Two groups of transformer manufacturers are active in the U.S. electric power industry. This month’s article will look into the power transformer side of the industry. Later this month, we will feature an assessment of the multi-billion-dollar distribution transformer market, led by another group of equipment manufacturers.

Large power transformer manufacturers include the global Big Three equipment suppliers to the electric power industry (Hitachi Energy, GE, Siemens), along with specialist power transformer manufacturers including Virginia Transformer, Delta Star, Pennsylvania Transformer, HICO, Hitachi, WEG and Hyundai.

Here are some “definitions” we use for power transformer classifications, based on MVA ranges.

- A small power transformer is a single phase or three phase unit ranging from 65 kV to 145 kV (U.S. Department of Energy definition) and range up to about 30 or 40 MVA. There are four major manufacturers with each having at least a 10% share of this market segment. These four together account for about 65% of the value of small power transformer shipments. Several additional important market participants are active in the U.S. market for small and small-medium power transformers.

- A medium-to low-end-large power transformer is a unit that ranges from 30-100 MVA. Six major suppliers (Hitachi Energy, Siemens, Hyundai, VA/GE Transformers, Delta Star and Prolec-GE-SPX) share 70+% of this estimated multi[hundred million dollar segment of the U.S. power transformer market.

- A very large power transformer (VLPT) as defined is a unit that ranges from 251-400 MVA. Four major suppliers including Hitachi, Hyundai, Siemens and Prolec-GE share more than two-thirds of this estimated multi-hundred-million-dollar segment of the U.S. power transformer market.

- An extra-large power transformer (XLPT) for this report is a unit that ranges upward from 400 MVA. Three major suppliers including Hitachi, Siemens and Prolec-GE share nearly 60% of the XLPT market in the United States. By 2022, Newton-Evans estimates that sales of XLPT units were growing nicely. XLPT units are purchased by EHV/UHV transmission utilities and a few industrials that together comprise this segment of the U.S. power transformer market. Importantly, HICO, Hyundai and Pennsylvania Transformer (acquired by Quanta Services in Nov 2023) have increased their market standing in the large and very large power segments over the past few years.

The Power Transformers market in the U.S. was estimated by one research firm at US$6.9 Billion in the year 2021. https://finance.yahoo.com/news/global-power-transformers-market-reach-115800430.html?fr=yhssrp_catchall . The Power Transformers market in the U.S. was estimated at US$5.2 Billion in the year 2022 by another research firm. https://www.researchandmarkets.com/reports/2498175/power_transformers_global_strategic_business. A third research firm, GMI, reported a U.S. combined power and distribution transformer market of $11.2 Billion in 2023, growing at 7.8% annually through 2032. https://www.gminsights.com/industry-analysis/us-transformer-market . Most observers, including Newton-Evans Research, believe that the U.S. accounts for about one quarter of total world demand for power transformers.

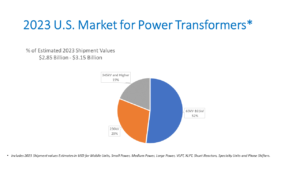

Shipment values of power transformers from 30 MVA and up were around $3 Billion in 2023, according to Newton-Evans’ own findings. Two major suppliers participating in our annual study indicated that 2023 large power transformer sales were close to $2B by year-end for 2023 and will be “well above” $2B in 2024. The Newton-Evans’ chart below shows what the firm believes is the dollar value range of actual unit shipments of power transformers for 2023. The “bookings level” for 2023 and for the next few years is well above these estimated shipment values, due in large part to the extended lead times for unit delivery of power transformers. Wood-Mackenzie recently wrote on the issue of long lead times for power transformers. https://www.woodmac.com/naws/opinion/supply-shortages-and-an-inflexible-market-give-rise-to-high-power-transformer-lead-times/

about $3

Renewable projects that were released 2-3 years ago and for which transformers are now getting ready to ship don’t always have a “home” ready to accept the power transformers. In some cases, at least one manufacturer has been delivering client transformer orders to a warehouse or other storage location. Some renewables developers have a growing inventory of ‘unused’ power transformers, and we believe this may impact future demand as this could result in increasing cancellations of active “build” projects.

Renewable projects that were released 2-3 years ago and for which transformers are now getting ready to ship don’t always have a “home” ready to accept the power transformers. In some cases, at least one manufacturer has been delivering client transformer orders to a warehouse or other storage location. Some renewables developers have a growing inventory of ‘unused’ power transformers, and we believe this may impact future demand as this could result in increasing cancellations of active “build” projects.

Shunt reactor orders are increasing as well, as many of the renewable sites have installed, or will install, shunt reactors. Newton-Evans believes that it is likely that the majority of demand for these shunt reactors will be of the variable type, rather than fixed type units, especially so for offshore wind projects. Other equipment included in the Newton-Evans series of power transformer market overviews include mobile transformers, phase shifting transformers and specialty transformers (including arc, furnace types) for industrial use.

Impact of ER and BESS: With the growth of distributed energy resources and energy storage across the country, there will be increasing demand for small/low power transformers over the five-year outlook period (2024-2029), especially with the emphasis on a green energy economy within the Biden administration. This could all change (perhaps dramatically) depending upon the outcome of the 2024 national election.

Already in 2024, the U.S. has gained promise of much-needed additional power transformer capacity, with the February announcement from Siemens Energy that it will construct its first large power transformer plant in the U.S. (Charlotte, NC). A second announcement in June came from the Italian firm, Westrafo, for a new large power transformer plant to be constructed in the greater Dayton, Ohio area. Both plants expect to be in full production within 36 months.

Look for our next article providing an assessment of the U.S. distribution transformer market by the end of July.

More information on our individual transformer report summaries found in this year’s edition: Overview of the 2024-2026 U.S. Transmission and Distribution Equipment Market: Transformer Series can be found here: https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-transformer-series/ .

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies