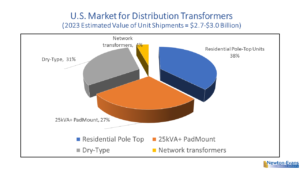

This overview provides a comprehensive look at the distribution transformer market in the U.S., highlighting its complexity, key players, and market dynamics. The article includes four sections covering the major classifications of distribution transformers as used in the U.S. These include overhead pole-mount distribution transformers, dry-type units, pad-mount transformers and network transformers.

One of the salient points in assessing the distribution transformer market is in the composition of key industry participants. Unlike the leaders in power transformer manufacturing, which are global or at least multi-national in scope and scale, there are multiple important North American-based manufacturers of one or more types of distribution transformers. This group of industry leaders includes significant sized North American companies. Howard Industries, ERMCO and Central Moloney – are leading U.S. firms, while Hammond Power Solutions and Carte International are Canadian-based, with both enjoying an increasingly important presence across the U.S. market.

The leading world-class power transformer manufacturers including Prolec-GE, Hitachi Energy, and Siemens Energy also certainly have a stake in one or more segments in this multi-billion-dollar portion of the electrical transformer industry.

A liquid-filled Distribution Transformer for this article is an oil-filled, overhead, pole- mounted transformer of 5 kVA or higher. Most of the estimated 45 million or more distribution transformers in the United States are liquid-filled and most are single-phase, overhead installations. By 2022, these amounted to more than one million units of annual production (Newton-Evans’ estimates). The 2023 market, while continuing to churn out more than one million units per year, had been hampered by long lead times, capacity limitations, material shortages, and changing FERC/DOE specifications. Nonetheless, the demand for these units continues to increase in mid-2024 as new housing units develop in an ongoing moderately strong economy and as millions of older units are scheduled to be replaced over the next few years.

With the market demand for overhead residential distribution transformers running at about 1,100,000-1,250,000 units per year, the median prices have been increasing each year, due to the cost of materials, capacity limitations and supply channel issues. For pad mount and three-phase units, recent sample bid price ranges are listed in the available market overviews comprising the Newton-Evans transformer market overview series https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-transformer-series/ . Average life span for 1-phase overhead units is 30-34 years, depending on climate and location. Some further observations include these:

- The majority (70-80%) of distribution transformers are sold directly from manufacturers to large utilities/end-users (IOUs and industrials) while mid-size municipals and co-ops tend to purchase via reps and distributors.

- Newton-Evans estimates that there are about 30-40 American utilities requiring at least 10,000 replacement pole-top units per year, and another 50 or so utilities that require at least 5,000 replacement units per year.

- Howard Industries, a co-leader in oil-filled distribution transformers, has a formidable competitor in the combined ERMCO family of distribution transformer manufacturers, which includes Power Partners, Pioneer Transformers and Jefferson Electric, as well as the large oil-filled distribution transformer business of the ERMCO Transformers unit.

A dry-type distribution transformer is considered to be a single phase or three-phase unit installed primarily at indoor locations of commercial and industrial sites. Price variations are significant, dependent upon these factors: kVA rating, 1p or 3p unit construction; primary and secondary voltage level; number of taps, temperature variance; frequency, type of windings, type (ventilated or encapsulated), sound levels, electrostatic shield requirement; K-factor and quantities.

Although there are no dominant suppliers in this segment in the USA, at least six companies, led by Hammond (HPS) have a double-digit share of this nearly $900 million-dollar market (Newton-Evans estimate). Other key suppliers include Hitachi Energy, Eaton, Schneider Electric, Prolec GE and Siemens Energy. On a worldwide basis, it is likely that Hitachi Energy is the market leader, with an estimated $750-$800 million in sales of dry- type transformers of small, medium and large power units (up to 63 MVA).

As a side note, a U.S. Department of Energy study released in late 2021, reported 2019 sales of about $716 million paid for several hundred thousand dry-type transformers, the majority of which were low voltage units. That same heavily redacted DOE study indicated only six suppliers accounted for the majority of dry-type unit sales. Other suppliers with at least a 1%-3% share include: Olsun, MGM, WEG, FedPac, Howard, Hubbell ACME, ELSCO, Sunbelt-Solomon (Newton-Evans observations).

A liquid-filled, pad-mounted Distribution Transformer is a pad-mount transformer of 25 kVA or higher. A significant portion of three-phase liquid units are pad-mounted outdoor installations. More than 65,000 three-phase, liquid-filled units were likely sold in 2023 (Newton-Evans estimate). Utilities purchase pad mount units for stock/inventory as well as for immediate installation. At least four manufacturers are believed to have earned $100 million or more in 2023 sales of residential pad mount transformers (Newton-Evans’ estimates). Key manufacturers include Howard industries, ERMCO and Central Moloney along with the larger multinational firms, including Eaton CPS, Prolec GE and Hitachi Energy.

The price range for pad-mounted distribution transformers vary significantly year-to-year, due to price fluctuations in the commodities markets for copper and steel. Typical price ranges found on bid tally sheets vary from about a low of $4,000 to a high end of about $40,000 – with price depending upon quantity and kVA ratings requirements. Utilities having blanket agreements with suppliers tend to obtain significant discounts from the open bid prices we have listed in the market overview series of reports. The pad-mount portion of distribution transformer shipments is more than one quarter of the total value.

Network transformers are high-end distribution transformers that serve underground grid and spot networks, and these are large three-phase units. The New York City (ConEdison) and suburban New Jersey areas (PSEG) together account for about 40-50% of all U.S. network transformer installations.

Network transformers are normally vault-types or subway types, which are defined in ANSI C57.12.40-1982: Vault-type transformers are suitable for occasional submerged operation while subway-type transformers are suitable for frequent or continuous sub-merged operation

Network transformers are also used in large buildings, usually located in the basement. In these, vault-type transformers may be used (as long as the room is properly built and secured for such use). Utilities may also use dry-type network transformers and related units with less flammable insulating oils.

Sources: https://electrical-engineering-portal.com/network-distribution-transformers-serving- grid-and-spot-networks/ and Newton-Evans Research – 2020/2022 Studies: See related article here https://www.newton-evans.com/network-transformers-linchpins-for-underground-electricity-distribution-networks/

The U.S. network transformer market is oligopolistic in nature with only four major suppliers (Carte International, Hitachi Energy, Prolec GE and Pioneer-ERMCO) and four minor suppliers (HPS, Howard Industries, Fed Pac and Maddox) that together produce and ship between 1,400 and 1,900 3p and 1p units each year (Newton-Evans estimates).

More information on our individual transformer report summaries found in this year’s edition of Overview of the 2024-2026 U.S. Transmission and Distribution Equipment Market: Transformer Series can be found here: https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-transformer-series/ .

Our planned August article will take a look into the substation modernization and automation market, summarizing some findings reported in the just-released series of market overviews located here: https://www.newton-evans.com/product/overview-of-the-2024-2026-u-s-transmission-and-distribution-equipment-market-substation-automation-series/.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies