Russia is the world’s third largest consumer of energy, and as such the country has announced plans and programs to modernize its energy infrastructure, especially for the nation’s power sector. Currently, the Russian national power grid includes more than 230 GW of production capacity. The country’s utilities are known as energos. These energos operate more than 31,000 T&D substations located throughout multiple regions and time zones. There are almost 800 large scale power plants in the country, including 15 nuclear sites operating some 35 reactors. Seven new nuclear units are now under construction as of mid-2017.

The world’s Tier One power equipment manufacturers each have a position in the Russian market for generation transmission and distribution. Each has made significant multi-hundred million-dollar (and some, multi-billion dollar) investments in the country. Cumulatively, the Tier One providers along with other very large equipment manufacturers from Asia and a few non-Russian Eastern European suppliers account for as much as 75% of all capital equipment used in the electricity sector today (Newton-Evans estimate). However, for lower cost MV equipment and for automation components, there is a growing presence of in-country manufacturers and suppliers, as well as important roles being played by market participants from China, India and other Asian countries, especially for electronic devices.

In terms of smart grid computer applications, there are a host of Russian companies providing integration and installation services, as well as developing a wide range of smart grid applications either to work in conjunction with systems being provided by the likes of ABB, GE, Siemens and Schneider Electric.

Russia is the host country for the upcoming 2018 FIFA World Cup of Soccer, with games to be played in multiple regions and cities across the country. To ensure the games can be conducted in a world-class manner, billions of rubles are being invested in grid modernization plans and programs that began in 2012 and will continue through mid-2018. Eleven cities throughout Russia will host a total of 64 soccer games.

Russia has an ongoing National Technology Initiative, and energy is a cornerstone of the initiative with a program component named Energy Net Roadmap. The current investment goals under the Energy Net Roadmap call for as much as $40 Billion per year through 2035 to upgrade and modernize the Russian power grid. Plans for specific development efforts can be found in the Russian Energy Outlook 2035 (approved this year) and the draft of a report entitled Russian energy Strategy 2035.

Joint stock companies (or JSCs) form the backbone of the Russian electric power network.

Federal Grid manages the Unified National Electric Grid, ensures electricity transmission through backbone lines and provides services for technological connection to electric grids.

“Federal Grid operates in 77 Russian regions. The territory in which the Company’s facilities are located is divided into zones of responsibility for corporate branches – backbone electric grids (MES), and their local enterprises (PMES). Underpopulated territories with no large customers are not integrated into UNEG because they do not have economic conditions necessary for laying electricity transmission lines and establishing large substations.” (Source: http://csrreport2015.fsk-ees.com/reports/fsk_csr/annual/2015/gb/English/1050/our-role-within-the-industry.html)

Several of the largest Russian energos are now active users of smart meters with projects underway or nearing completion in the regions of Kaliningrad, Bashkiria, Saint Petersburg and Sevastopol. Most Russian energos have been operating SCADA systems for more than 30 years and several operate major EMS systems developed and implemented by (primarily) western suppliers using qualified in-country partners.

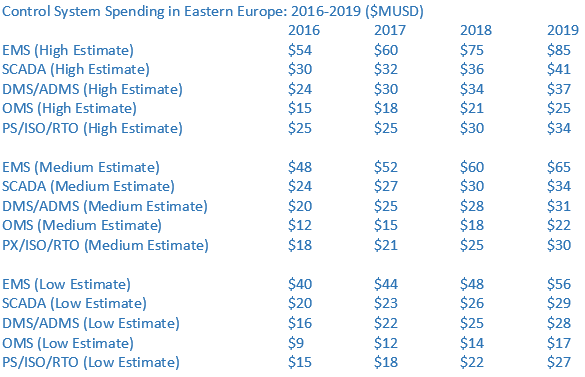

Smart Grid Operational Systems Investments: Russia accounts for 65-70% of the following estimates for Eastern Europe. (Newton-Evans 2016 study estimates)

“JSC Russian Grids is the largest electricity transmission and distribution grid company in Russia and, the Company believes, one of the largest electricity transmission and distribution grid companies in the world by length of transmission and distribution lines and installed transformer capacity.”

“The JSC Russian Grids property portfolio comprises interests in 43 joint-stock subsidiaries and affiliates, including interests in 16 interregional and regional distribution grid companies (IDGCs/RDGCs) and Federal Grid Company in Russia. The controlling shareholder is the Russian government holding 85.3% of the stock.”

“The total spread of networks of JSC Russian Grids operating subsidiaries exceeds 2.3 million kilometers. Smart grid definition in Russia is first and foremost the technological integration of power grids, consumers and electricity generators into the unified automated system.”

(Source: https://rdif.ru/Eng_fullNews/954/)

Importantly, each major international EMS/SCADA/DCS systems leader has one or more regional installations in Russia. Latvian interconnection with Kaliningrad is a GE system, Moscow (MOESK) has an EMS from a Russian firm (Monitor Electric) and multiple GE PowerOn DMS installations; Leningrad has an ABB system; Schneider Electric has a major DMS installation at the Interregional Distribution Grid Company. In the power production side of control systems, these firms, plus Invensys-Foxboro each have DCS control systems installations at major power plants around the country.

There are many capable Russian systems developers/integrators that belong to RUS-SOFT, the nationwide association of the most technically competent software development companies in Russia. Most of these suppliers serving the electric power industry within the country have developed joint ventures or partnerships with Western software companies, in both the IT and OT sides of the power industry. Oracle, Intergraph, SAP, VMWare, Symantec and many other market leader offerings are available throughout Russia either directly or via in-country partners. In the Newton-Evans’ Substation Automation Volume Four report, there are profiles for ten or so Russian-based electric power substation integration specialists.

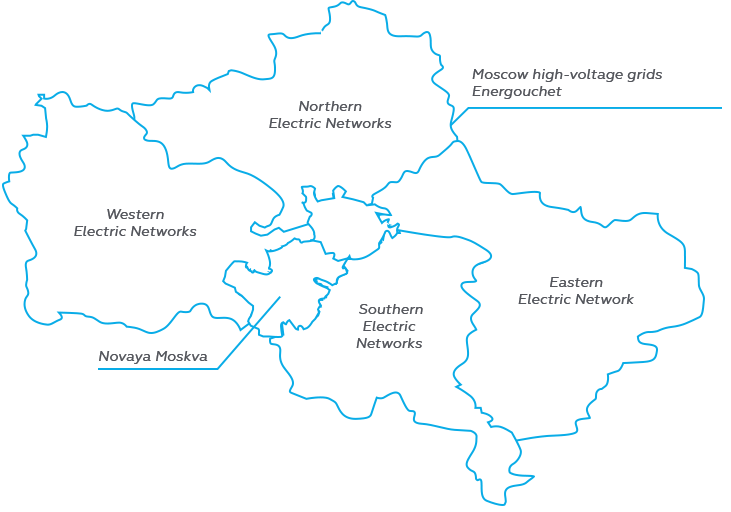

In the capital region of Russia, MOESK is the principal electric supply company:

PJSC MOESK has been created after reorganization of a subdivision of OJSC Mosenergo. The main office is in Moscow. PJSC MOESK includes 8 branch offices, and the group includes four subsidiaries. The main activities of the company include transmission and distribution of electrical energy, providing grid connections for electrical energy consumers.” (Source: https://www.moesk.ru/en/about/)

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies