Newton-Evans Study Finds Heavy Use of IP/MPLS and Continued Reliance on Utility-Operated Telecommunications Networks for EMS/SCADA and DMS Systems

May 5, 2017

The latest findings from the Newton-Evans Research Company study of control systems used in the electric power industry point to heavy reliance on IP/MPLS networks for wide area communications from substations and other field locations to central site control systems.

Reliance on IP/MPLS Networks

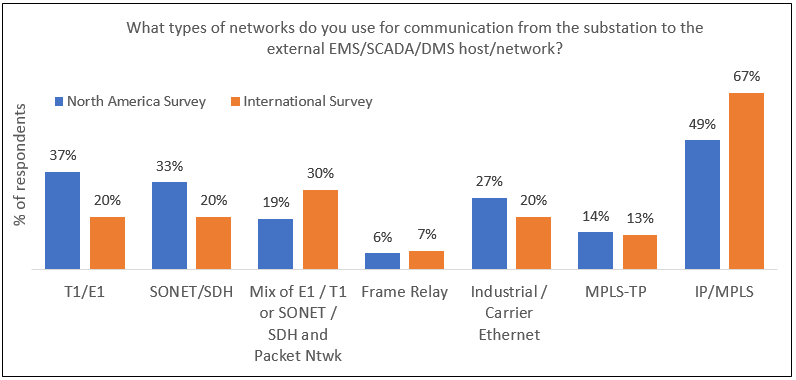

Sixty-seven percent of international respondents use Internet Protocol/Multi-Protocol Label Switching (IP/MPLS) technology for communication from the substation to the external host/network. Thirty percent use a mix of T1/E1 and/or SONET/SDH and packet networks. It is likely that MPLS-TP (Transport Profile) will see increased use in the next Newton-Evans control systems study scheduled for 2019.

Forty-nine percent of North American respondents use IP/MPLS network technology for communication from the substation to the external host/network. Thirty-seven percent use T1/E1 and 33% use SONET/SDH, followed by 27% who use Carrier Ethernet. Often, more than one type of network is used. Half of North America’s investor owned utilities in the survey continue to use T1/E1, and over half of them use IP/MPLS as well.

Reliance on In-House Networks

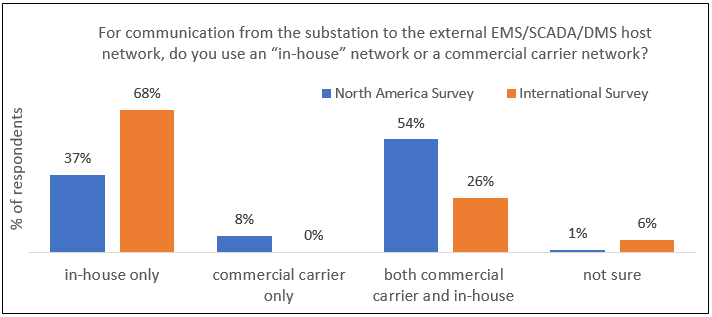

Sixty-eight percent of international respondents rely on in-house networks for communication from the substation to EMS/SCADA/DMS. Twenty-six percent use a mix of in-house and commercial carrier, but none of the respondents indicated total reliance on commercial carrier networks.

Fifty-four percent of North American respondents use a combination of commercial carrier and in-house networks for communication from the substation to EMS/SCADA/DMS. Thirty-seven percent rely exclusively on in-house networks, and 8% use commercial carrier networks only.

Among large North American investor owned utilities, 83% use a combination of commercial carrier and in-house networks to reach each of their substation locations, which typically range from dozens to hundreds of sites over hundreds or thousands of miles of service area. Nearly two-thirds (62%) of public power utilities and 56% of small utilities (rural electric cooperatives and municipal utilities serving fewer than 50,000 customers) limit their operational telecommunications approaches to in-house managed networks.

Further information on this new series The World Market Study of SCADA, Energy Management Systems, Distribution Management Systems and Outage Management Systems in Electric Utilities: 2017-2019 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com. For readers interested in purchasing this new series please call or email info@newton-evans.com for special introductory pricing.

Newton-Evans Study Indicates Similarities in Plans for Full Digital Substations and Differences for Condition-Based Maintenance Programs Among Electric Utilities

April 27, 2017

Newton-Evans Research Company continues to assess findings from its six-month research study and survey of protective relay usage patterns in the world community of electric power utilities. Insights received from 114 large and mid-sized utilities in 28 countries point to some interesting differences in plans for implementation of the “full digital substation” concept and to increased use of condition-based maintenance (CBM) strategies for protective relays.

Implementation of the “Full Digital Substation” Concept:

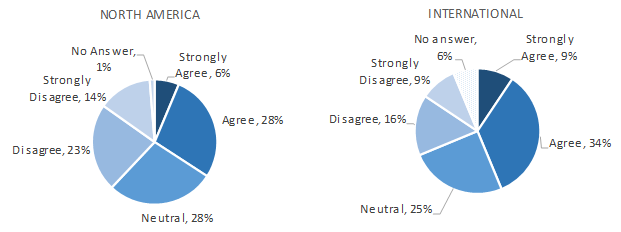

Thirty-four percent of the survey respondents from the U.S. and Canada agreed with the statement, “By year end 2018, we will be well on our way toward implementing the full digital substation concept.” Thirty-seven percent disagreed with the statement. Forty percent of small North American utilities (fewer than 100,000 customers) agreed with the statement, but only 18% of large utilities (more than 500,000 customers) concurred.

Forty-three percent of the international respondents agreed with the same statement, which is slightly more than what was observed in North America (34%). Twenty-five percent had no opinion, and another 25% disagreed. Importantly, the typical international utility respondent was somewhat larger (in terms of customers served) than their North American counterpart.

“By year end 2018, we will be well on our way toward implementing the full digital substation concept”

Increased Use of Condition-Based Maintenance:

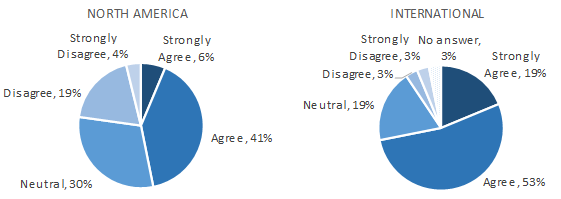

Forty-seven percent of North American respondents agreed with the statement “We plan to increase use of condition-based maintenance to reduce maintenance testing time of technicians.” Fifty-six percent of IOUs, 43% of public power utilities, and 39% of utility cooperatives agreed with the statement. Fifty-nine percent of large utilities (>500,000 customers) plan to increase in use of CBM while only 37% of small utilities (<100,000 customers) plan to do this.

Seventy-two percent of international respondents agreed with the statement that they plan to increase use of CBM to reduce maintenance testing time. Only 6% disagreed.

“We plan to increase use of condition-based maintenance to reduce maintenance testing time of technicians”

This Newton-Evans survey of electric utilities included more than 20 questions on product functionality and market-related issues. The 2016-2018 study is a series of four reports published during late-year 2016. These reports are geared to the planning needs of protective relay suppliers, power industry consultants, and utility protection and control departments. The four volumes include the North American Market Study, the International Market Study, Supplier Profiles, and Global Market Assessment and Outlook.

Further information on the research series The World Market for Protective Relays in Electric Utilities: 2016-2018 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com for additional information or to order the report series online. For readers interested in purchasing this new series please call or email info@newton-evans.com for special introductory pricing.

Newton-Evans Study Finds Differences in Spending Plans for Electric Utility Control Systems Over the 2017-2019 Years

April 25, 2017

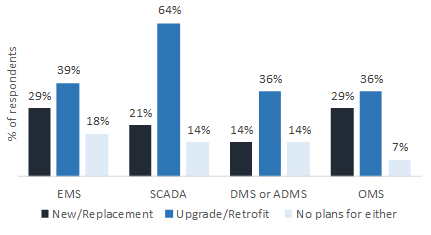

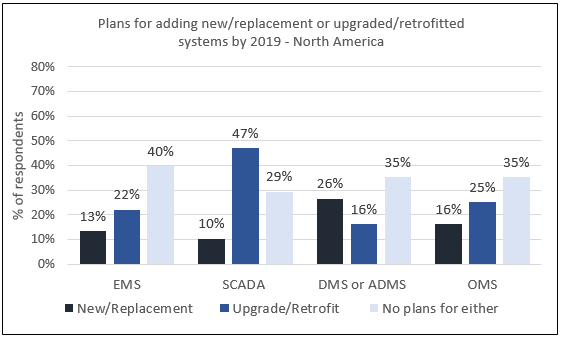

Nearly half of North American electric utilities participating in the 2017-2019 Newton-Evans Research study plan to upgrade or retrofit their SCADA system by 2019. Twenty-two percent plan to upgrade or retrofit their energy management system (EMS), and twenty-five percent will upgrade or retrofit their outage management system (OMS). Twenty-six percent of North American utilities in the survey sample are adding a new or replacement distribution management system (DMS) or advanced DMS by 2019.

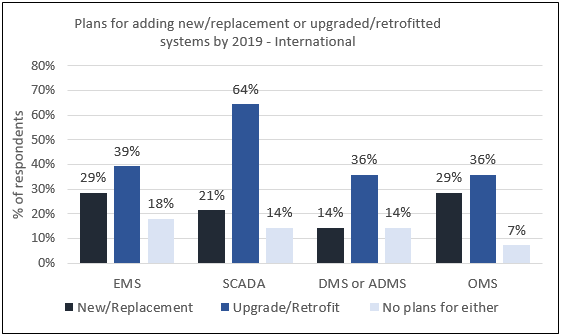

In comparison to the North America survey sample, a greater percentage of international utilities surveyed plan to install new or replacement systems for EMS, SCADA and OMS. A greater percentage also plan to upgrade and/or retrofit systems across the board. Twenty-nine percent of international survey respondents plan to replace or install new EMS or OMS systems by the end of 2019. Sixty-four percent will upgrade or retrofit their existing SCADA systems, and 36% will upgrade or retrofit their DMS or OMS systems by year end 2019.

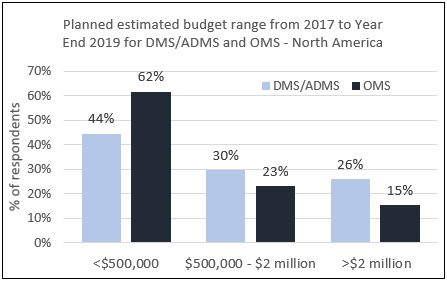

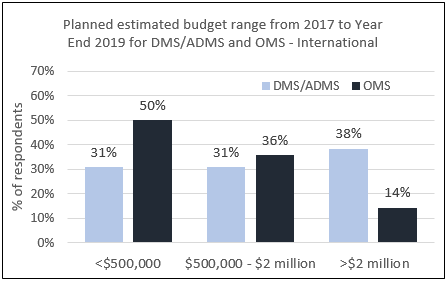

Planned budget range from 2017 to Year End 2019 for DMS/ADMS, OMS

Twenty-six percent of North American utilities operating (or planning to operate) a DMS/ADMS plan to spend more than $2 million on DMS or ADMS from 2017-2019. Fifteen percent of OMS users plan to spend that much on their OMS. As is usually the case, major IOUs have larger budgets for such operational systems than do smaller utilities.

Overall, one-half of international utilities sampled said they have budgeted less than $500,000 for OMS from 2017-2019. Thirty-eight percent of international utilities surveyed plan to spend over $2 million on DMS or ADMS from 2017-2019, and 14% plan to spend that amount on OMS.

Further information on this new series The World Market Study of SCADA, Energy Management Systems, Distribution Management Systems and Outage Management Systems in Electric Utilities: 2017-2019 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com. For readers interested in purchasing this new series please call or email info@newton-evans.com for special introductory pricing.

Findings from International Study of EMS, SCADA, DMS, and OMS Indicate Differences in Usage Patterns and Development Priorities When Compared to North American Companies

April 19, 2017

The Newton-Evans Research Company has published report findings from the company’s recently completed study of EMS, SCADA, DMS and OMS usage patterns in international electric power utilities. This is the second of four volumes of its 14th global market assessment of operational control systems – a survey-based study conducted by Newton-Evans since 1984.

Here are some observations gleaned from interviews and surveys with 31 utility participants from 25 countries:

Systems in Use

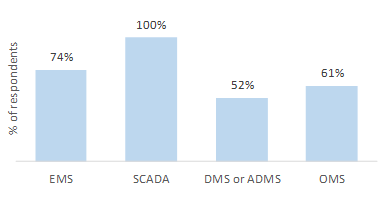

All utilities that participated in the survey are operating SCADA systems, and 74% also have an energy management (EMS) installation. Fifty-two percent use a distribution management systems (DMS) and 61% use an outage management system (OMS).

Fig. 1. Control Systems in Use – International Electric Utilities

Supplier Usage Patterns

GE led in terms of suppliers used for each type of system included in the study, based on the inclusion of Alstom Grid mentions. ABB and Siemens were next in total number of mentions.

Upgrades and Replacements

While almost two-thirds of international respondents plan to upgrade their SCADA installations, 29% plan to replace existing EMS and OMS systems.

Fig. 2. New/Replacement or Upgrade/Retrofit Control Systems Planned – International Electric Utilities

Distributed Energy Resources

Forty percent of international utilities surveyed said their SCADA functionality and network models include distributed energy resources (DERs), and 47% indicated they plan on including DERs in the next few years. By contrast, none of the North American utilities surveyed said their SCADA functionality and network models include DERs. However, 82% of North American utilities surveyed plan on integrating DERs into their SCADA in the future.

System Convergence

About one-third of international respondents (34%) stated that they had already converged SCADA/DMS with OMS functions. However, 28% indicated no plans to converge these systems. Half of the North American utilities surveyed said they have not converged SCADA, DMS and OMS and have no plans to do so.

Third Party Services

More than one half of the international survey respondents use third party services for cyber security monitoring, while 48% use outside assistance for critical infrastructure protection and/or vulnerability assessments. These percentages are higher than what was reported in the previous study conducted in 2013.

Role of Analytics Software

The use of analytics software has increased since the 2013 study; this year’s survey found that 69% of international utilities use OMS analytics, while the 2013 survey reported that 29% of the survey sample used OMS analytics. About one-third currently use analytics for asset management.

Cloud Computing Interest

Only 23% of the international utility participants indicated any interest in cloud implementations at their company. This finding closely parallels the observations provided from North American respondents.

Further information on “The World Market Study of SCADA, Energy Management Systems, Distribution Management Systems and Outage Management Systems in Electric Utilities: 2017-2019” is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com. For readers interested in purchasing this new series please call or email info@newton-evans.com for special introductory pricing.

Research Findings Point to Upgrade of EMS, SCADA and DMS Capabilities during 2017-2019 among North American Electric Power Utilities to Accommodate Renewables Integration and Demand Response

Emphasis Placed on Extending Applications and Expanding Roles of Distribution Management Systems and Outage Management Systems

March 17, 2017: The Newton-Evans Research Company has published its report of findings from its just-completed study of EMS, SCADA, DMS and OMS usage patterns in North American electric power utilities. This is the first release of the company’s four component reports of its 14th global market assessment series on operational control systems, conducted since 1984.

Here are some observations based on interviews and surveys with 68 utility participants from across North America:

Almost one-half of all survey respondents (46%) plan to upgrade or retrofit their SCADA installations by 2019. Most respondents with such plans were mid-size and larger cooperatives and public power utilities.

Twenty percent of respondents plan to purchase a new or replacement DMS by 2019. Only six (major) utilities reported that they currently have an Advanced DMS, but 23 others will have an ADMS in the near future. Importantly, of the 29 respondents using or planning to use an ADMS, none indicated that their SCADA functionality and network modeling presently include distributed energy resources (DERs). However, most of this sub-group (82%) plans to include DERs in their ADMS functionality in the future.

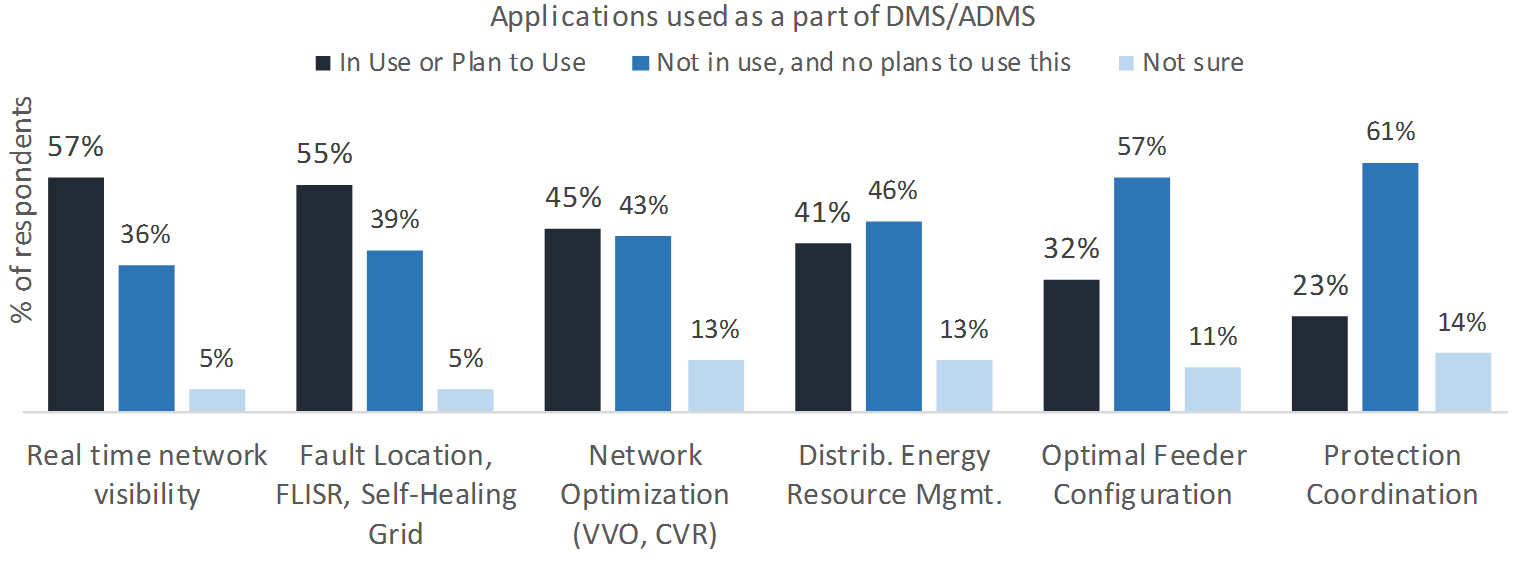

Real-time network analysis and fault location were the prevalent applications being used as part of current DMS or ADMS installations. Plans are centered on supplementing these (where not yet implemented) and adding network optimization and distributed energy resource management capabilities. (See Fig. 1)

Figure 1. Applications used as a part of DMS/ADMS

Real-time linkages between SCADA and GIS or OMS were found in 44% of the utility sites. Forty-one percent reported having no real-time linkages among these systems.

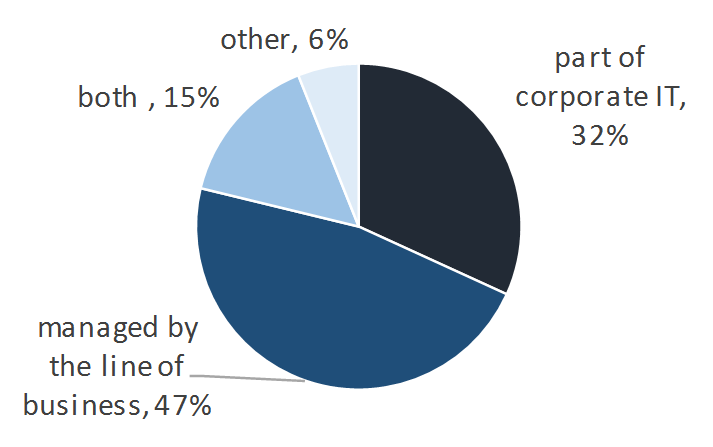

Almost half of the survey respondents indicated that the operational systems support group is managed by Operations, while about one-third stated that such support is now part of corporate IT. (See Fig. 2)

Figure 2. How is OS Support Managed?

Third party services are being used and relied upon to assist with NERC CIP compliance issues and for the conduct of vulnerability assessments.

DNP 3 continues to be the most prevalent operational data communications protocol throughout North American electric power utilities. Plans call for continuing the use of DNP 3 for the foreseeable future among most of these utilities. Some planning for IEC 61850 is underway, but remains at a low level among these respondents.

More than a score of additional topics were surveyed in this new study including the impact of NERC CIP compliance on budgets and workloads; cyber security issues; telecommunications strategies and methodologies; distribution network model maintenance; changing organizational responsibilities for control systems; budget outlooks; and applications usage patterns.

Further information on this new series, “The World Market Study of SCADA, Energy Management Systems and Distribution Management Systems in Electric Utilities: 2017-2019” is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 Email: info@newton-evans.com or visit us at www.newton-evans.com or to order any of more than 100 related reports. For readers interested in purchasing this new series please call or email the company for special introductory pricing.

Newton-Evans Study Finds Market for Relay-Centric Devices and Controls Expanding with Emergence and Growth of Newer Industry Segments

March 14, 2017: Newton-Evans Research Company continues to assess the results of its six-month research study of protective relay usage patterns in the world community of electric power utilities. Findings from 114 large and mid-size utilities in 28 countries point to some newer trends in adoption and use of protection and control technology.

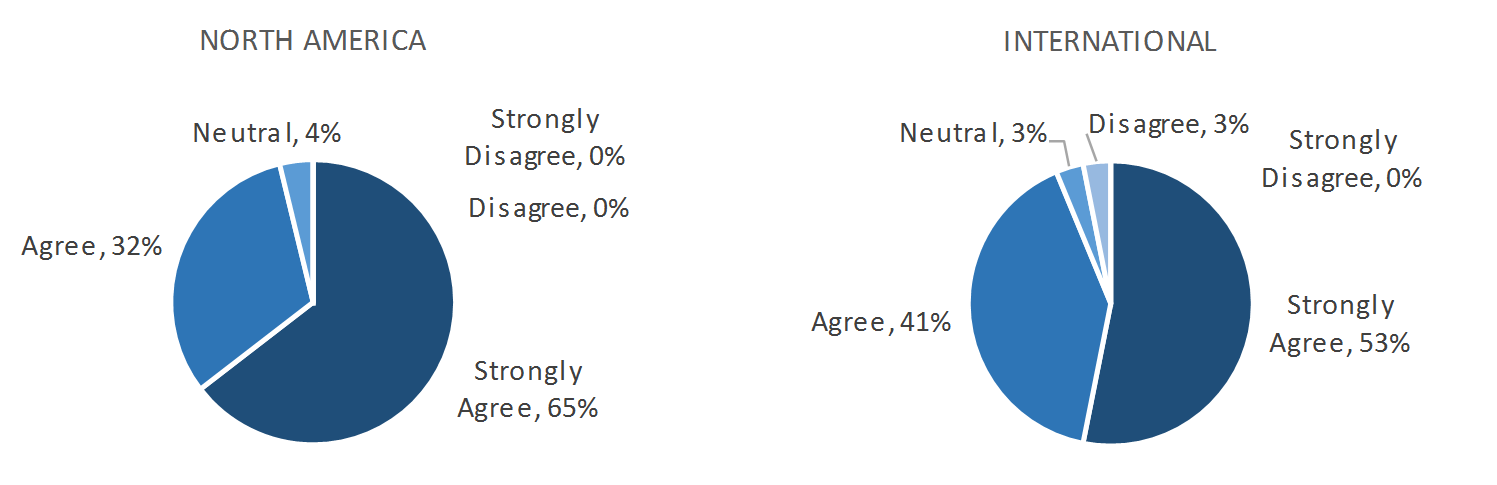

Importance of Purchasing “Known” Relays: Sixty-five percent of the North American respondents strongly agreed with the statement, “It is important that we purchase known relays (a proven product with which we have had prior experience).” Overall, 97% of North American respondents strongly agreed (65%) or agreed (32%). Three people were neutral about this statement. None of the respondents expressed any level of disagreement. Eighty-two percent of North American utilities serving more than 500,000 electricity end users strongly agreed with this statement.

Fifty-three percent of international respondents strongly agreed with this statement. Forty-one percent agreed only somewhat. One person disagreed and one person was neutral about this statement.

Agree or Disagree: “It is important that we purchase known relays (a proven product with which we have had prior experience.)”

Impact:

The role of “purchasing known relays” makes it very difficult for new market entrants to gain a share of this multi-billion-dollar global protective relay market. Similarly, it has become equally difficult for existing relay suppliers to gain new customers unless the relays are components of larger electrical equipment (motors, transformers, switchgear, et al). Despite these market constraints, caused in large part by a steep learning curve in programming and protection settings, some relay manufacturers have increased their market presence through specialization in the design and supply of protective relays for one or more product segments (protection of motors, transformers, generators, switchgear and the like). Other manufacturers have continued to offer a wide range of protection solutions, but address specific world regions or specific types of electric utilities or industries.

Examples of such specialized expertise can be found in many of the companies engaged in the manufacture of protective relays. Witness the success of Beckwith Electric, a market leader in generator protection and now actively engaged in distributed generation protection as well. Basler Electric’s microprocessor-based relays combine multifunction protection with control, metering, data acquisition and network communications. RFL and ERLPhase are two additional specialist participants in the North American and international markets. The global electrical equipment manufacturers with a wide array of protective device offerings include ABB, Eaton, GE, Siemens and Toshiba. Relay-centric manufacturing leaders include the multi-hundred million dollar businesses of the USA’s Schweitzer Engineering Labs (SEL) and the China’s NARI.

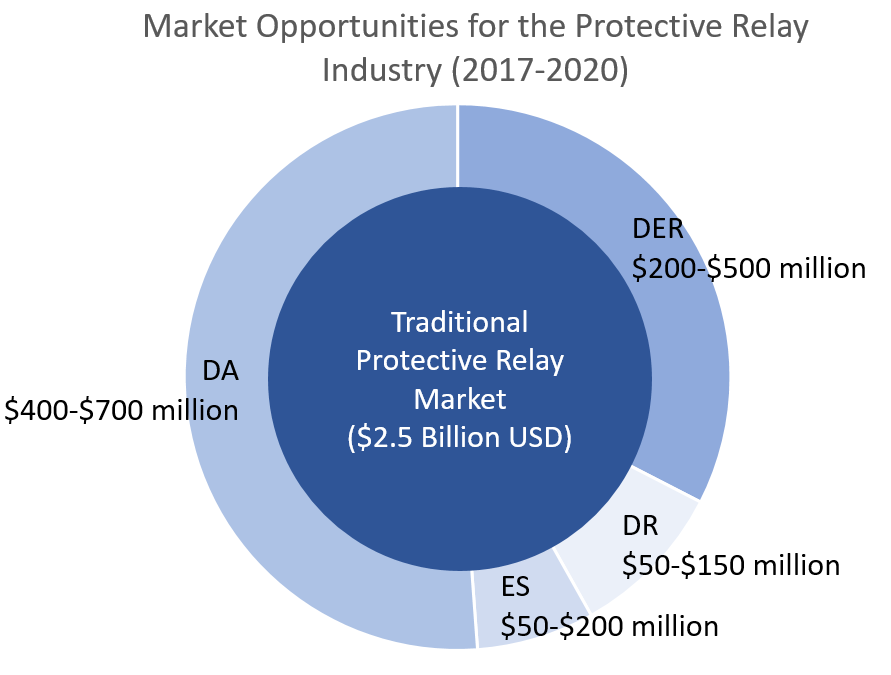

So the question now is – how do relay manufacturers grow in a “mature” market for protective devices? The response is this: While the traditional utility and industrial markets for device protection are indeed mature in many countries- there are a host of new relay-centric applications for protective devices that include significant relay-like functions and control-monitoring capabilities and require less complex programming and relay setting procedures. The market requirement to protect distributed energy devices including wind turbines and solar panels continues to grow. The expanding market for distribution automation device controls (capacitor banks, reclosers, line monitors, fault sensors, etc.) provides additional new opportunities for participation by relay manufacturers.

DA: Distribution Automation – Capacitor bank relays, Recloser controls, Fault current limiters

DER: Distributed Energy Resources – Wind turbine relays, Photovoltaic panel relays

ES: Energy Storage – Storage battery relay, AC/DC converter controls

DR: Demand Response – Load control switch relay

For further information on the research series or to order The World Market for Protective Relays in Electric Utilities: 2016-2018 visit our reports page.

North American Study Finds Continuing Moderate Growth in Protective Relay Market with Commitment to Increasing Protection Coordination and Grid Security Practices

Role of Synchrophasors and Teleprotection Continues to Grow, Providing Better Situational Awareness and Visualization to Help Prevent Outages

May 10, 2016: Newton-Evans Research Company has prepared an interim news release based on preliminary findings from 59 large and mid-size North American electric utilities.

Among the early trends reported in this first of a four volume set of reports are these:

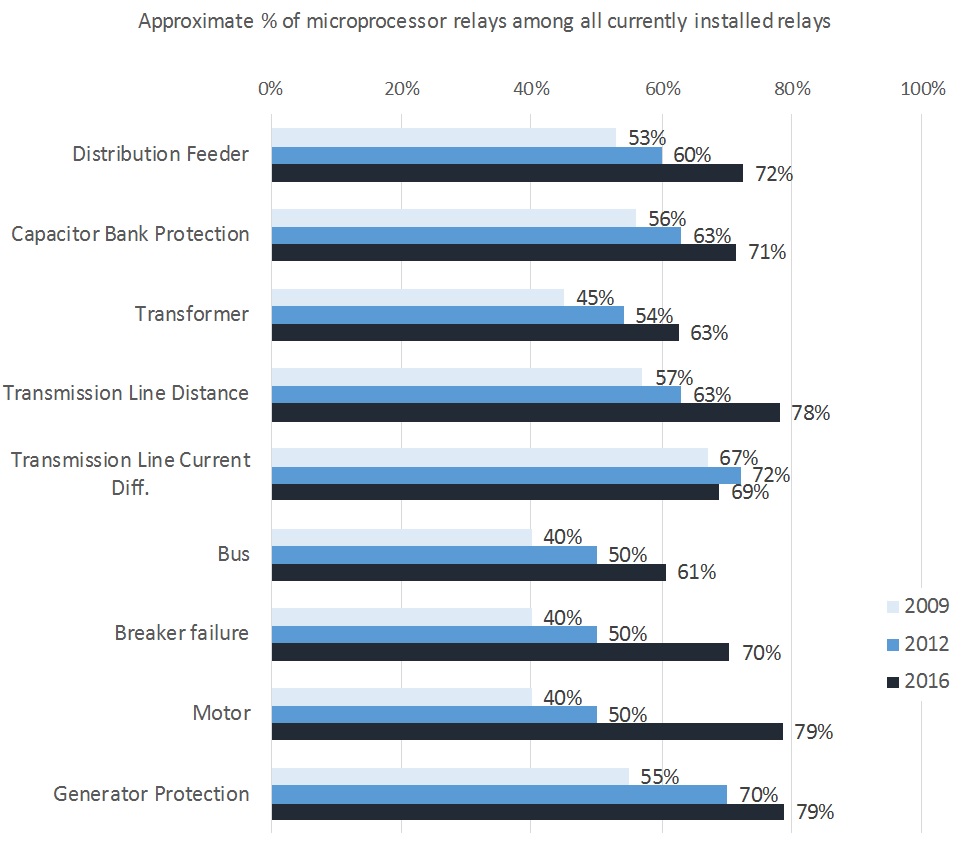

- The percentage of microprocessor relays in the mix of all protective relays used by utilities continues to increase with each passing year.

- The vast majority of new and retrofit units being planned for purchased are also digital relays, but in some of the protection applications studied, such as motor protection and large generator applications, and in installations where electrical interference is strong, electromechanical and older solid state relays continue to have a niche market position.

- Real-time analysis of synchrophasor data has become a key application for the emerging field of operational analytics for transmission operators.

Communications protocol usage patterns in North American utilities of all sizes continue to rely on DNP3, the dominant protocol in use in the North American region. IEC 61850 is found in some of the TOP 100 utilities, but is by no means prevalent as of mid-2016.

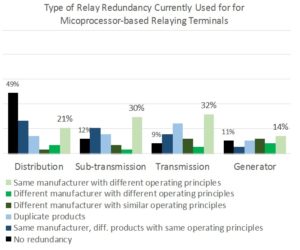

Relay redundancy being used for microprocessor-based relaying terminals varies by application as seen in the chart below.

The 2016 Newton-Evans survey of electric utilities includes more than 20 detailed product functionality topics, related technical questions, and market-related issues, together incorporating more than 250 items of information from each of the participating utilities.

This year’s study will result in a series of four reports published during June and July. These reports are geared to the planning needs of protective relay suppliers, power industry consultants, and utility protection and control departments. The four volumes include the North American Market Study, the International Market Study, Supplier Profiles, and Global Market Assessment and Outlook.

Further information on the research series The World Market for Protective Relays in Electric Utilities: 2016-2018 is available from Newton-Evans Research Company, 10176 Baltimore National Pike, Suite 204, Ellicott City, Maryland 21042. Phone: 410-465-7316 or visit www.newton-evans.com for additional information or to order the report series online.

summary reviews and highlights from completed studies

summary reviews and highlights from completed studies