2. LV Substation implementations for (a) an overhead system and (b) underground plant, featuring coupled integration with a distribution transformer for siting on a standard pad in a residential area. Adding a power electronics-based regulator with integrated sensing, computing, communications and control software brings grid modernization to legacy distribution transformers.

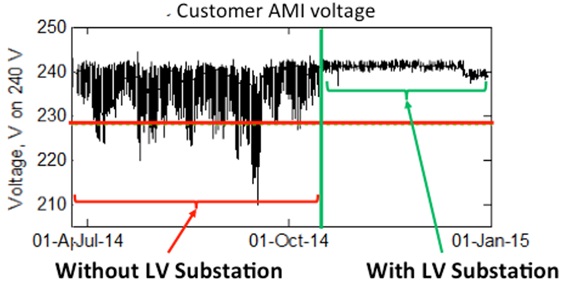

Figure 3 shows voltage data at a particular customer meter over several months without grid automation; then with the voltage regulation from the LV Substation in place. Voltage variability before upgrading the system reflects MV voltage variations, with dips well below ANSI limits, as delivered to the distribution transformer. When the power electronics regulator is activated with an initial setpoint at 240 V, the only variability at the customer is the load-dependent voltage drop on the LV line itself. This particular customer, and neighboring customers behind this LV substation, now receive compliant voltage and superior power quality, independent of the bulk MV system.

Figure 3. Customer voltage delivery improvement measured by utility AMI voltage data showing the control provided by power electronics voltage regulation after introducing the automated LV Substation.

Looking Toward the Near Future

The daily news cycle reminds us that the forces putting pressure on the distribution grid are accelerating, driven largely by changes in how customers choose to participate in their energy future. Whether it’s Hawaii mandating a 100% renewables goal; solar power’s levelized cost of energy continuing to plummet; New York’s REV plan; the ongoing retirement of coal-fired power plants; or nationwide deployment of EV charging stations, the trends are clear.

Fortunately, the concept of automated LV Substations – elevating the status of the long-serving distribution transformer – provides a capital-efficient blueprint for a path forward, modeled after the successful rollout of automation in the MV distribution layer. The difference today is that localized pressure points call for localized solutions appropriate for the demands of the LV layer. The evolution of power electronics-based system designs has resulted in compact, reliable and cost-effective options to consider.

Vince Martinelli is responsible for managing the company’s product roadmap and articulating the business case for agile grid infrastructure. Vince brings over 25 years of product experience and an in-depth understanding of how to effectively drive new technology into legacy systems, transforming them in the process. He joined Gridco Systems in 2013 from Amazon Robotics (formerly Kiva Systems), where he led a team responsible for the integration of Kiva’s robotic order fulfillment system into Amazon’s global network. Prior to Amazon, Martinelli led the North American arm of Professional Services at Sycamore Networks. He has also held senior management positions at Corning Inc., including product management roles in the Optical Fiber business. Vince earned both the SB and SM degrees in Materials Science & Engineering, with a concentration in Economics, from MIT, where he was a Tau Beta Pi Fellow and an Academic All-American athlete.

For further information on multi-function power electronics-based regulation systems that turn distribution transformers into automated LV Substations, please visit www.gridcosystems.com

North American Protective Relay Marketplace: New Report Now Available

Volume One of this 2016 study of protection and control is based on a sample of North American investor-owned, public and cooperative electric power utilities.

The data provides information on a segmented basis by type of utility and by number of customers served. These tables help illustrate occasional important differences in the findings based on the type and size of utility.

The findings in this report are based on survey responses received from 79 electric utilities that include 16 investor-owned, 28 public power, 26 cooperatives, 4 electric power consulting groups, and 5 Canadian electric utilities. This survey was conducted between April and May of 2016. Initial phone calls were placed to utility officials and relay engineers to invite them to complete the survey either as a Microsoft Word attachment via email, or completing an online survey on www.surveymonkey.com. Reminders were sent via email every 2 weeks until the last call deadline was issued.

The 79 utilities participating in this year’s study represent 31 million electricity end users/customers, having 3,340 transmission substations and 7.841 distribution substations covering over 800,000 total T&D line miles. This sample is about 20% of the North American customer base and approximately 15.7% of utility-operated transmission and distribution substations. Newton-Evans has previously estimated that direct shipments to utilities account for about 40% of the overall North American market for protective relays.

Each question in this report contains:

- A pie chart or bar chart summarizing how all of the survey participants responded to the question

- A table (or series of tables) showing the data by:

- Summary: all survey respondents

- Investor Owned: investor owned utilities

- Public Power: publically owned utilities (municipals, public utility districts, state or federal government)

- Cooperative: member owned electric utility cooperatives

- Canada: electric companies in Canada

- Other/Consultant: respondents representing power technology companies, industrial facilities

- <100,000: electric utilities serving fewer than 100,000 customers

- 100,000 to 499,999: between 100,000 and 499,999 customers

- >=500,000: 500,000 or more customers (either directly via distribution, or indirectly via generation and transmission.)

- Some written analysis and observations based on the tables and charts

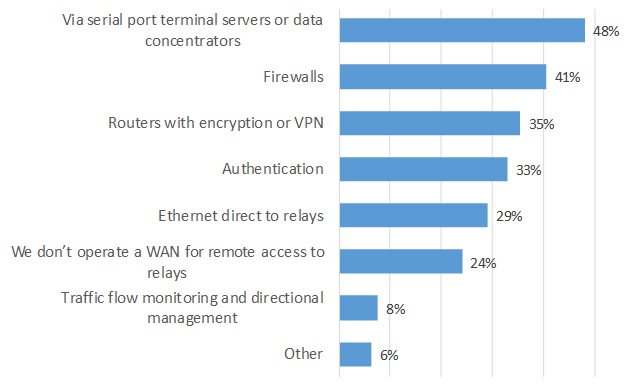

What approaches are you using to operate a WAN for remote access to relays?

While 24% of the respondents said they don’t operate a WAN for remote relay access, almost half said they connect via serial port terminal servers or data concentrators. Forty percent use firewalls in conjunction with the WAN, while just over one-third said they use routers with encryption or VPN capabilities to access relays over a WAN. Other mentions included “gateways”.

WAN Usage for Remote Access to Relays

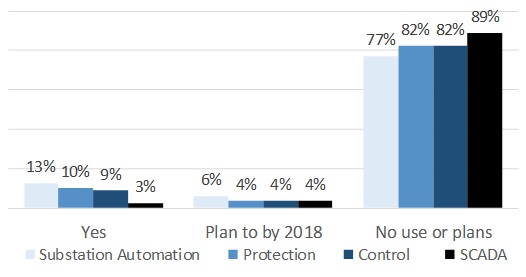

Does your utility’s control system use protocol IEC 61850 for Substation Automation, Protection, Control, or SCADA?

Seventeen respondents said they use IEC 61850 in at least one of the four areas. Thirteen percent said they use 61850 within the substation, and another 6% said they plan to use it in the substation by 2018. About 80% of the respondents have no use or plans for IEC 61850 in any area, and 89% said they don’t use or plan to use IEC 61850 for SCADA.

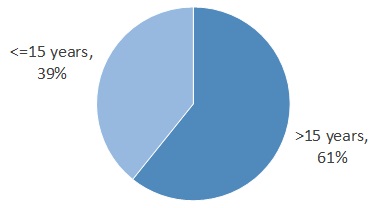

What % of your relays have been in service for more than 15 years?

Overall, 55% of survey respondents reported that more than one-half of their protective relays have been in service for more than 15 years. Out of all 76 respondents to this question, twelve said that less than 20% of their installed base is older than 15 years. However, in some cases the useful lifespan of a protective relay is stated as nearly 30 years. There are installations of electro-mechanical relays that have been in operation since the 1960’s according to some utility officials. According to the observations reported in Table 23, two-thirds of relays installed at surveyed IOUs (and nearly two-thirds among Canadian respondents) have been installed for more than 15 years.

Percent of Relays Among Newton-Evans Sample that are >15 years in service

To order Volume 1 of The Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018 visit our reports page or fax an order form to 1 410 750 7429: www.newton-evans.com/relaymarketplacestudy2016-2018

Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018

The Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2016-2018, a four volume report series by Newton-Evans Research Company, is scheduled for publication in August 2016. Volume 1 – North American Market is now available.

Overview

Newton-Evans’ Worldwide Study of the Protective Relay Marketplace: 2016-2018 is planned to be a multi-client study which encompasses the world market for protective relays in the electric utility industry. This four volume report series will be the seventh worldwide study of protective relays which Newton-Evans has undertaken. Participants in this market study will include utility engineers and managers from investor-owned utilities, municipal and provincial utilities, cooperative utilities within the United States and Canada, together with national power systems throughout the world. The study will measure current market sizes and contains projections on a world region basis for the next several years. The entire research program will define the product and market requirements which suppliers must meet in order to successfully participate in one or more of these diverse world market regions.

Newton-Evans Research Company estimates from our earlier 2012 relay market study indicate that the North American protective relay market stood at almost $600 million for both utility and industrial applications. It will be important for the P&C community to learn how changes in the world market conditions since 2014 will affect the outlook for 2016-2018.

To read more about this upcoming study and get ordering information, see the brochure page.

North American Study Finds Continuing Moderate Growth in Protective Relay Market with Commitment to Increasing Protection Coordination and Grid Security Practices

Role of Synchrophasors and Teleprotection Continues to Grow, Providing Better Situational Awareness and Visualization to Help Prevent Outages

Newton-Evans Research Company has prepared an interim news release based on preliminary findings from 59 large and mid-size North American electric utilities.

Among the early trends reported in this first of a four volume set of reports are these:

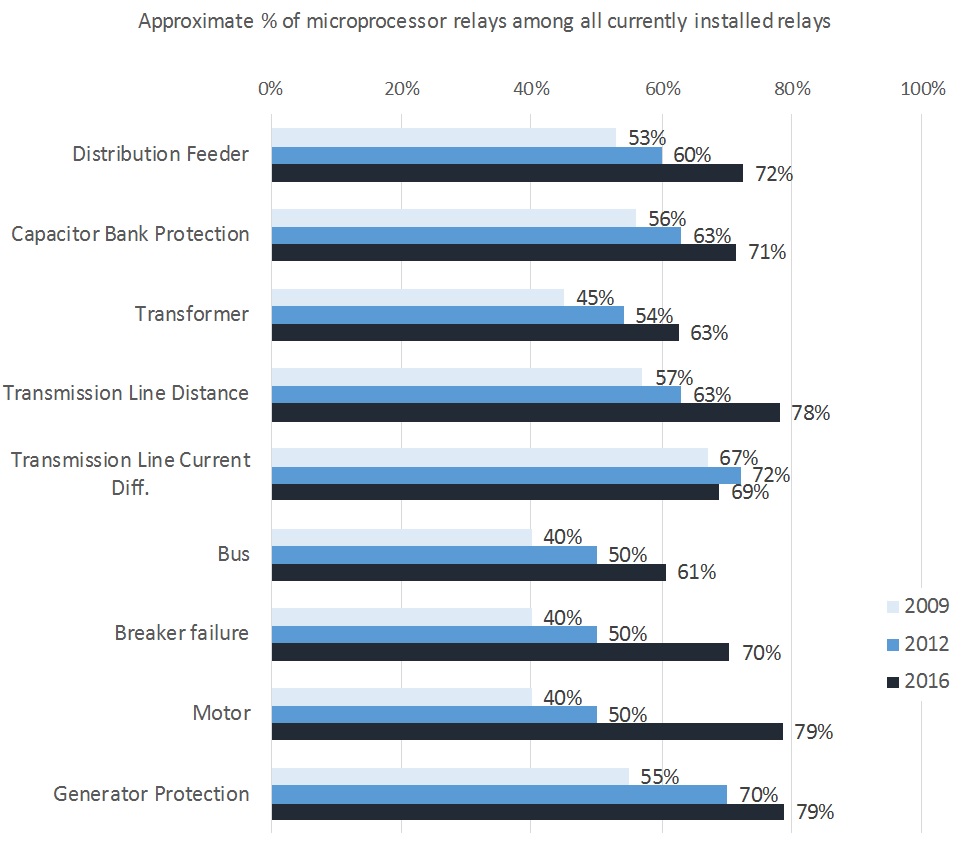

- The percentage of microprocessor relays in the mix of all protective relays used by utilities continues to increase with each passing year.

- The vast majority of new and retrofit units being planned for purchased are also digital relays, but in some of the protection applications studied, such as motor protection and large generator applications, and in installations where electrical interference is strong, electromechanical and older solid state relays continue to have a niche market position.

- Real-time analysis of synchrophasor data has become a key application for the emerging field of operational analytics for transmission operators.

Communications protocol usage patterns in North American utilities of all sizes continue to rely on DNP3, the dominant protocol in use in the North American region. IEC 61850 is found in some of the TOP 100 utilities, but is by no means prevalent as of mid-2016.

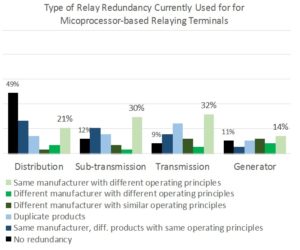

Relay redundancy being used for microprocessor-based relaying terminals varies by application as seen in the chart below.

The 2016 Newton-Evans survey of electric utilities includes more than 20 detailed product functionality topics, related technical questions, and market-related issues, together incorporating more than 250 items of information from each of the participating utilities.

This year’s study will result in a series of four reports published during June and July. These reports are geared to the planning needs of protective relay suppliers, power industry consultants, and utility protection and control departments. The four volumes include the North American Market Study, the International Market Study, Supplier Profiles, and Global Market Assessment and Outlook.

Further information on the research series The World Market for Protective Relays in Electric Utilities: 2016-2018 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com for additional information or to order the report series online.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies